The Federal Reserve Is About to Go Full Banana Republic

Peeling back the truth, one banana at a time.

According to an article on Yahoo! today, the top banana in finance, J. Powell, has already decided to go full bananatard. It is the financial hallmark of banana republics to print money in order to finance their debts. The Federal Reserve has never been allowed by law under its charter to do that because politicians were, long ago, smart enough to notice that all nations that take that path to financing their ambitious government programs turn to ash in the flames of hyperinflation.

We already have high inflation to deal with. After just writing a Deeper Dive that explained why we are already in a situation of true stagflation—the very situation that banana republics try to print their way out of—another financial writer this morning says the same thing on Seeking Alpha:

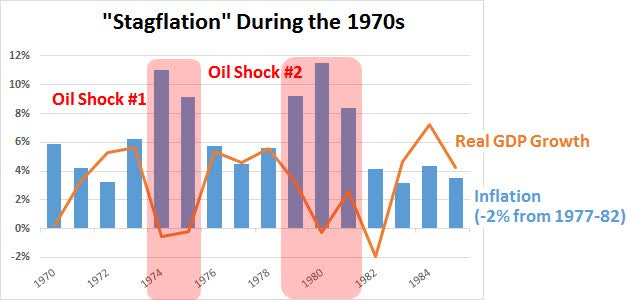

An old "new word" has entered the economic and market narratives in recent weeks: Stagflation. It's an old word because the United States suffered from two bouts of "stagflation" from the middle 1970s to early 1980s. It's a new word because there's a new generation of market participants.

Stagflation is an economic cycle when economic growth is low (the "stag") and inflation (the "flation") are high. Low growth in past bouts also included high unemployment. A key factor in those stagflations was OPEC's manipulation of oil supplies….

One of the key components of inflation has always been energy. We can see that going back a century in the data. It was most acutely felt during the 1970s and early 1980s stagflationary periods.

The graph is clearly not up to date, as the current real GDP growth is clear down at 1.6%. However, it shows well what happened in history as inflation rose and GDP plummeted during two periods of oil shortages that drove the prices of everything up

Now that we have entered exactly that kind of stagnant economic scenario with rising inflation again (and even an oil crisis that will drive inflation all the more in months ahead), the Federal Reserve has apparently decided to finance the government’s ambitious Bidenomics expansion by monetizing the national debt (the fancy word for printing money to paper over the debt versus sending the government packing to find investors to buy its debt).

The difference between monetization and what we have now is that currently, the Fed is not buying any new government debt. The government has to go to investors to find real buyers for its debt because the Fed has started doing what it always promised it would do. It has stopped buying new government debt and is forcing some of the old government debt it holds from all its past periods of printing money to roll off—forcing the government to finally find investors to fund that debt.

The Fed always argued during all its prior money printing (QE) cycles that it was not doing the thing it is not allowed to do, which is printing money just to fund the government, on that basis it would eventually “normalize” its balance sheet from all those holdings and not carry the debt. That would force the government to fund itself without the Fed being the buyer of first resort. That would cause interest on the debt to rise, and the benefit of that is that real interest forces the government to get real about the debt it is creating. However, we’ve lived in pretend world too long for that to ever really be possible now.

With enough money printing where the Fed is the buyer of first resort (in that it promises banks up front it will absorb all the government debt they buy as quickly as they buy it, making the Fed the true buyer), the Fed has held interest on the debt down. At present, however, we’ve switched to quantitative tightening, where the Fed does not refinance that debt. That forces the government to find other funders, and so interest has been rising.

The Fed was making good on its promise wherein it always claimed those QE cycles were purely done for monetary policy, not to help the government. (Always baloney, of course, but the Fed still needed to roll that debt off and eventually push the government back to other funders if it was going to prove its argument.) If the Fed did not “normalize” its balance sheet, that would prove it was truly funding the government all along by promising banks it would hose up all the government debt they took on. (Or, at least, buy the massive amounts that the Fed promised to buy in each QE program.)

