THE DEEPER DIVE: US Manufacturing Heats up Right along with Tariff Inflation. What Does it Mean?

Everyone is pouring on the coal and running things as fast and hot as they can.

So much for recession. US manufacturing activity just soared to its highest since 2022 upon strong sales, but is this a boom or a bust? The details are an interesting tale of top-heavy tariffs and overheating prices. While the flurry of activity could mean tariffs are bringing business back to the US, it may mean something decidedly different. I’ll lay it out, and you decide. The closing point, I think, will be that it is too early to tell, but let’s dig in to see why things are getting hot because there may be some danger hidden here:

One month after unexpectedly sliding into contraction for the first time in 2025, moments ago the S&P Manufaturing PMI even more unexpectedly soared from 49.8 to 53.3 … smashing expectations of another decline … and printing well above the highest economist forecast.

Sounds glorious, but we have two tales here, and we have to decide which tale is the trend: Last month, manufacturing wailed a dirge about sliding into recession. This time it sings a song of boom towns. The same can be said for GDP. It was in recession in the first quarter, and then boomed into the second quarter. It’s reasonable to ask which month is right as well (as which quarter was right) or whether this month when manufacturing roared is just making up for last month when it sputtered into the dust to where the two average out flat.

The devil is in the details, and the tale they tell is equally forked and clouded in chaos.

According to S&P's PMI report, the surge signaled "a renewed improvement of factory business conditions after a brief deterioration in July."

Or will it equally prove to be a brief surge in August after a brief deterioration in July? This is where I say it is too early to tell. We won’t know until we see if September starts to establish a trend. A drop into recession followed by a subsequent bounce do not make a trend, but the details that I’ll lay out below hint at chaos beneath the surface. For the moment, the headline news was great. One could hardly ask for better.

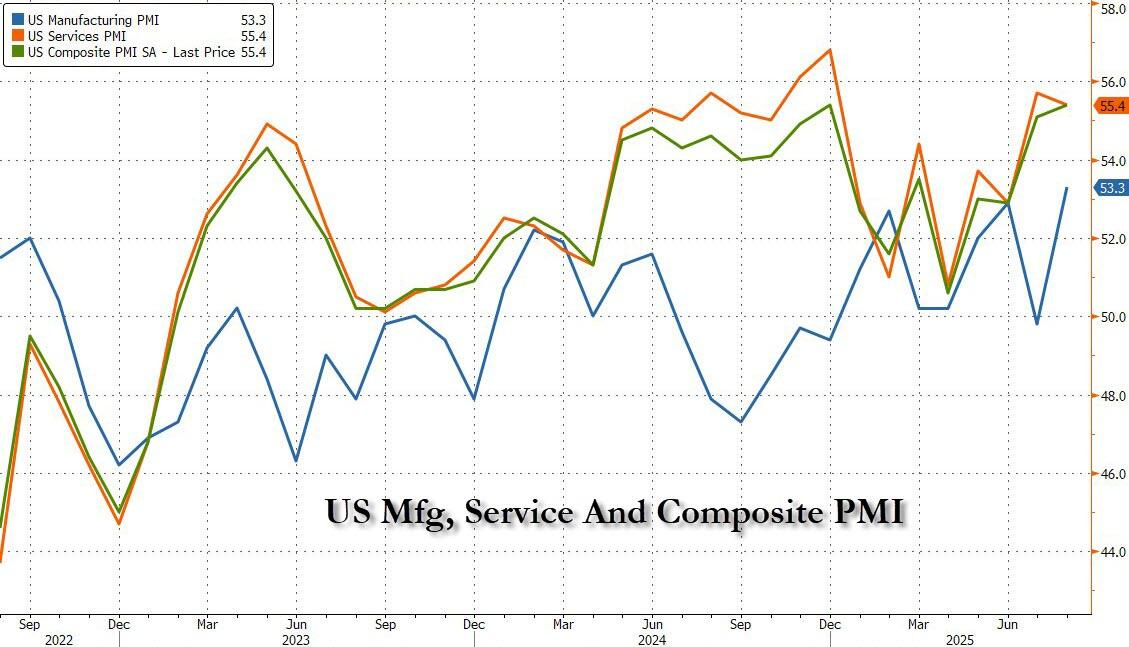

If you graph it out, services (gold line) took a minor nudge down while manufacturing (blue line) bolted upward:

However, as you can see, last month, manufacturing put in a slightly lower low than it had going all the way back to the last month of last year, and this month it put in a slightly higher high than it had in the best month of this year; average the two moves out, and you’re still right in the middle of a range we have held to all year long. There is no change in trend so far.

