The Path by Which We Got Here

It wasn't just COVID that got us down the road to ruin. Because many think we are in what looks like a post-apocalyptic world of rubble only because of COVID or because of Trump, I decided now would be a good time to summarize how predictably the Fed's Great Recovery and Great Rewind got us here.

Now that we see the Fed has become too impotent to even risk acting, lest it prove its impotence before the entire world, let us look at how predictable every step down our road to economic ruin has been. This blog has proven that by laying out each turn before we got to it so that, when we got where we are now, we could tell how we did and how one could see it coming.

Let's not lose site of the path many never saw

Long before COVID blew a hole in the road, our present circumstances could be seen coming, and it didn't take some conspiracy theory of smoke-filled rooms and scheming bankers in the 1920s to plot where our course was taking us -- just an understanding of ordinary human nature when coupled to predictably bad philosophy.

We'll look just at stocks because that is where the Fed was pumping all of its mojo, and looking at anything more would needlessly complicated the picture without adding value. Stocks are where most people think the Fed still rules and always will rule, as though the Fed is omnipotent and omniscient by virtue of infinite money, not human and fallible, limited in foresight, blinded by bad philosophy and, therefore, apt to fail.

In 2017, when the Fed's Great Rewind (quantitative tightening) took us down a new trail from its decade of quantitative easing, I said stocks would not likely take any big damage that year. I mention that now to note I'm not a permabear who is right by accident because he always says the same thing, but mostly to note how accurately the path could be seen, even the times that didn't blow up.

In 2017, I said stocks would wait to take their first major hit until January of 2018. Why? Did I say that based on some clandestine knowledge of when the Fed's evil scheme had plotted to jog the world of finance? No, it was because many months before that the Fed publicly stated it would double down on its initial rate of quantitative tightening in January.

I believed the initial start of QT in the fall of 2017 would not likely damage the market because it was so miniscule at only 10 billion a month in money subtraction by the Fed and because the market would be relieved that the long-feared event came and not much happened.

The market was already rising on a tide of excited new investors during President Donald Trump's first year in office, and that excitement was not likely to run off course if nothing bad happened from the loss of $10 billion a month. As a matter of fact, the market's rise only became more euphoric because the big event had begun, and nothing bad happened, just as I said it wouldn't:

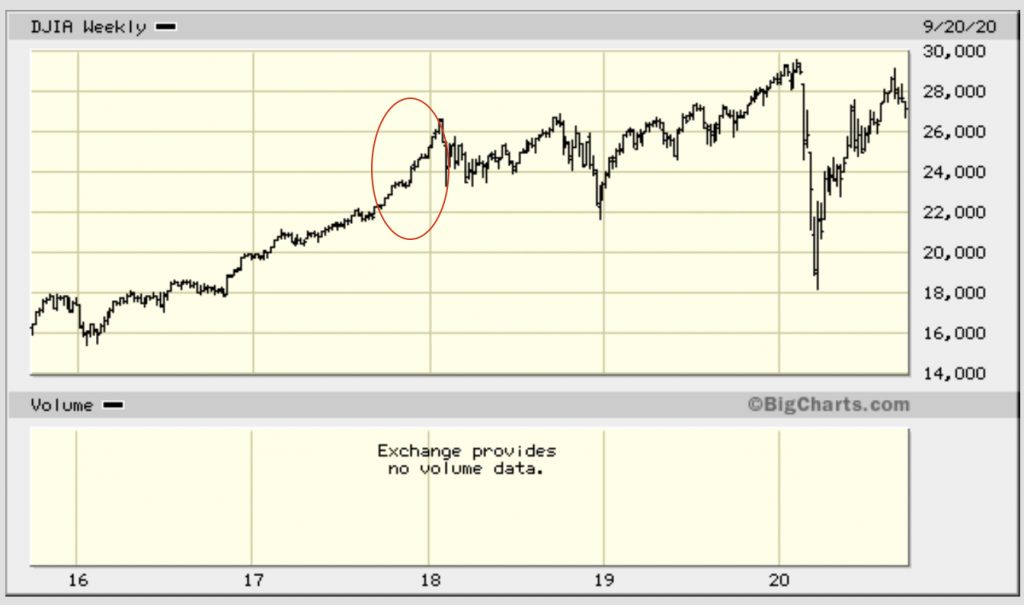

For January, however, I predicted the Fed's doubling of its rewind rate would get the market's attention with a foreshock that portended a long breakdown in the market. You can see in the graph, the market has travelled through a rough neighborhood ever since that January with each new plunge driving deeper.