Here’s where we are now going bananas

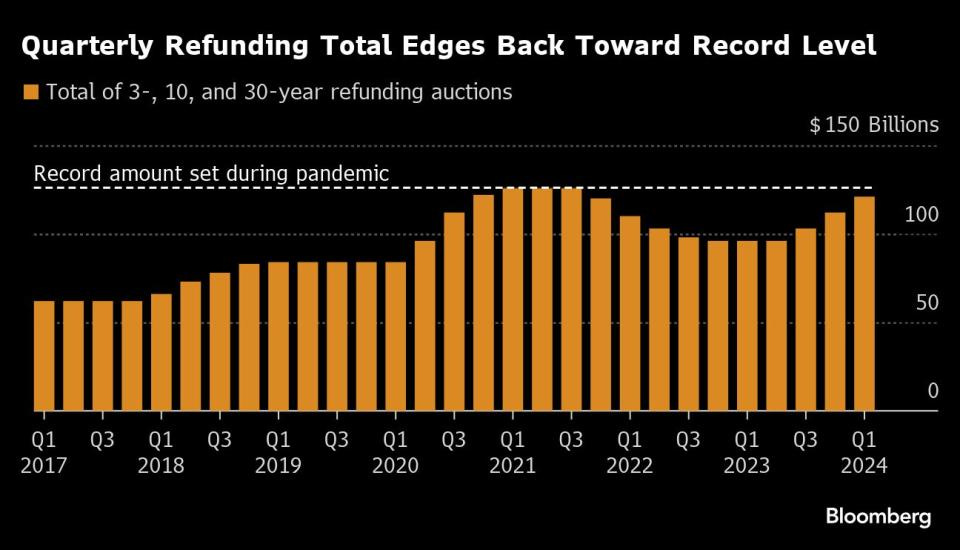

As you know, being a Daily Doom reader, the US government has increased its gargantuan debt auctions by such enormous amounts in order to fund Bidenomics that it has been having a harder time with its auctions in finding enough buyers to offset the retreat of the Federal Reserve as THE buyer. As you can see in the following graph, the government's actions have rolled back up to the highest they have been since the extreme financial bailout programs that began under Trump to rescue the economy from the failures that would have been created by the Trump administration’s choice to force Covid lockdowns upon the nation: (I.e, we printed our way through that economic all-out crash—avoiding the actual crash as it was happening—by creating money and giving it to everyone to keep things running, but we did it as a “temporary rescue plan.” Now, under Biden that horrible approach has become regular financing during a time when we were told the economy was strong so shouldn’t need rescue plans, so government debt has gone right back up to those crisis levels as the new norm with the congressional budget office saying that will continue as far as the eye can see.)

Now that the Treasury is starting to choke on those huge debt financing demands, the Fed has apparently decided to ease its pain by dispensing, at last, with the charade of the century and make its financial decisions purely and overtly for the sake of helping the government afford its ballooning debt:

US Debt-Sale Plan Seen Benefiting From Fed That ‘Stops Hurting’

The US Treasury is set to keep its sales of long-term debt steady in a new plan this week, with the government expected to get relief soon from the Federal Reserve’s rapid run-down in its securities holdings.

Dealers anticipate the Treasury on Wednesday will follow through on its January guidance of holding off on further increases in its so-called quarterly refunding auctions — which are now approaching the record sizes seen in the Covid crisis. That would mean $125 billion in auctions of longer-term securities next week.

Borrowing requirements have escalated thanks to a gaping federal budget deficit and the Fed’s quantitative tightening program — which has seen up to $60 billion of Treasuries [per month] run off the central bank’s balance sheet, forcing the government to sell more to private-sector buyers.

The Fed will offer an update on its plans Wednesday, after officials in March suggested they soon could slow the pace of QT.

If Janet Yellen’s Treasury (which is ultimately yours and mine, but she runs it for us) is anticipating relief from the overwhelming problem Bidenomics is creating for the federal government to come from the Fed at its next FOMC meeting, then the plan must have already been decided between Powell and Yellen and is just awaiting approval of the Fed’s Federal Open Market Committee (FOMC) that runs financial policy. The Fed is not, according to this article, deciding to slow down QT because QT is hurting the economy. It’s planning to slow it way down because forcing the government to find actual investor financing is crushing the government under rising interest … and that is happening even though the Treasury is delaying the huge auctions it really needs to have to fund the national debt.

This need suddenly arose because that rising inflation that I have promised would show up has arrived and it is pressing bond yields back up just as the government is needing new money to keep Plan Biden rolling. I said for years those interest rates were artificially held down by all the Fed’s bond hoarding and that “bond vigilantes” would return to gun down the government with higher interest as the Fed released its grip on bonds with it QT program.