Under the hood, some of the details looked really good, according to Zero Hedge:

Production rose for a third month at a pace not seen since May 2022, buoyed by the largest influx of new orders since February 2024.

Factory employment rebounded after a decline in July to register the largest payroll gain since March 2022.

Backlogs rose at an unchanged and therefore joint-steepest rate since May 2022 in the services economy

Uncompleted orders rose for a fifth consecutive month, rising in August at a pace unsurpassed since May 2022 reflecting stronger demand and near-term capacity constraints at some companies.

But there were also some telling details that cast a little different light on this:

Inventories of inputs also rose sharply after a drop in July.

While many manufacturers reported improved sales and demand, the upturn in production and order inflows was in part linked to renewed inventory building. Stocks of finished goods rose to an extent not previously recorded since data were first available in 2007, while stocks of purchased inputs showed the second-largest rise seen for over three years.

While stock building was partly fueled by expectations of rising demand, some factories also reported increased safety-stock building amid fears of supply shortages or to protect against further price rises, in turn reflecting the recent impact of import tariffs.

Those details reveal the turbulence at the bottom of all of this that explain what is happening here. What we are seeing is enormous efforts to build inventory—to stock up ahead of tariffs. It’s all just further evidence of the front-running I’ve been writing about. Orders were up because retail businesses were stocking up ahead of tariffs, but production rose a lot more than orders because manufacturers were building up inventories ahead of tariffs. Yet, with all that, the manufacturers’ inventories of their “inputs”—the materials they use to make the things they make—rose even more!

What you see is everything cramming toward doing as much as possible ahead of finalized higher tariffs. This is what I’ve been talking about when saying we’d see companies pulling business from the future into the present. All the engines are running as hot as they can to get ahead of tariffs. Everyone from retailers down to their manufacturers was pouring on the coal, hiring more people to stock up inventories throughout supply chains out of fear of shortages to come due to tariffs, and fear of the higher costs tariffs will bring.

We may see more of this kind of major surging of our economic engines, or this may be its last hurrah, all in one month. The up and down from May to June and then June to July is also the effect of TACO tariffs constantly flashing on at very high levels and then back off again. Businesses suddenly back off when the tariffs go up, rush back in as soon as they go down, etc. So, again, we may only know as we go deeper into the year and see if the surge holds or not once the tariffs are finalized.

I think the strongest argument is that when you pull business into the present to frontload all that you can ahead of tariffs, it creates a vacuum of business down the road. You run the engines of industry at full throttle while prices are still somewhat down and then let them cool once prices are up to stay, and you use all of that cheaper inventory you stockpiled to try to buffer the rise in your prices as much as you can.

The tariff tell

The real tell is the tariff connection in the comments of manufacturers:

There were some concerns on the price side, with tariffs reported as the key driver of further cost increases in August. Companies across both manufacturing and service sectors collectively reported the steepest rise in input prices since May and the second-largest increase since January 2023.

That means this inventory rise was already pricier to create than in previous months, but the rise in costs pressed businesses to put the rush on before costs gets even worse because we all know Trump’s idea of a good trade deal is one that allows the US to place higher taxes on its citizens and businesses than other nations place on theirs. That, in his book, is a win because of his view that other nations are paying our tariffs for us.

This understanding of the business surge and all the comments about tariffs and costs matches up perfectly with what we saw in the soaring PPI inflation report last week, while the rise in production matches up with what we saw in GDP, where I had forecast we’d see a rise from the previous recessionary quarter because of front-running turning on a temporary growth engine (one that borrows from future sales down the road as everyone stocks up inventory before the high prices are firmly locked in place). This was exactly that, and the rise in PPI was proof that other nations are not paying for our tariffs. It was US tariffs that businesses were complaining about in the present reports as well. As the US places tariffs on the materials and parts they buy from foreign nations, US business costs are soaring.