That first foreshock, I said, would hit because investors would start to feel the pinch of the slowly tightening money supply. As you can also see in the chart above, the market began a record-breaking plunge in late January, right, which was when the Fed doubled its tightening. That plunge continued through February and partially into March.

Sometime around March of 2018, shortly after the plunge bottomed out, I said the market would experience a large relief rally and would not fall again until summer. That rally went even higher than I anticipated, just like the one this year, but I believed the market could still overcome the Fed's small amount of tightening and would take a natural bounce after such an abrupt correction in January.

It did.

I explained the rally would happen because QT was still slow, and the market had adjusted in the just-completed fall enough to somewhat align with the Fed's tightening of the economy (and, hence, of money available to all markets), and because the initial scare had, again, passed.

I based my bearish prediction for a summer plunge on two things: The Fed had already stated its plans to increase QT again at the start of summer. At that point, the rate of rewind would be double again from what it was in January. The rewind's downdraft would become serious in terms of cash flow (at $40 bill per month -- half the rate of the Fed's QE that had pumped up the market for years, so it would be enough negative flow for the market to really start fighting it).

The relief rally had enough momentum to carry us through the Fed's spring increase in QT, but that momentum, I believed, would exhaust itself by summer, given all the Fed tightening that was undermining the market's support all along the way. Therefore, the early-summer step up in QT would knock the wind out of the tired market.

Summer proved significant, but not in the way I expected. It wasn't out of line with what I said would happen, but I anticipated another general market plunge like the one we had in January and February -- maybe a little longer. I didn't spell out that level of detail in my public prediction, but it is what I was thinking (just based on logical projections of economic and financial plans and trends, not chart lines).

What we actually got was gentler on the surface but torrid down deep: The overall market did fine (see the minor dip in the graph above at the start of summertime); but, from the start of the summer through the end, all the FAANG stocks crashed into their own bear markets -- some down more than 40%. Trillion-dollar companies almost sliced in half! So, the plunge was much narrower than I thought it would be but cut much deeper into the heart of the market.

The FAANGs rebuilt quickly, but their damage was more significant than the January crash because these were the supposedly invulnerable leaders that traders had depended on for a decade of easy and safe money, AND they were a huge part of the market's wealth store; so, those who held them in quantity lost a fortune. Their crash took some confidence out of blind investor sentiment.

The significance of the event was less in the amount of loss to investors than in proving the market's indomitable leaders could be knocked down. They were no more invulnerable than Great Father Fed, himself. That gave a deep chill to the market, I think, at a subconscious level that helped set it up for the next fall, which I had predicted all year would be the big one in the fall. (See the biggest plunge of all in 2018 on the graph, which started in the last week of September.)

We'll see why.

Our road to ruin came with a map

The logic that made all of those predictions possible lay in the simple fact that the market was far more dependent on Fed easing than market investors or the Fed realized or would admit at the time. I believed neither group saw the damage that was coming, so the damage would come.

I stated each time I made those predictions that the Fed's Achilles heal was that it believed it could continue tightening, as it had always said it would do. Its wrong beliefs about its ability and its plan were due to bad monetary and market philosophy but would be reinforced for both the Fed and the market by the fact that the market would (and did) make it through the first two big hiccups from 2018 tightening, which I described as legs of a protracted 2018 crash. (And, as you can see in the graph again, 2018 ended the year well down from where it began, which is rare for stocks. Tightening, it turned out, was terrible for the Fed-rigged market.)

Ironically, instead of serving as forewarning, like they should have, those foreshocks shored up Fed belief because we made it through each one, as I said we would. Thus, I maintained that the Fed, right at the point where the market had just finished a major breakdown in the summer, would bring its tightening up to full speed just as it had stated in its schedule for the fall, fully believing it could do all that it had long said it would do because the market kept recovering. (After all, the market peaked up 9.6% for the year on October 3, 2018.)

The Fed wouldn't see those first market events as foreshocks of something bigger but as proof the market could recover from each shock. That would reinforce the Fed's confidence, causing it to continue longer and harder on its tightening than it ever should have attempted. I stated that over and over before the fall came.