Again, that’s the program that attempts to make good on the Fed’s claim that it is not monetizing the debt in that QT makes the monetization temporary. The problem with that is that the monetization has always only been as temporary as the Fed’s inflation was back in 2021 and early 2022. It’s always been a farce because every time the Fed has tried to end its rounds of quantitative easing (the money printing), the economy has failed and the Fed has had to run back to QE; and every time it actually tries reversing the QE with QT, the economy and financial markets have failed worse. So, the Fed could never actually do this, which is why I’ve always claimed the Fed had no end game for getting out of its endless rounds of QE rescue plans. Each exit wound up actually requiring a bigger round of QE than the one before in order to save us from the exit!

So, here we are. The government finally had to START getting real as the Fed rolled off some of the government debt it has been holding on the side lines for the government, and the Treasury is choking to death because of it:

US government bonds were heading for their biggest monthly loss since 2022 as of Thursday’s close, hit by hot inflation data that sharply curtailed expectations for Fed interest-rate cuts and by bloated auction sizes. Sales of longer-dated securities surprised traders two weeks ago with weak demand despite higher yield levels.

“I’m not so sure if all this helps Treasuries as much as it stops hurting them,” said Michael Pugliese, senior economist at Wells Fargo & Co., referring to Fed QT tapering and a stabilization in Treasury debt-sale plans. “Issuance is still really high and we are learning — a little in real time — how well these auctions will be digested.”

Now, if the Fed was just winding down its QT rate for the sake of monetary policy necessary to achieve its two charter mandates—maintaining a stable currency (i.e. free of inflation or deflation) and maintaining a strong jobs market, what it is about to do would not be illegal under its charter.

HOWEVER, that is the exact opposite of what is about to play out: We have rising inflation again now, and the purpose of QT was to clamp down on inflation by diminishing the foundations of money supply and forcing Treasury rates back toward real market pricing in order to slow economic activity by raising all interest pegged to Treasuries. (We never went completely there because the Fed still rolls over some government debt all the time. It just isn’t rolling over all the debt as it matures, forcing the government to get real on some of it.) Slowing QT when inflation is starting to rise again is doing exactly the opposite of what monetary policy demands for a stable currency.

A stable currency requires the Fed to create the amount of money the economy needs in order to avoid the value of the dollar going either up or down. (Though they have always allowed themselves 2% inflation under their baloney definition of “stable.”) So, decreasing the rate of roll-off just as inflation is rising, is a choice to not fight inflation has hard.

The only justification the Fed would have for this legally is its second mandate—maintaining a tight labor market. If the Fed’s QT starts to raise unemployment, then the second mandate requires it to balance its inflation mandate against its labor mandate. That is, of course, the impossible corner I’ve said all along the Fed was painting itself into. The labor market is, based on the Fed’s broken metrics, already tight at historic levels. Unemployment is, in other words, already low at historic levels and remaining low. So, the Fed is clearly not reducing QT in order to help labor when it has been saying for many months that tight labor is driving up the price of labor, which adds to inflation.

The labor tightness has been happening not because the economy is strong but because labor is in weakened supply after the Covid lockdowns, so it doesn’t take much of an economy to use up all the labor we have available in the pool. So, the Fed has been given a lot of latitude by labor to tighten up finances against inflation. In fact, many economist believe that raising unemployment is essential to combatting inflation. The Fed has hoped to raise unemployment just a little (a “soft landing”), but unemployment hasn’t budged.

So, the Fed has zero legal basis for backing down from its inflation fight. The only real reason it is backing down must be the benefit laid out in today’s article—helping the government afford the debt that IT IS NO LONGER CAPABLE OF MANAGING WITHOUT FED HELP.

Underscoring investors’ focus on supply, the Treasury Department’s quarterly financing estimates, due for release Monday afternoon in Washington, have received increasing attention. With solid jobs and economic growth, tax receipts lately have come in strong, improving the near-term deficit picture.

The problem is, with the economy softening, those tax receipts will go down.

Tom Simons, a senior economist with Jefferies, predicts the Fed will slash in half its roll-off of Treasuries, beginning immediately after Wednesday — taking it to a pace of up to $30 billion a month.

Now we get to the bananatard part

When central banks carry government debt (or in this case cut their roll-off of debt in half) AT A TIME WHEN INFLATION IS RISING, they always risk putting their economy into something worse than “stagflation.” They risk hyperinflation. I’m not saying we are going to now go into hyperinflation, but I am saying that the Fed’s inflation fight will lose out even faster as inflation starts going back up to where it was, which is likely if the Fed cuts QT in half.

