The Stealth Recession Is Creeping Back, Even as AI Stocks Go for Broke

The economy is sneaking toward a second run at recession, even as GDP appears to be lingering positive. The monster never really left. It just hid behind tariff front-running.

At the start of the year, I was calling it a “stealth recession.” News today is that 22 states are fully in recession. Half of the rest are just “treading water,” and the remaining quarter or so are still hanging in there on the positive side.

The U.S. economy is very close to falling into a damaging contraction — and many states are already experiencing a recession, according to Mark Zandi, chief economist at Moody’s Analytics.

As a result, it is not too surprising, that only 2-in-10 people surveyed think Trump is doing a good job on the economy. That number, however, also means a good portion of Republicans think he’s doing poorly with the economy, which is a little surprising. A total of 74% of people polled rate the economy as either “fair” or “poor.” The Republican party, as a whole, however still ranks higher in almost everything than the Democratic Party.

“Who leads on the economy? Republicans by seven. Immigration? Republicans by 13. How about crime? A big issue for Donald Trump and the Republicans. Look at that lead, by 22 points!… So the bottom line is, at this particular point, the ball may be on the ground, but the Democrats have not picked up the ball and running [sic.] with it. If anything, at this particular point, it’s the Republicans who are running with the ball on the top issues, the economy, immigration and crime.”

Going for broke

In real terms of how the economy is impacting individuals, Chapter 7 bankruptcies for individuals are up by 15% for the first nine months of the year.

The sharp rise highlights mounting financial pressure on households, Michael Hunter, vice president of bankruptcy data provider Epiq AACER, said in the ABI statement.

“The growth in active Chapter 13 case inventory suggests more consumers are turning to bankruptcy as a necessary financial reset. We expect this upward trend to continue, with a strong likelihood of accelerating into 2026.”

Commercial bankruptcy filings are also on the rise.

AI is also going for broke, too

But it is doing it by going up. The rush into AI stocks is looking like the prelude to the 2000 dot-com bust.

The world is spending record-breaking amounts on Artificial Intelligence. Experts have been warning that the current AI craze might be a speculative bubble — just like the dot-com bubble of the 1990s which ended in a big crash and bankruptcies.

Ya think?

To give you a sense of scale for how high the mania is running …

Tech firms are pouring hundreds of billions into AI chips, massive data centers, and tools to keep up with chatbots like ChatGPT, Gemini, and Claude. The total AI spending could reach trillions of dollars. The money is coming from venture capital, loans, and even unusual deals that are worrying Wall Street investors, as per the report by Bloomberg.

Even top AI supporters admit the market is “frothy” but believe the technology will change the world….

However, no one really knows how AI will make steady profits yet. Many executives are spending heavily on AI out of fear of falling behind rivals — not because profits are guaranteed.

That was exactly what happened leading up to the dot-com bust. Fortunes were invested in companies that had never showed a dime in profits, but no one wanted to get left behind on the tech that would and eventually did change the world. Some of those companies like Amazon did go on to make it big. Many went bust. The NASDAQ crumbled into dust and did not fully recover for a decade.

The exuberance today for AI is even more extraordinary than the froth that boiled over for internet companies back then:

In January, OpenAI CEO Sam Altman announced a $500 billion “Stargate” AI infrastructure plan at the White House, shocking many with the price tag. Meta’s Mark Zuckerberg followed by promising to invest hundreds of billions in AI data centers. Altman later said OpenAI could spend “trillions” on AI infrastructure, as stated by Bloomberg report.

Half a trillion dollars pledged by just one AI company! Yet, no one is quite sure yet how AI will turn a profit and few AI ventures have. Eventually, of course, a few will go on to be the next industry giants. Many others will fail. Here is the clincher, though: Back in 2000, even the companies that went on to become the industry giants for the next quarter century, crashed so hard it took years for their overvalued stocks to recover all that was lost, too.

With AI presently priced to the stratosphere …

Hedge fund manager David Einhorn warned, “There’s a reasonable chance that a tremendous amount of capital destruction is going to come through this cycle.”

Goldman Sachs is issuing a similar warning in our headlines today. Goldman’s CEO David Solomon said the market has been propelled to record highs by “AI frenzy.”

I’m not so sure the frenzy isn’t being created by AI, which may have taken over the algorithms that have been the market makers in investing for the last ten years, unbeknownst to anyone since their barely pre-AI algos were all designed to reprogram themselves in the first place; and their designers have said they don’t even know in what ways they have reprogrammed themselves because the designers cannot keep up with the ongoing daily tweaks, as they adjust their formulation based on what moves proved successful. If AI cannot run the major market algos or reprogram them directly to benefit its own development (perhaps at the behest or demand of the AI companies who are creating the AI), AI certainly can figure out how to game them indirectly. But my guess is AI companies are well ahead of the game, turning their own AI supercomputers to such tasks in order to drive their own stock values up.

Solomon’s warning continued,

“Markets run in cycles, and whenever we’ve historically had a significant acceleration in a new technology that creates a lot of capital formation, and therefore lots of interesting new companies around it, you generally see the market run ahead of the potential ... there are going to be winners and losers….”