The market, I said, would crash when the Great Rewind got up to full speed in the fall. As you can see in the chart, its crash began (on October 4) right after Powell assured the world that full-speed tightening and interest hikes would continue on autopilot for a couple of years because, as Janet Yellen had promised, quantitative tightening would be "as boring as watching paint dry," and, so, the market immediately started its big event for 2018. (Even most investors at the time believed interest was the big thing affecting the market, not QT, so they didn't have their eye on the right ball in order to see what was going to hit them in the head.)

This conclusively proved out the map I had laid out for events caused by Fed's balance sheet unwind: Because the market would weather through the first two legs of its 2018 protracted crash, the Fed would believe it could make it through this last step up in tightening and go too far. The Fed would see the October crash when it did begin as just another reflexive action that would go away on its own, just as January's plunge had and as summer had.

Many bears, like Peter Schiff, claimed the Fed wouldn't dare move forward with tightening -- that it would never happen. The Fed would not dare reverse QE or would stop as soon as things got bad. I kept saying, even in the face of arguments like that on my own blog, the Fed would keep right on believing it could do the very thing it absolutely could not do -- tightening -- because it would believe the market would get over it ... again. It also would be intensely motivated by desire to prove to the world it could do everything it had long said it would do.

The Fed followed its scheduled course as I thought it would and tightened the market into paroxysms of despair and then still kept tightening until the market became a full bear market in many indices in December. Even in December, Powell & Co. continued to believe they were completely capable of continuing to take down their balance sheet without crashing the entire recovery they had built by pushing the balance sheet up so long as they stopped interest rate increases. They thought the market's drops in 2018 were all about the interest. I kept saying it was mostly about QT.

The market's downfall became so intense in December that Secretary of the Treasury Steven Mnuchin called all major banks to make sure they had the funds to survive. Then, just to reassure the world he had everything firmly in hand, the Munchkin tweeted from poolside that he had talked to all the banks to make sure there would be no runs, and all was fine. Panic instantly struck the market's spinal cord, and the Fed scrambled to stop the damage the Munchkin's dumb chatter about his calls had accelerated.

ALL OF THIS WAS EXACTLY THE THEME OF MY BLOG FOR THE PREVIOUS TEN YEARS. Through all that time, I had said the Fed's recovery plan was not sustainable and definitely would crash into ruin when the Fed finally stopped the easing and tried to actually rewind it. THE FED HAD NO EXIT PLAN. I said it again and again. The Fed, however, really believed it could unwind, and so it would go too far with it. That was easy enough to foresee from a human-nature standpoint.

Right after Munchkin finished floundering spectacularly in his Christmastime swimming pool in the Caribbean, Powell announced that tightening would move to a shortened schedule and that interest increases would stop immediately, and THAT is what got the market to immediately stop falling (as in same day).

Powell, however, continued to believe it was mostly about the interest with QT being secondary. Apparently so did most investors because the market relaxed.

Making that sudden huge policy shift, however, cause the Fed to lose face in such a big way that Powell in his later talks at banking forums began to openly worry the Fed was at grave risk of losing public trust (as I pointed out in my Patron Posts -- next one in the works).

That, too, was exactly what I had said would happen. When QT failed, as it certainly would, the Fed would find it was losing the public's faith, and FAITH was and is the only thing that makes the Fed's money worth anything. (See "The Moron’s Guide to Money: What gives money its value? And what is the gold standard?")

So much for "as boring as watching paint dry."

QT was a Fed fiasco and was proof, as I had been arguing for years, that the Fed had no exit plan that would work. It had painted itself into a corner of perpetually expanded money supply, which is where I had said for ten years it would end up because its plan would create perpetual market codependence. The Fed had become dependent upon the market for the "wealth effect" it hoped would stimulate the economy because it had tied its whole recovery plan to the market, and the market was permanently dependent on the Fed for stimulus money.

Bridge out at mile marker 2019

In January of 2019, I specifically said I was not predicting a market crash for 2019, as I had for 2018, because all the events of 2018 had relieved some of that pressure. However, something much worse, I warned, lay just ahead because, while the Fed announced its tightening would end early, it remained dumb enough, as I said it would, to think that stopping interest hikes was sufficient to end the damage its tightening was creating and, with that relief from tightening money markets, it could continue to tighten money supply through the summer ... and as if damage to the stock market was the only thing it had to worry its tightening would cause.