Rates of increase accelerated in both sectors. While the manufacturing cost rise was especially large, being the second-steepest since August 2022, the service sector increase was the second-highest since June 2023. Average prices charged for goods and services rose at the sharpest rate since August 2022 as firms passed higher costs on to customers. Although goods price inflation cooled slightly for a second month in a row, it remained among the highest seen over the past three years. Service sector price inflation meanwhile was the sharpest since August 2022.

Here you see that the idea that customers won’t have to pay for it is equally ludicrous. While there was a little warring up and down in the price tug-o-war, generally there was a lot more up than down; and the key note there was that companies did pass “higher costs on to customers.” All of this reflects those surging Producer Price Index inflation numbers I wrote about last week and says some of those higher prices by producers are now starting to flow onward down the pipe to consumers, as expected … like this:

Tariffs were again widely cited as the principal cause of sharply higher costs, which in turn fed through to the steepest rise in average selling prices recorded over the past three years….

“Companies across both manufacturing and services are reporting stronger demand conditions, but are struggling to meet sales growth, causing backlogs of work to rise at a pace not seen since the pandemic-related capacity constraints recorded in early 2022. Stock building of finished goods has also risen at a survey record pace, linked in part to worries over future supply conditions."

Also, note that inflation can skew PMI data. While production reported here for manufacturers asks manufacturers to report a change in “units” manufactured for business output, rather than dollar value, in order to avoid counting the impact of inflation, the Services side (by far the biggest part of US industry) asks businesses to report on a change in “business activity.” That, usually has to be measured in dollars, not units. So, if prices are rising, it looks like business activity is rising, which may not be the case at all. You may just be measuring the impact of inflation.

Even with units, manufacturers may wind up factoring in dollar values. For example, what if you produce cars and toothpicks. Your production in toothpicks went up by a hundred-thousand, while your production in cars fell by ten. How do you balance which was more significant to your change in “business output,” other than by dollar value? Usually units will work fine, but not always.

It’s much more problematic for service providers. How do you estimate “business activity” in units? In most cases, you can’t because there are no equal-size units. Let’s say you clean bathrooms. One month you cleaned fifty, the next month you cleaned 45 but they were roughly twice the size, so you charged more. Rather than try to sort that out by the number of square feet of floor cleaned plus some measure of the number of fixtures cleaned, which take more time per square foot than floors do, you’re likely to estimate your change in business activity by your change in revenue, especially if you made more for the smaller number of bigger bathrooms than you did on the larger number of small bathrooms the month before. However, since you’re going by your change in revenue, any increase in your pricing or your pass-through of costs is going to look like an increase in “business activity.”

Another example would be home construction. You can’t just report a difference in square feet constructed, because projects extend across multiple months, involving the same square footage, but one month you were pouring foundations, the next month you were doing finish work. Sometimes you're doing a high-end home with a lot more fine work involved per square foot than the low-income housing you build. So, you’re probably going to report revenue changes, rather than try to sort all of that out.

So, as the price rises each step along the way, that price inflation may add to production figures and almost certainly adds to “activity” figures in the services sector, but that addition is a mirage in the chaos because that part of the increase isn’t due to an increase in the number of products manufactured or increase in actual business activity. It’s just a measure of the effect of inflation! When inflation is gradual and consistent, it doesn’t matter that much. But if inflation is burning upward, it can create a huge skew in business data.

The problem now is that we have only a cloudy idea about what the sudden burst in inflation amounts to. Some people don’t even believe it is happening because PPI, where we saw that it happened in a big way, is not on the average person’s radar screen. So, some of the surge in data may have more to do with inflation than with a change in business.

Something that should also get your attention here is the statement that we haven’t seen surges of this kind since the pandemic. We all know how churned-up and disorienting the data became during that time of rapid flux. We also all know how that ended in the highest inflation seen since the seventies and eighties, which we were still fighting at its tail end this year just before all this new inflation started screaming into PMI.

Now the threat of tariffs is spiking demand at the same time that tariffs are turning up costs in production. The spike in demand being reported keeps the inflationary heat on because it means consumers are not backing down from price increases, nor are retailers. Both are asking for more product to get ahead of future price increases.

“While this upturn in demand has fueled a surge in hiring, it has also bolstered firms’ pricing power. Companies have consequently passed tariff-related cost increases through to customers in increasing numbers, indicating that inflation pressures are now at their highest for three years."