Solomon pointed to the mass adoption of the internet in the late 1990s and early 2000s, which led to the emergence of some of the world’s largest companies — but also saw investors lose money to what became known as the “dotcom bubble….”

“I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good….”

Solomon is not alone in having concerns about current market levels. Speaking at the same event, Amazon founder Jeff Bezos said Friday that artificial intelligence is currently in an “industrial bubble….”

And earlier this week, veteran investor Leon Cooperman told CNBC that we are in the late innings of a bull market where bubbles can form — something Warren Buffett had warned about….

Karim Moussalem, chief investment officer of equities at Selwood Asset Management, meanwhile, warned of “enormous risks” on the horizon for the AI trade which could rapidly unravel. “The AI trade is beginning to resemble one of the great speculative manias of market history.”

The only real question is when does the long cascade down begin. I thought we saw it getting started last spring, but then it got strangely shortstopped as tariffs began flashing on and off.

The slow decline of the economy also got shortstopped after a first quarter of negative (recessionary) GDP growth due to the front-running of tariffs that I said would give a temporary reprieve. However, the decline has now resumed based on other metrics than GDP. I dug deeper into those metrics that reveal a significant actual people-hurting decline of the economy in my weekend Deeper Dive and explained why some metrics like job reports, unemployment and GDP are likely to be unreliable for some time.

We’ve seen these cycles before:

Economania (national & global economic collapse plus market news)

Are we in a recession? Yes - if you live in one of these 22 states.

Shock Poll: Majority Believe Trump Has Hurt Economy. 2 in 10 Say He’s Helped

Chapter 7 Individual Bankruptcy Filings Jump 15 Percent In First 9 Months Of 2025

Why Fears of a Trillion-Dollar AI Bubble Are Growing

Goldman boss David Solomon warns of a stock market drawdown: ‘People won’t feel good’

The following highlighted stories that laid out the true condition of the economy were covered in the weekend Deeper Dive:

Shutdown delays jobs report, obscuring potential economic problems

Here is what the jobs report would have said about the US economy

Employer hiring plans at lowest level since 2009

Wealth of top 1% reaches record $52 trillion

The U.S. SERVICE SECTOR IS IN COLLAPSE. (This Represents the Overall Majority of the U.S. Economy).

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

Treasury Department considers minting a $1 Trump coin

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

Seige on Venezuela: US military ‘preparing to seize ports & airfields’

—

White House authorizes deployment of National Guard to Illinois

Trump to send 400 Texas National Guard troops to Illinois as anti-ICE protests continue to rage

‘Military-Style’ ICE Raid On Chicago Apartment Building Shows Escalation in Trump’s Crackdown

Body slamming, teargas and pepper balls: viral videos show Ice using extreme force in Chicago

COLD AS ICE: Immigrants nationwide placed in solitary confinement for weeks

Using helicopters and chemical agents, immigration agents become increasingly aggressive in Chicago

—

Gen Z Anger at Ruling Elites Is Erupting Across the World

—

—

Hamas Is Still at War with Itself over Terms of Trump’s Peace Plan

Hundreds Of Thousands Turn Out At Pro-Palestinian Marches In Europe

Many American Jews sharply critical of Israel on Gaza

Steve Witkoff and Jared Kushner head to Mideast as Trump warns Hamas against peace deal delay

For Netanyahu, Trump’s Nod to Peace Puts Him in a Tough Spot

Israeli strikes kill 20 Palestinians hours after Trump urges Israel to ‘stop bombing Gaza’

Top Vatican cardinal says Israel carrying out massacre in Gaza

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

Way Past Its Prime: What Caused Amazon to Turn So Terrible?

Political Pandemonium & Social Senescence (socio-political issues & events)

Senate reject measures to end shutdown; House GOP to extend recess through Oct. 13

Johnson cancels House votes next week, pressuring Senate Democrats to end shutdown

‘We’re just beaten’: For beleaguered federal workers, shutdown is last straw

Trump no longer distancing himself from Project 2025 as he uses shutdown to further pursue its goals

Pod man out: Trump’s support among influential podcasters is waning

Has Trump’s government made political comedy feel important again?