Its promise to stop raising interest and to reduce the rate of quantitative tightening in summer, and to end QT sooner than it had scheduled, all gave the market space to rest. This left the Fed oblivious to how its tightening of money supply was creeping up on banks, so it kept taking its balance sheet down.

Sure enough, when summer came, the Fed had to stop QT even sooner than it had promised it would back in its December plan revision because the market started to stall, but something more wicked lay right ahead. It's not clear that the Fed saw it coming, but I had specifically warned of it back in January based on a couple of articles on Zero Hedge pointing out some year-end troubles in repo. You could start to see where the pressure was building. (It was also based on my conversation with a Fed economist and the Fed's own statements about its member banks reserves.)

For years, I had said the Fed would be slow to learn when it came to this juncture and reluctant to back away from QT because it had managed to get so far down the path of proving it could do what it had always maintained would be easy. Having lost face by just partially backing down in December, the Fed would trap itself by its own desire to prove it really could tighten more.

The Fed would, thus, continue to inflict more damage on its recovery than it knew it was causing. By the time it became clear the bridge was out ahead, the Fed would be screaming along so fast, it would be too late to stop. In blind desire to prove the Fed could do as it said, Powell would keep the pedal to the metal right off the end of the bridge and hope to jump spectacularly the river with his whitened knuckles firmly gripping the steering wheel.

Many bears continued to argue against me, claiming the Fed would never let its prized market get damaged or its economic recovery or its strengthening of banks, so it would leap back to QE before things ever got that bad and cause hyperinflation. Some even believed hyperinflation (ultimate devaluation of the dollar) was the Fed's sinister global agenda all along.

My main January predictions for 2019 were two-fold and disinflationary:

1) The economy would slowly sink into recession as tightening continued on far too long, in spite of the major stimulus the economy was supposed to have gotten from the Trump Tax Cuts. Those cuts, I had said for over a year, would deliver nothing economically. GDP would not rise, other than briefly, because almost all the tax savings in 2018 would go into stock buybacks, not upgrading factories or building new factories in America or expanding markets or developing new products -- just easy-money buybacks that serve only the rich owners at the expense of their own businesses and the nation.

That is because major shareholders don't care about business at all any longer because the Fed and welfare-level capital-gains taxes made it easy for them to be nothing but traders for a decade, not true owners at heart with a business to oversee. They are there to just milk out all the easy money they can get and move on like vampire squids -- most of them -- to the next prey. They are not the type like Warren Buffet who plan to strengthen actual business.

Thus, we'd see GDP decline in 2019 because 2018's tax cuts did NOTHING for actual business or for consumers (workers), With that failure and the

Fed's tightening, a recession would start in the summer of 2019. BUT (and this is a BIG BUT) I said over and over almost no one would see the recession starting either! Certainly not the Fed, who is always last to see such things, and certainly not economist who only figure it out minutes before the Fed, but not even the general public.

I promised I would point out where it was forming for my own readers so they could watch how it was unfolding bit by bit to see it develop.

2) I predicted the recession that began in the summer would most likely coincide with the worst repo crisis we had ever seen, starting in late summer. That would happen because the Fed's tightening was rapidly taking down all of its member bank reserves as they were forced to soak up the bonds the Fed was no longer refinancing for the government. I laid out in graphs and from my own personal discussion with one of the Fed's chief economists how and why that was happening. The Fed believed the banks could endure this loss of reserves without a hitch.

Overnight bond repo yields skyrocketed from 2.5% to 6.125%, the sharpest increase since 2001. Some have suggested this was a foreshock of deep bank liquidity problems that are starting to surface. One securities trader noted that year-end funding pressure should have created a 50-basis-points rise, but this was a 350-basis-points rise. The spike left mouths hanging open. It suggested banks suddenly had to raise cold cash....

This change in how robust bank reserves are as their holdings in bonds devalue creates fear between banks, reducing their willingness to lend to each other, which tightens up the credit market for the whole economy because money stops moving as freely....

This is more in the realm of prediction than current headwind, but this gentle wind looks likely to whip up later in the year. The vital note here is that credit of every kind is tightening as central bank money supply shrinks. We’ve seen sudden spasms in bond rates.... Because the world is built on debt-based monetary systems, a credit seizure is everything; and we can now see dust falling out of the cracks in these columns that support our economy.

