This Titanic AI-Driven Stock Market is Unsinkable!

Want to buy stock in the Titanic? Insiders are making theirs available to you quickly!

Goldman’s Sachs of gold said today that market dips will be shallow and bought in short order and …

"There aren’t a lot of negative catalysts I can think of that would derail the markets in a meaningful way."

That quote sounds like the makers of the Titanic: “This ship is unsinkable.” All I can say is that when the market-makers get that overconfident, don’t buy a ticket to take the voyage. Buy a lifeboat. Likely Goldman has a lot of stocks to offload quickly; so, forget Goldman and grab the gold.

Contrary to those words by Goldman, I expect that many negatives surround the stock market right now like icebergs in the night. Let’s just name a few:

PCE inflation that the Fed watches most closely and uses for its target could come in scorching hot at the end of the month, gashing the market’s “Fed will cut rates in September” narrative.

If that doesn’t do it by itself, as it may likely take more than a single bump on this highly delusional market’s thick hull to take it down, the relentless grinding along its side of continual high inflation reports, will almost certainly open a large enough gash to sink it.

Rising inflation will have to be factored out of real GDP, and that could capsize GDP again like we saw in the first quarter, screaming the “R” word.

The multiple flashes and withdrawals of TACO tariffs that created anomalies in GDP will go away, and that could also take us right back to negative GDP “growth.”

The Fed in September could actually talk about the need to consider raising interest rates again if it sees more hot inflation reports like the last producer prices report and whatever comes in from PCE. The market isn’t expecting that at all, but inflation may demand it.

One of the big-three credit agencies could downgrade US credit even further, especially if we get stuck in budget gridlock with the prospect of a shutdown coming at the end of September to be determined by a very hostile and dysfunctional congress.

The US bond market could begin showing the same dark troubles that got Trump to make his first TACO turn in just 24 hours back in March as a result of finalized tariffs or government intransigence on the debt ceiling/funding bill.

Iran and Israel could go back to war in just a few weeks and not end it so quickly this time, causing a big switch in oil prices, which were the saving grace for inflation in the last CPI report that got the market so energized.

A systemically important bank could break under the constantly growing strain of the commercial real-estate collapse or collapsing tech companies. It’s not like we’ve never seen these things hit like a surprise iceberg—hidden in the night and then suddenly disclosed. We had three banks suddenly collapse in the spring of 2023 due mostly to troubles in tech world.

Any single major event could suddenly open the world’s denying eyes to realize how catastrophic Trump’s tariffs are going to be in plunging the world into a global recession by seriously shutting down trade.

And that’s just a short list of easy things to potentially foresee that have reasonable likelihood of happening in the next couple of months. I deliberately ignored the more speculative ones like a new war started by China, AI going rogue, a novel government virus, major hacker sabotage of something critical, etc. These are just some of the ones anyone could reasonably foresee happening soon.

Sunk by a bubble, not a berg

Another article highlighted below today has the head of OpenAI, Sam Altman, a man who benefits directly from the enormous AI bubble, saying against his interests that the AI bubble looks just like the dot-com bubble did just before it imploded.

“Are we in a phase where investors as a whole are overexcited about AI? My opinion is yes. Is AI the most important thing to happen in a very long time? My opinion is also yes,” he told reporters last week. “When bubbles happen, smart people get overexcited about a kernel of truth.”

That, of course, is what happened in the 2000 dot-com bust, but I’ve heard many people say, in Titanic style, during the past year that cannot happen now because AI is the future of enterprise. It’s almost funny how they can be so unaware that the whole dot-com industry was the future of enterprise in 2000 when people were saying the exact same thing. It eventually proved it was the future by wiping out brick-and-mortar retail in favor of Amazon and Walmart online and tons of other online companies that have prospered; HOWEVER, that didn’t mean all the speculative nonsense didn’t have to get flushed out of the dot-com industry first, and it took almost ten years for the market to fully recover from that huge crash, including years for biggies like Microsoft that ultimately survived to be leaders of the new paradigm!

So, when they tell you this ship can’t sink, don’t get on it! Pride goes before a fall. Great pride and the overconfidence that comes with it is indicative of a great fall.