It’s interesting to see all of that in an article from ZH after they spent months towing the Trump line that tariffs will never cause inflation. Guess they couldn’t have been more wrong. Thus, the …

… rise in selling prices for goods and services suggests that consumer price inflation will rise further above the Fed’s 2% target in the coming months. Indeed, combined with the upturn in business activity and hiring, the rise in prices signaled by the survey puts the PMI data more into rate hiking, rather than cutting, territory according to the historical relationship between these economic indicators and FOMC policy changes.

Ooops on ZH!

Of course, they put an INCREDIBLY STUPID PRO-TRUMP SPIN ON IT to try to save face after all their claims that tariffs would not cause inflation. This one was out-loud laughable:

In other words, the report coming unexpectedly strong, [unexpected by ZH] may be just an attempt by the traditionally anti-Trumpian S&P to pressure the Fed into maintaining a hawkish bias even as the labor market - at least as measured by most other 3rd parties - continues to deteriorate.

Yeah, sure. You expect us to believe S&P Global created all the inflation comments and data in PMI just to trick the apparently trickable Trump into backing off on pressuring the Fed to cut rates or to trick the Fed directly into believing in inflation by faking PMI into matching up to the recent PPI report as well as what was seen beneath the surface in CPI. That’s ridiculous.

There was NOTHING here that was unexpected at The Daily Doom. Cutting through the inflation chaos in the numbers, it’s fundamentally simple: huge on-and-off tariffs spawned huge attempts by industries with huge muscles to rush ahead of those tariffs to the fullest extent they could. That includes manufacturers, service businesses, and retailers all sucking like a giant vacuum hose on their supply chains to manufacture and move inventory into place ahead of permanently worse tariffs as quickly as possible. It’s the production side of “stocking up.” And now it is followed by all of these entities passing the huge cost of those tariffs on to their customers as well, including ultimately “consumers,” the end users. It’s an enormous amount of churn created by front-running tariffs, none of which is likely to become an enduring trend.

And it’s all exactly on the timeframe I laid out months ago. SO, NO SUPRISE, ZH. Fully seen and expected … AND RIGHT ON TIME!

Where ZH admitted some to inflation the other day, they also put a one-and-done spin on how it would play out. As I wrote in my last Deeper Dive, tariffs are not going to have a one-time impact on inflation. One of the multiple reasons I’ve given is this:

Zero Hedge … is … claiming tariffs will not cause inflation or, seeing this report, now saying, at the very most, they will cause a one-time bump in inflation. I’ve already pointed out that it will be far from a one-time bump just because of how tariffs have been all over the place and are still being worked out from nation to nation, not so much product to product.

I’ll show very clearly further down in this article how my statement that this will be far from a one-time bump is already proving true in the words of companies that specialize in low prices, such as Walmart. I’ll spell out the number of reasons this period of inflation will not be one-and-done. On the face of it, one-and-done makes sense: the tariffs raise prices, but then that raise is all in; so the inflation doesn’t happen again. I’ll lay out why that is not how this will proceed. I’ll also use the story of Walmart to show what you need to do and how easily you can do it to spare yourself some of this inflation misery.

Inflation veges out but you shouldn’t …

Meanwhile, the BLS reported a 38% rise in the wholesale price of vegetables, coming soon to store shelves near you. The price increase here was said to be largely due to the impact of Trump’s ICE teams scavenging fields for migrant workers, causing vegetables to rot on the stem as I warned about due to fleeing harvesters.

This is the biggest price spike for any product category month-to-month.

“It's insane. That's why I'm growing a lot more myself this year,” said Dana Roads, who is visiting from Utah.

It is insane. It didn’t have to happen, as I wrote a month ago, because immigration enforcement on time-immediate things like crop harvesting could have been and should have been phased in; otherwise, I said, crops will rot in the fields, cows will get sick from mastitis, some will die, and we’ll have some potentially serious food shortages in the fall and winter. And here we are seeing that start to show up already!

So, your time to protect yourself as follows, using Walmart’s same approach, is starting to run out, especially when you see the price changes that follow:

(Note: Links to sources for the quotes and charts above can be found in headlines that come at the end of this article as designated by boldface type.)