I maintained the Fed's continued tightening through the first half of 2019 would take reserves far below where they could go in the utterly Fed-dependent new economy that came out of the Feds' Great Recovery (the ten-year QE period). Note that the Fed had to keep revising its QE plans upward throughout that period to keep its recovery moving, indicating it didn't have a great master conspiracy for how QE would work either. Every time it stopped, it had to go back quickly to doing even more.

Thus, in the summer of 2019, we saw the first signs of a real recession, as the manufacturing sector of the economy slid into outright recession. The Fed apparently saw some clue of it, too, because it suddenly reversed its interest tightening that had happened in the prior year and "preemptively" lowered interest three times in the summer. (Preemptive interest lowering -- as in before official acknowledgment of a recession -- is an extremely unusual Fed move and requires the Fed believe recession may be imminent.) Until that point, the Fed had simply stopped raising interest.

I had said many times in preceding years, based on the Fed's history, that the Fed's reversal of interest policy and return to QE would come too late to save the day. Thus, we saw the worst repo crisis in history start a credit crisis in the final week of summer due to banks not being willing to loan to each other because tightening had sucked so much funding out of completely dependent markets, such as hedge funds that had now become dependent on Fed easing.

Tighter bank reserves and a plethora of bonds the Fed was now rolling off, left banks not wanting to do repo loans that exchange the bank's money for bonds on a temporary basis. Banks were stuffed with bonds and low on cash reserves.

Another basis for all these predictions was one common-sense underlying truth -- a point of logic: You cannot undo the very things you did to create recovery if the recovery remains dependent upon them without totally undoing your recovery! KIND OF SIMPLE REALLY. But who could have seen that coming?

Many bearish types like me could see that coming and believed the Fed could, too; but the Fed believed its philosophy. It always has. The philosophy is just wrong! You can be smart and powerful and be wrong. Karl Marx is a good example. The world is full of brilliant people who are dead wrong. Philosophies can be blinding.

I continued to maintain the stock market would not crash again UNTIL a full-on recession brought it down, and the Fed has a solid track record of never seeing a recession until it's standing in the middle of one that it helped create. As even Ben Bernanke has said,

Expansions don’t die of old age. They are murdered.

"Federal Reserve Confesses Sole Responsibility for All Recessions"

And as Janet Yellen averred, it is the Fed that blindly pulls the trigger:

Two things usually end them…. One is financial imbalances, the other is the Fed.

And, as I added,

Think that through, and you quickly realize that both of those things are the Fed. Is there anyone left standing who would not say the Fed’s quantitative easing in the past decade was the biggest cause of financial imbalances all over the world in history?

All of that, I laid out in one of my early 2019 articles, saying how clearly the next murder was about to happen.

As the year dragged on, I continued to maintain that the recession I was predicting would not be officially recognized by the Fed (or even generally recognized by anyone) until early 2020.

After the repo crisis I had said was likely coming late in 2019 actually did hit in September of 2019, I stated in October that the Fed's claim that it could resolve the crisis by just offering its own repos was completely mistaken -- that the ONLY way the Fed would finally resolve the crisis would be by going back to full-on quantitative easing in order to fully reverse the tightening it had falsely believed it could do and long claimed it could do.

The Fed didn't dare admit it was wrong because it had already lost face enough in the December crash and course reversal. Admitting that it had gone too far with its tightening policy after that and admitting that it had to rush back to full-on easing would be admitting total failure of the Great Rewind it had promised. It would mean the Fed admitting it couldn't do ANY of the things it had long claimed it would do because it had to now restore ALL of that easing it had rewound -- something all humans are loath to do. Moreover, it has long based its claim that QE was not monetizing the debt (illegal for the Fed to do) on the basis that it was just temporary monetary policy that would eventually be unwound (in quite an easy and boring manner).

Human nature was enough to explain how Fed would get itself mired down in the road it had chosen.

I claimed the Fed would have to reverse ALL of its tightening to back out of its rut, no matter how much it wanted to save face by continuing forward. It was now just spinning its wheels with these overnight repos because it was never actually able to do any tightening in the first place and should have never driven into that swamp. It just wrongly thought it could and convinced almost everyone it could. It was time to just back up!