House of Judge Criticized by Trump Admin Set Ablaze... Received Death Threats

Young People Are Falling in Love with Old Technology

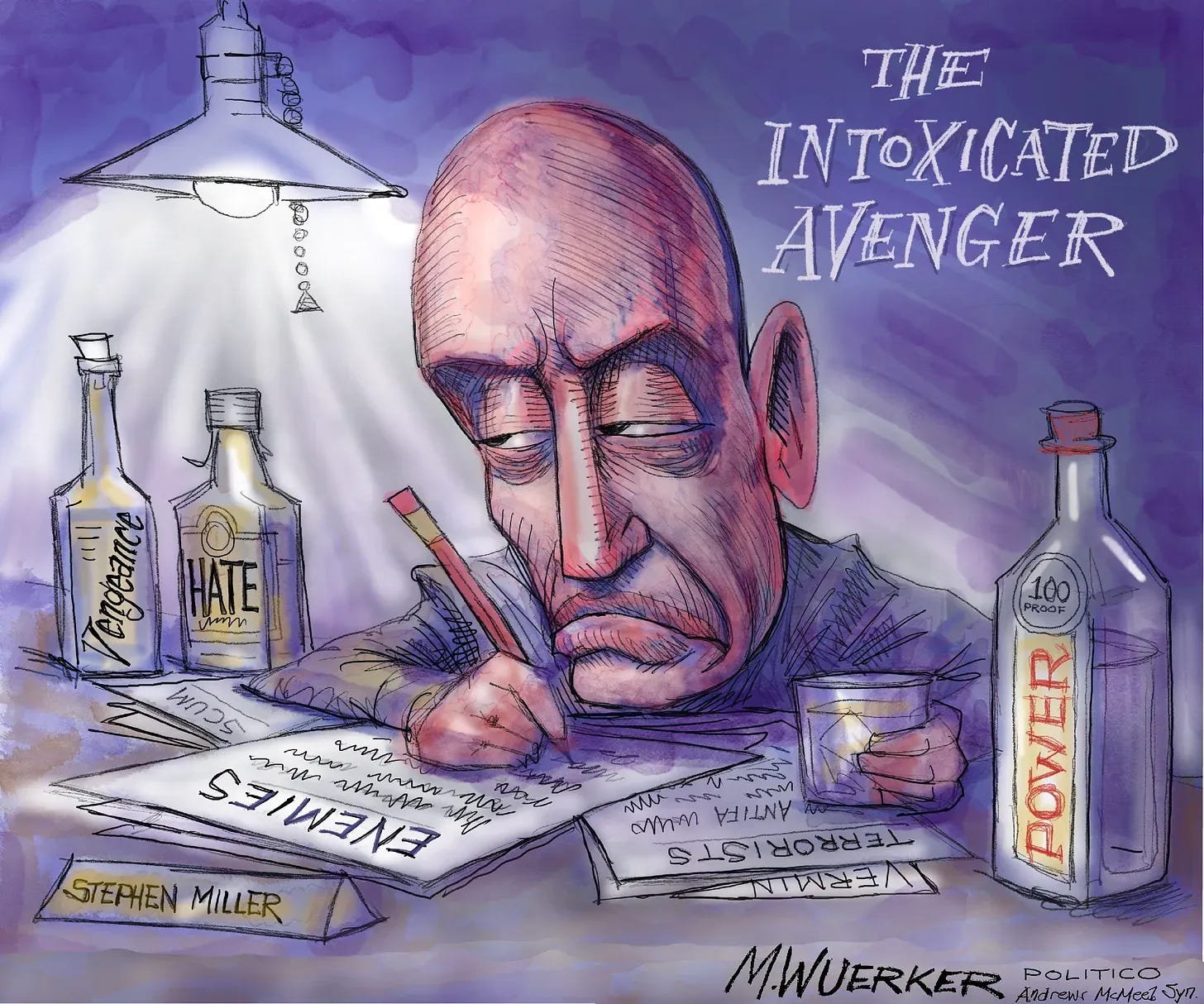

Stephen Miller’s Own Cousin Disowned ‘Face of Evil’ in Wrenching Post

Does anyone else remember when Amazon was just a bookstore? Their only product was ink-on-paper books, sent by mail (now called snail mail). A gazillion other small internet sellers wanted their piece of the pie, so most emulated Amazon in becoming a one-category mail order seller. One company sold kitchen gadgets. Another sold hardware store items. And so forth. Some companies decided to concentrate on services. Travelocity was an online travel agent, booking only plane tickets (back when airlines paid travel agents to book their tickets, because travelers did not buy tickets directly from the airlines back then). eBay was an online auction (you actually bid for items online in a fixed time frame; no “buy it now” buttons back then). People quickly learned that eBay sellers stole their money and never shipped the goods, until eBay itself started guaranteeing performance when you paid with their credit service (now called PayPal).

How was all this possible? Venture capitalists lent millions to entrepreneurs with nothing but an idea. Everyone was going to be the next Amazon in their little niche of the market. And they burned through billions in VC to “gain market share.” The holy grail was “market share.” Company officers were living the high life on VC. Advertising agencies and the media were getting rich on VC. VC was buying server farms and internet backbone time. But the VC folks were not getting anything in return. Until seemingly overnight, the venture capitalists realized that “market share” did not pay a return on their investment, so they cut the spigot. And the dot-com boom became the dot-com bust.

Companies closed their virtual doors. Company officers were sacked. (My brother was pretty high up in AT&T, until he quit to become VP of an online customer resource management (CRM) startup. Within 6 months of jumping ship at AT&T, he was unemployed.)

Like you, I see an amazing parallel between the AI bubble and the dot-com bubble. It will end the same way. A few strong companies will survive, like Amazon and Travelocity from that era, but far more will go bust, such as the tens of thousands of companies like my brother’s that you’ve never heard of.