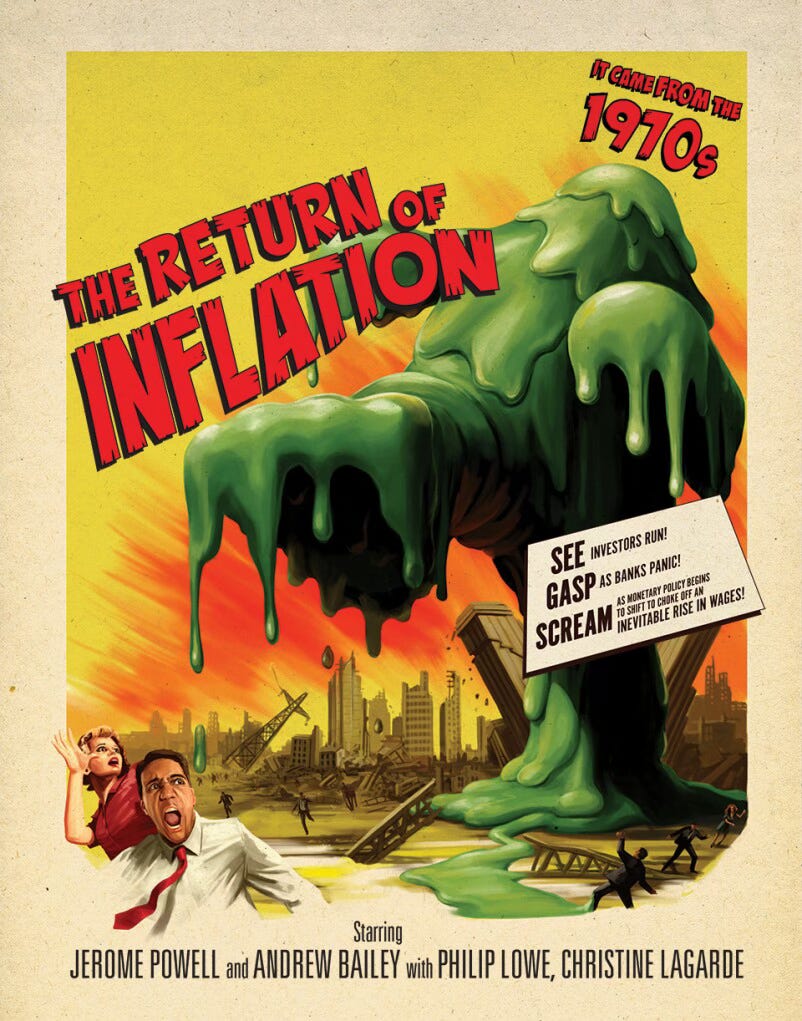

The Return of Inflation

It's being reported EVERYWHERE now.

Having just published the clearest charts I’ve seen showing the return of inflation in my weekend Deeper Dive, I discover headlines everywhere today are recognizing the rise in inflation all over the world and especially the US. They are also telling the tale of the complete loss, for now, of the Fed pivot narrative because of inflation’s rise. So, today I’m going to summarize that now apparently unmistakable horror story from all the headlines covering it.

First off, the Fed’s Raphael Bostic says he sees no urgency in cutting interest rates because of the economy’s strength. He obviously doesn’t see the cracks that are all over the economy, but I wouldn’t expect he would. The Fed never even sees the cracks that are all over banking until they break into full public view and require massive emergency bailout programs. He sees only two rate cuts, both late in the year. (So, we are now moving even lower than three among the rate-cut counters.)

But he also said the Fed was walking a "fine line" to be sure that current economic strength does not evolve into "froth" and a new round of inflation.

Before rate cuts "I need to see more progress to feel fully confident that inflation is on a sure path to averaging 2% over time."

"Only when I gain that confidence will I feel the time is right to begin lowering the federal funds rate," said Bostic, a voter this year on interest rate policy. "The good news is the labor market and economy are prospering, furnishing the (Federal Open Market) Committee the luxury of making policy without the pressure of urgency."

It is also said that Powell is going to double-down on the “no rush to cut” message when he speaks to congress on Wednesday and Thursday.

The US central bank chief and nearly all of his colleagues have said in recent weeks that they can afford to be patient in deciding when to cut rates given underlying strength in the US economy.

In other words, they are seeing nothing in their broken labor gauges that would indicate anything other than a “strong and resilient” US economy. So, it’s full steam ahead with tightening for awhile longer.

That cautious approach has been validated in recent weeks by data showing inflation picked up last month.

One article on Goldseek even ventures to say we can expect a rate hike as being more likely now that inflation is becoming visible to all. Add this to the other sources I’ve noted in the last couple of weeks that have started saying this.

I’m beginning to change my mind about rate cuts happening mid-year, and maybe not at all in 2024. In fact, the Fed could very well start raising rates again, due primarily to a healthy economy, including a strong dollar and job market, and persistently high inflation.

Wolf Richter points out that the Fed is now even talking about “balance-sheet normalization,” by which they mean continuing to pare down their balance sheet for a long time until they get it looking a little like it did before all the QE nonsense.

The Fed wants to drive QT as far as possible without blowing stuff op, and it’s working on a plan.