What COVID-19 did was give the Fed a convenient excuse to make the total reversal it knew it had to make without losing face.

Conspiracy theories be damned

You can believe them for the fun of it if you want. It's just that you don't need them to have seen where every turn in the road was coming. (And I'm not saying I was right about everything economic event I ever predicted, because I wasn't, but these things about where the Fed was taking us and how the Fed would fail were all spot on.)

Some people maintain the Fed did ALL of that by plan as a grand conspiracy. It did so only if you are willing to believe the Fed wanted to look desperately stupid before the entire world and wanted to lose all faith and also ONLY if you believe the Fed is omniscient and omnipotent so it could see all of this coming and shrewdly design each intended failure along the way decades ahead of time in order to lay out a path of failures as some great scheme to stair-step us into the apocalypse. That belief takes more faith in Fed omnipotence than I have.

Instead, I see the evil greed that drives people, the flaws in their ideology, and the ways in which that will likely break down over time based on the trends that are building from their clearly stated plans. It's a little different way of looking at the Fed's failures -- a simpler way -- but it allowed me to see every major turn in the road with clarity, so I think it was the right way. It was at least right for me because simply put, it worked. It got me there! It got me to see where the Fed would end up before it all ended up with no need of a conspiracy theory to see it coming.

There could still be a grand conspiracy driving it all, but my point is that you don't need to believe that to see clearly what's coming ... obviously, as this site demonstrates. If there is such a conspiracy behind all the Fed's confounded actions, you have to believe these powerful people love to make themselves look stupid and inept and love to pick the most complicated and convoluted and drawn out road to their objectives imaginable and that they are omnipotently able to control every turn with perfect underhanded skill in order to make it look as if things are always going the way they wouldn't want them to go and yet still get them all to go exactly where they want to go. They must be gods if they can master all that.

I'm not saying banksters don't meet at the Bilderberg summit every year to figure out how to recover from the previous year's failures and plot moves for the next year in order to try to retain greedy control of the world's finances and keep themselves rich. And I'm not saying greed and arrogance don't give them common objectives at every meeting that trend the same way. That's human greed at work.

I'm just saying it is all the damndest master plan conceivable if you think this road of Keystone-cops chases and crashes was laid out decades ago. It looks more like an endless effort to run things that is just as endlessly bungled and bounces up against its own abject failures and, so, has to be recalibrated every year because it is all based on a lousy financial philosophy and daily human greed between competitors. It looks like people flying by the seat of their pants as they attempt to keep the world beneath their feet each year. They appear to be endlessly struggling to keep the car on a winding, cliff-edged road as greed keeps the accelerator hammered to the floor.

But if you want to believe the whole thing is a masterplan, O.K. However, my simpler point of view made it just as possible to map out where all of this was heading better than many conspiracy theorists did over the last three years, and apparently better than the Fed could see it and better than many in the nation who watch the Fed could see it because very few sites were predicting a repo crisis for late 2019, except Zero Hedge, and even fewer were predicting a recession would begin insidiously in 2019.

I found it possible to predict all of that based on belief that the Fed runs by wrongheaded financial philosophy. It was predictable (as demonstrated) based on nothing more than human nature -- pride, inability to publicly admit you're wrong, hubris to think you cannot be wrong ... all the ordinary stuff of a Greek tragedy wrapped up as a comedy of errors. I laid out the path precisely, and it did not take ANY conspiracy theory to do that. The proof is in the pudding. Here we are, right where I said we would be.

The Fed reaps the whirlwind

Thus, I noted that the Fed's endless overnight repos were nothing but covert easing because the Fed could not admit its failure. (If you keep rolling 100-billion in repos over every single night, it is NO LONGER OVERNIGHT. It's a 100-billion in quantitative wheezing. It is, in other words, a 100-billion in new money that you are endlessly rolling back into the economy, which makes it permanent money if you cannot stop. And the Fed could not stop.) I even prognosticated that the Fed would have to keep upping the amount of its "overnight" repos and later "term" repos and expand the number of them until it got serious and just caved in to full-on, undeniable QE.

The repos, of course, became a steady roar in the background of our poorly functioning financial system that was tilting due to the failure of the Great Rewind. The repo crisis continued every day, even as the Fed kept upping the amounts and the length of the terms, then started buying up bonds again to hold to maturity, and still the crisis did not end until the Fed finally went to outright, undeniable QE on a massive scale, fully reversing ALL the QT that had caused the crisis.