QT has, as the article says, pressed Treasury interest rates up by taking the Fed out of the picture entirely with respect to financing new government debt. The Fed has continued refinancing some of the old, but has been, at least, finally honoring its promise to not do that indefinitely. Switching to doing that at half pace will soften the rise on those interest rates that has been happening due to QT, and those rates actually need to rise more if they are going to beat inflation back down. So, inflation will likely rise more rapidly after the Fed stops rolling off government debt so quickly.

Where relief is unlikely to come for now is on the interest-rate front. With the federal government’s debt-servicing costs on course to reach a record high as a share of GDP next year, high inflation readings mean Powell and his colleagues are unlikely to be signaling rate cuts for the coming months.

They definitely won’t be signaling rate cuts, but reducing QT has the same effect by backing off pressure in the bond market for the government to find new buyers outside of the Fed. That is why the article on Yahoo! today is saying this change will bring desperately needed relief to the Treasury. So, this, being done largely for that reason, is a first step into the banana-republic land of the central bank buying and carrying government debt indefinitely. There is no reason the Fed cannot back down on its QT if it is just to avoid creating a problem of unemployment that goes too high; but it appears the main thing being done here is avoidance of creating a problem of rising interest for the government, since unemployment is extremely low.

The Fed, of course, will deny that is what it is doing. But the truth is they cannot unwind their balance sheet without creating massive problems for the US Treasury, and that is what we are now seeing (well, unless the government were to cut its debt spending way back, but banana republics don’t do that). Can you imagine what would happen to GDP if Bidenomics came to an end when GDP is already falling pretty badly even with Bidenomics. (All part of the corner the Fed and feds have painted us into).

“The biggest language change is going to come from the messaging from Powell during the press conference,” said Lindsey Piegza, chief economist for Stifel Financial Corp. “This is where he’s really going to have the opportunity to backpedal some of that optimism for a near-term rate cut. Inflation data, while we’re not going to overreact to it, has been moving in the wrong direction.”

That leaves investors contending with hefty auctions in a still-inflationary environment.

This is the impossible corner. Since inflation drives up interest on bonds, the Fed has to fight inflation to help the government; but the way to fight inflation is to drive up interest on bonds. That can be done when the government can afford the debt it has, but the government can no longer afford the massive new debt to keep Bidenomics rolling because inflation drives up interest on bonds, and the Fed’s fight against inflation also requires driving up interest on bonds just as the government needs to issue a lot more bonds!

Now, if oil prices come down, that will ease inflation and give some reprieve in this tight jam, and today they did come down a little because Israel announced the possibility of a forty-day ceasefire in the Gaza war. That, however, is far from a done deal, and forty days, if it happens, is only a reprieve, not the end of the conflict. I wouldn’t count on much reprieve from oil as we drive into the summer season.

For now, we sit here:

Auction sizes for several tenors just reached new records. With yields right across the maturity spectrum not being far from 5%, investors have preferred shorter-dated Treasuries, as seen in sales last week that went off with little issue. But demand for 10-year notes earlier this month was viewed as abysmal, while that for 30-year bonds was lackluster.

“Abysmal!”

For now, the Fed is losing ground in the inflation fight, and the battle is getting as heated as the Gaza Strip.

Bond investors will also have a heavy slate of economic data to contend with over the week. There will be reports related to housing, consumer confidence and manufacturing activity, but top of mind for investors will be more insights on the state of the US labor market. Job openings for March will be of interest, but most important will be Friday’s release of nonfarm payroll figures for April.

Expect things to start getting interesting, and maybe invest in bananas because that is the way the nation is going.

(Is it any wonder gold has been rising so rapidly with Biden going bananas?)

Economania (national & global economic collapse plus market news)

Another Bank Bites The Dust – So Who Will Be The Next Dominoes To Fall?

Key Events This Extremely Busy Week: Fed, Treasury Refunding, Jobs, JOLTS, ISM And Tons Of Earnings

Why so many men have stopped working

Weaker Growth And Higher Inflation... Why Consensus Was Wrong

Dallas Fed Manufacturing Contracts For 24th Straight Month: “We are entering stagflation.”

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Florida housing bubble has burst?