The problem there is that they always go until they blow stuff up. Why would we trust them to do any better this time? Nevertheless, the nation will trust them this time and all the next times, too, because it always does … as I laid out in my little book: DOWNTIME: Why We Fail to Recover from Rinse and Repeat Recession Cycles. (As the book’s cover asks, “The same characters who created bailout bonanzas for banksters in the Great Recession are doing it again. Shall we let them?”)

On the good news side of inflation, all the news about the return of inflation has been rocket fuel for gold, sending it to its highest level ever today—$2,100.

One article on Zero Hedge today now takes the Fed pivot narrative all the way back to the 70s or even the 40s, by which they mean there will be “No cuts for 2024.“ That is because the resurgence of inflation is now looking like what it did in the 40s and 70s when it returned with a vengeance. Supercore inflation (which excludes energy, and housing and is the Fed’s most preferred measure) is particularly soaring now while surveys show that more small businesses are already planning future price increases (as in a lot more). They are also more planning to raise worker compensation (as in quite a bit more). The charts in that article will tell the story.

Even Wall Street is reported as increasingly being concerned about the return of inflation. It is no longer a one-way Goldilocks narrative:

Recent signs of stickier-than-expected inflation have some Wall Street strategists concerned that investors have become too optimistic about the odds of a soft landing in the US economy.

The prevailing concern is that inflation could enter an era of stagflation, where price increases reaccelerate while economic growth slows.

I’ve said for the last few years, the next big recession would be a stagflationary recession. That would be this one.

This was most famously seen during the 1970s and 1980s when a swift move down in inflation proved to be a head fake, and the US was left fighting higher prices for more than a decade.

"We believe that there is a risk of the narrative turning back from Goldilocks towards something like 1970s stagflation, with significant implications for asset allocation," JPMorgan chief market strategist Marko Kolanovic wrote.

So, a little reality about inflation has finally sunk in. That’s why my motto for this site is “the news before it happens.” Eventually … it happens. “Chapter Two: The Great Re-inflation” has begun. It’s being acknowledged everywhere now. Stay tuned to find out what will happen next in the news. (As trends become clear, my paid subscribers will be first to know what I believe is coming. They deserve that much for making ALL of this possible.)

(Today, the headlines supporting the above editorial, and many other headlines, are available to all for free. Normally they are only available to paid subscribers. You can find those related to the editorial in bold:)

Economania (national & global economic collapse plus market news)

Gold & Bitcoin Close At Record Highs As Bonds & Stocks Dip

Some NYCB deposits may be a flight risk after Moody’s downgrades ratings again

Stock rally stalls as week begins, Nasdaq falls from record despite Nvidia gain

Money Matters (monetary policy, metals, cryptos, currency wars & CBDCs)

Fed's Bostic: No urgency to cut interest rates given US economy's strength

Fed’s Powell to Double Down on ‘No Rush to Cut’ Message

Don’t Be Surprised if the Fed Raises Interest Rates

Fed Discusses Balance Sheet “Normalization”

The PCE Inflation Report: Rocket Fuel For Gold!

Gold rises above $2,100 to highest level ever as traders bet on interest rate cuts

Bitcoin tops $67,000 as it nears 2021 all-time high

Inflation Factors (due to too much money chasing too few goods)

No Cuts Ahead: Back to the 1970s or the 1940s for inflation?

Wall Street is increasingly worried about inflation's resurgence

Gold Grabs Center-Stage as Stagflation Starts to Rage

$15 Hamburgers Don’t Even Cover Costs

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

China Debuts Drone Game-Changer

New AI generates election-meddling worries

Gaza War Is Shifting Ties Between Secular and Ultra-Orthodox Israelis

Political Pandemonium & Social Senescence (socio-political issues & events)

Supreme Court Unanimously Overturns Colorado Ruling Throwing Trump Off Ballot

Donald Trump's Colorado win sparks fear of 'second January 6'

Supreme Court rules states can’t remove Trump from presidential election ballot

House Dems Implode Over Supreme Court Decision; Raskin Crafting Legislation To Bar Trump From Ballot

The Golden Age of American Jews Is Ending Due to Their Own Liberalism

Utah Tells the Feds To Pound Sand

Why Is Congress Nuking Northeast Gasoline Reserve As Part Of Bill To Avert Federal Gov’t Shutdown?

Calamity, Catastrophe & Climate Craziness

Tumbleweeds invade towns as severe weather sweeps Western states

Snowpocalypse Closes Highways In Northern California

Up to 2 feet of snow to hit Northern Sierra, days after powerful blizzard

Off-the-Beat News & Just Plain Offbeat News

Inside plans for Mark Zuckerberg’s massive $260M bunker on secluded Hawaiian island

Patmos: The Greek island where the end of the world began

SpaceX-backed startup says preorders for its $300,000 futuristic flying car have reached 2,850

Bet the White House won't acknowledge it, and if they do, they'll say it's Putin's fault. Linking tomorrow as usual @https://nothingnewunderthesun2016.com/

Added shares today $NEM $ALVLF $NSUPF. Adding to others every day this week. LFG. LOL.

Don’t tell my wife.