All predictable YEARS in advance because the Fed started down an unsustainable course with its first steps into QE during the Great Recession from which it could not ever unwind. It even laid out the schedule in advance, telling us how it would try.

That fall, something else happened. The SERVICES sector -- the main part of the US economy -- also started to slide into recession. PMI figures moved into retreat. I maintained my position that, still, almost no one would see the recession that was opening up until early 2020.

When the recession was realized, the market would finally have its truly MAJOR crash. Even that crash, I said, would be protracted, taking probably two or three years to find its bottom because of the historically record-breaking exertion by Fed and feds that would be taken to try to pump the market back up, which would be partial successful ... and because that is how the worst crashes have often played out -- a huge plunge, a huge rally (bigger than I thought in this case, but, hey, it's 2020!), followed by a much longer cascade down.

I have spent ten years here listing the many reasons those efforts would fail when this day came; but the short-and-easy reason is that the Law of Diminishing Returns would make the Fed impotent by the time we got to this part of the Fed's self-created crisis.

Not COVID

So, here we are. 2020 came, and every one of those things happened from 2018 on as I said they would. Yet, some will still say we got here all because of COVID-19, and I would have been wrong about 2020 without that shove over the cliff.

Well, I wasn't wrong about late 2017, when the Great Rewind began, or 2018 or 2019, so why would that be? I laid out what was practically an itinerary of troubles for the Fed's journey.

There is no doubt that COVID accelerated the secular decline we were already in, and we'll never know with certainty if my long string of predictions would have finally failed at this point without COVID, but we can know that everything before COVID went exactly as I laid out; so it is not that unreasonable to think the rest would have followed, though perhaps not as abruptly.

Here is the thing: when you set yourself in a weak position with no ammo left to fire, any major attack by any bad string of events is much more likely to wipe you out.

I maintain, for example, that we could have weathered the Covidcrisis far better if we had not spent the last ten years hollowing out all of our corporations in order to fatten the pockets of their rich owners as they milked their companies dry. Those corporations would not be depleting the government now for their survival if they had become robust under a true recovery that served business and workers and not just stakeholders and bankers.

The Fed's plan was always a plan that would only fuel stock buybacks. So is a low capital-gains tax. So are the Trump Corporate Tax Cuts. That is all any of that fuels! Corporations not only pumped all their disposable revenue into share-holder dividends and buybacks, but they took out massive debt at cheap Fed-induced interest rates to deplete all their available credit capacity just to give even more to extraordinarily greedy shareholders! All of that did nothing to build up actual business.

That economic plan left us with no reserve fuel in our tanks. It created companies that were up to their eyeballs in debt and already totally dependent on near-zero interest forever. That is the definition of a zombie corporation. We created zombies all across the American landscape that could never survive their own debts if interest were ever allowed to become market-determined.

Here is where that becomes important now: With so many corporations dependent forever on Zero Interest Rate Policy by the Fed just to maintain themselves, the Fed had nothing to offer when real troubles came. Holding interest down at the zero bound can have no stimulus effect at all because ZIRP had already become essential just for continued corporate survival BEFORE COVID hit! That's WHY the Fed was engaged in huge financial troubles with the unending Repo Crisis. And that, as I pointed out months ago, is "How the Fed Fixed the Repo Crisis."

ZIRP dependency leaves you with nowhere to go but into Alice's Wonderland of negative interest rates, which have proven themselves to have almost zero stimulative affect while turning the financial realm upside down. That's why I've said in my Patron Posts the Fed won't go there.

Negative interest rates are on that terminal plunging end of the Diminishing-Returns curve where everything you do to stimulate with lower interest creates more negative side effects than the good you hoped to achieve. The Law of Diminishing Returns is Economics 101, which the high-minded economists at the Fed forgot about after their first year of schooling as they moved on to fancier financial philosophies. Now they're getting schooled by reality, and the rest of us get to take that lesson with them.

What I'm describing is the mechanism by which the Law of Diminishing Returns worked in this case. The Fed had depleted all of its dry powder, as David Stockman is fond of saying. When the Repo Crisis hit before COVID-19, the Fed already absolutely had to reverse QT just to end the damage it had inflicted by trying to reduce its balance sheet.