Money Matters (monetary policy, metals, cryptos, currency wars & CBDCs)

Gold SWOT: Silver Has Caught up and Outperformed Gold by 10% Since Mid-February

A modern gold rush is on, as people cash in on record-high prices

Gold Fluctuates as Investors Turn Focus to Fed Meeting, US Data

$35 billion Thai gov’t pension fund shifts assets to gold and oil to mitigate geopolitical risk

The Bull Case For Commodities Is As Strong As Ever

Yen Sparks Intervention Suspicion After U-Turn From 1990 Lows

Yen Downgraded To Banana Republic Currency After Another Rollercoaster Session

Fed in holding pattern as inflation delays approach to soft landing

Affluent Americans are driving US economy and likely delaying need for Fed rate cuts

Inflation Factors (due to too much money chasing too few goods)

Oil Drops as Progress on Ceasefire in Gaza Shrinks Risk Premium

Dastardly ploys supermakets use to trick you into spending more

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

Hope for new Israel-Hamas cease-fire piles pressure on Netanyahu as Gaza war nears 7-month mark

Parties see hope for a Gaza cease-fire: ‘Maybe this time it will work’

—

—

China firms go 'underground' on Russia payments as banks pull back

Growing Shadow Fleet Makes Oil Price Cap Impossible to Police

Putin has lost 450,000 soldiers, 3,000 tanks and 500 aircraft in Ukraine war

Kremlin Disputes Report Putin Didn’t Order Navalny’s Death

What Putin’s No. 2 Believes About the West

Another Russian Oil Refinery Hit by Ukrainian Kamikaze Drones

—

—

The Day We Stopped Trusting Media

—

72 Minutes Until the End of the World? New book lays out the fast path to nuclear Armageddon.

Political Pandemonium & Social Senescence (socio-political issues & events)

The Plot to Wreck the Democratic Convention

David Pecker and The National Enquirer: When a Tabloid Becomes a Political Tool

President Joe Biden says he’s ‘happy to debate’ Donald Trump. Trump says he’s ready to go

Worst In 70 Years: Biden Approval Rating Absolutely Dismal

Stagflation: Biden's Dire Rating On His Handling Of The Economy Is Remarkable

Tensions grow between Trump and Lake in Arizona race for Senate

Thousands of Islamists rally for Caliphate in Germany

Holocaust memorial covered up in UK over fears it would be vandalised by pro-Palestine activists.

"Explain To Me Why We Don't Have The Right To Exist?" – Eva Vlaardingerbroek Warns European Whites Against Massive Demographic Changes In Their Native Countries

Justice Kavanaugh Warns Of Vicious Cycle Of Malicious Prosecutions That Could End Presidency

Seinfeld Slams 'Extreme Left' For Ruining Comedy

Globalism & Deep Domination (undemocratic government & censorship)

Media freedom ‘perilously close to breaking point’ in several EU countries

Russia arrests more journalists on ‘extremism’ charges

Calamity, Catastrophe & Climate Craziness

Trail of Destruction: 83 reports of tornadoes across five states

Red Sea Diversions Spew Carbon Emissions Equal to 9 Million Cars

Off-the-Beat News & Just Plain Offbeat News

Homicide Rap For Tesla Driver On Autopilot

NHTSA Probes Tesla Autopilot Again After 20 Crashes Since Update Remedy

Moral Legalism in Iran Becomes Excuse for Violent Immorality against Women

Boeing Goes Boing: 767 Loses Emergency Slide After Departing From New York City

Misplace your keys? Don’t worry, forgetting is actually good for your brain

Biologists Construct Groundbreaking Tree of Life Using 1.8 Billion Letters of Genetic Code

Doomer Humor

Russell Brand announces baptism after months-long spiritual journey: 'Taking the plunge' (Brand was regularly featured in this section for awhile, so that is why this headline is in this place.)

In real terms, bonds peaked in July 2020. Stocks peaked in December 2021. Gold has been sniffing that out ever since, and even silver is starting to catch the foul smell of rotting bananas.

A whole lot of investors are already on the wrong side of the pain line. Most of them have no clue. My bet is that they will figure it out eventually, and a lot of them won’t be alive when the next equity peak arrives.

“He who panics first, panics best.

After me, the deluge”.

Attribution: Unknown.

The Fed’s primary mandate is to re-elect Joe Biden, as was recently exposed by O’Keefe Media.