That means going back to full QE would not save the market or economy from the Covidcrisis any more than trying to bury us lower in interest rates because that move was already essential before the crisis, too. QE became essential in the fall of 2019!

Again, the Law of Diminishing Returns.

So, ZIRP became essential before COVID because corporations had fattened their owners by using massive corporate debts to stuff their pockets with cash, and QE became essential before COVID to resolve the Repo Crisis that QT had created.

We became so dependent in normal times on continued emergency measures that those measures have NOTHING to offer now that truly tough times have come. That is what David Stockman has meant by talking for years about how the Fed would find itself with no dry powder when it needed it most. Those are my granular explanations of how that plays out. Stockman is another one of the few who could see this coming and who never relied on conspiracy theories to see it.

We witnessed the Fed's impotence in all of that in March of 2020 when the crashing market did not respond to the biggest rescue plans in Fed history. The market did not respond UNTIL the US government jumped in with both feet and started dishing out helicopter money to the masses in even larger amounts than what people were losing due to unemployment.

Now, however, the government has stopped that, and the Fed has stopped additional QE, so the market is back in major trouble for exactly the logical reasons I said it would be at this time: The Fed and government are not there for support (entirely predictable based on all they had already scheduled and the laws the government had written with expiration dates).

All of this has nothing to do with chart trends any more than with conspiracies. These are all just logical deductions about where our greedy choices over how to run our economy and our financial system for the good of the few are going to collide.

If this didn't cause us to get here, why did it get right where I thought it would take us?

So, here we are with the worst September in 18 years! Who can be surprised?

September trading is living up to its billing and then some.

Stocks on Monday were seemingly unraveling a bullish trend that now risks thrusting U.S. equity benchmarks into a bearish tilt that could set the stage for the worst September selloff in years for the major equity gauges.

With a decline of about 7.3%, the index is on track for its steepest decline in a September, since 2002, when it crumbled 11% in the month on the back of growing fears of inflating internet-related stocks

All of the above is why the market is crashing today.

It is also why I wrote everything as predictions. If one can see it coming in advance and lay out each major turn publicly on record, it's much harder for the Fed and other greedy people to argue convincingly later on that everything you said about where it would lead had nothing to do with what got us here when we landed where all of that said it would lead! It's a little harder to argue the dots were connected wrongly if their connections were that predictable before they even became dots!

And, in that case, maybe there is some reason listen to what we need to do to set a correct course -- the things the greedy do not want to do.

Our tired plans have simply exhausted themselves because they never created a recovery that could sustain itself (and they never had any hope of creating such a recovery). That has left us unable to sustain ourselves now that tough times have finally assailed us.

It was inventible this day would hit us, whether by COVID or not, because you cannot avoid tough times forever. If your economy is already in ruin internally ... below the surface ... that is when a black swan can cause grave damage, instead of reparable damage. Our car had already swerved off the cliff; we had bailed and were already hanging from the cliff by our fingertips. Then COVID came along and stomped on our hands.

Was it COVID that made us fall by stomping on our hands, or were we going to slip and go the rest of the way down anyway?

Now here's another warning

If September's plunge ends, as well it might, don't say, "There, that wasn't so bad" because there is plenty more coming. This market has a long way to fall to become rational again because it was floated on Fed hot air that is failing. It will complete the fall. It ALWAYS does when the economy fails like this, and this economy is going to give it lots of black swans up ahead to learn again and again how wildly irrational the market was and to catch down to economic reality.

We live in a time when flaming white swans are circling the horizon everywhere, so how long can it be before a crispy, blackened swan falls at our feet, still on fire?

There is more denial in the market now than any time in history, I think; so, I fully expect denial to resurrect the bulls for another head bashing more than once; but from here on out, I think we see lower highs and lower lows; and we won't likely see the market's early September high again for, at least, two years, possibly a lot longer.

There is a lot of nonsense to knock out of this market and out of our economy, and COVID finally was a swan with enough moxie to do it.

So far, the path down looks more like stair steps than the two huge waterfalls that happened last February and March (which is also as I said would be most likely):

Yet, there is October, which loves a surprise, and swans await everywhere now. We just don't know which black swan will come swooping down into our little ballet first; but with all the white swans on fire now, odds are pretty good it won't be long before an ashen one arrives.