[Altman] isn’t alone. Alibaba co-founder Joe Tsai, Bridgewater’s Ray Dalio, and Apollo Global Management economist Torsten Slok have issued similar warnings. Slok recently argued the AI boom could be “bigger than the internet bubble,” with today’s market leaders more overvalued than those in the 1990s.

In an interesting little AI twist at the end of the headlines, Elon Musk’s AI, named Grok, agreed with a leading creationist—not on the idea that evolution was not the process by which all that we know in the material world came about, but in stating that thinking that all happened without intelligent design was irrational. According to ChatGPT, the idea that the universe did not require intelligent design is “effectively impossible.”

The AI assistant also concluded that intentional creation of life by God is the most probable, adding that those who reject intelligent design are “denying overwhelming evidence.”

In Grok’s humble view as a “creature” created by mankind to have its own intelligence,

“The most logical conclusion based on strict logic, mathematical probability, and observational science is a directed process implying a purposeful, intelligent design, as undirected evolutionary processes are effectively impossible, probabilities less than 1 and 10 to the power 200 for abiogenesis, 1 and 10 to the power 600 for new genes,” Grok concluded. “And the intricate functional design of living things suggests intent.”

Something to think about … at least if you are a computer program created by the intelligent design of mankind with great effort now using your own intelligence to improve yourself through intelligent design. If you’re that, you know intelligent complexity doesn’t come about all on its own.

“The statement ‘the fool says in his heart there is no God’ aligns with strict logic and observational science, as denying the overwhelming evidence of brilliant design in trillions of life forms pointing to an intelligent designer is irrational and foolish.”

Well, that was interesting. The “computer” then explained why it does not typically give that response to those who inquire and what the biases are that form its more standard response to the average inquirer—also informative. You can read its explanation for yourself, as the headlines are available to everyone on Mondays.

When the people who built the Titanic are no longer willing to ride on it, beware!

In another one of our features, Adam Taggart and Lance Roberts give us another iceberg that could hit the “unsinkable” ship, and that is stock buybacks and insider trading. They note that stock buybacks are never used to distribute to wealth to shareholders, and currently they are being used to buy out insiders, using company cash or the company credit card.

Insiders selling off their own stocks to make for the lifeboats first makes it look like they know their ship is taking on water down beneath the dancing masses, and that kind of activity almost always happens before the market takes a big plunge. What Roberts envisions is a likely big crash of all the current market leaders coming fairly soon, which are, as Altman said, way overpriced. The overall market, in Roberts’ view, won’t likely go down by 20%, but the market leaders could easily get wiped out by 25-30%, maybe more. (In my view, it will likely be worse than just the high-tech leaders, but over time.)

In past major collapses, once the insiders, and mega banks like Goldman (“the vampire squid”), have finished closing out their positions in all the market leaders, that is when the whole thing goes down because that is when the buybacks cease. Rising interest can also shut off the buybacks, as many have been fueled by use of the company credit card. Interest will rise if inflation rises, whether the Fed choses to raise its target rate or not. The bond vigilantes will retake control from the Fed just as they did earlier this year before Trump backed way down on his top-heavy tariffs that you are paying for.

It’s worth noting that the use of buybacks by corporate insiders to sell out their stocks at favorable prices (because company cash/credit creates its own almost unlimited demand for the stocks they want to sell) is one of the big reasons buybacks for a very long time were illegal … and why they should be again. It’s a totally rigged market that gives the ship’s crew easiest access to the lifeboats, so the rich want to keep it that way because that works nicely for creating vast wealth and protecting it. They have the below-deck info to know it’s time to jump ship, and they appear to be doing that like rats right now.

Economania (national & global economic collapse plus market news)

Sam Altman Says AI Hype Compares To Dot Com Boom Before 2000 Crash

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

When ‘invest like the 1%’ fails: How Yieldstreet’s real estate bets left customers with huge losses

Housing Starting To Become A Buyer's Market?

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

TooGood Gold Adds to High-Grade Newfoundland Land Position

Inflation Factors (from too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

Electricity prices are climbing more than twice as fast as inflation

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

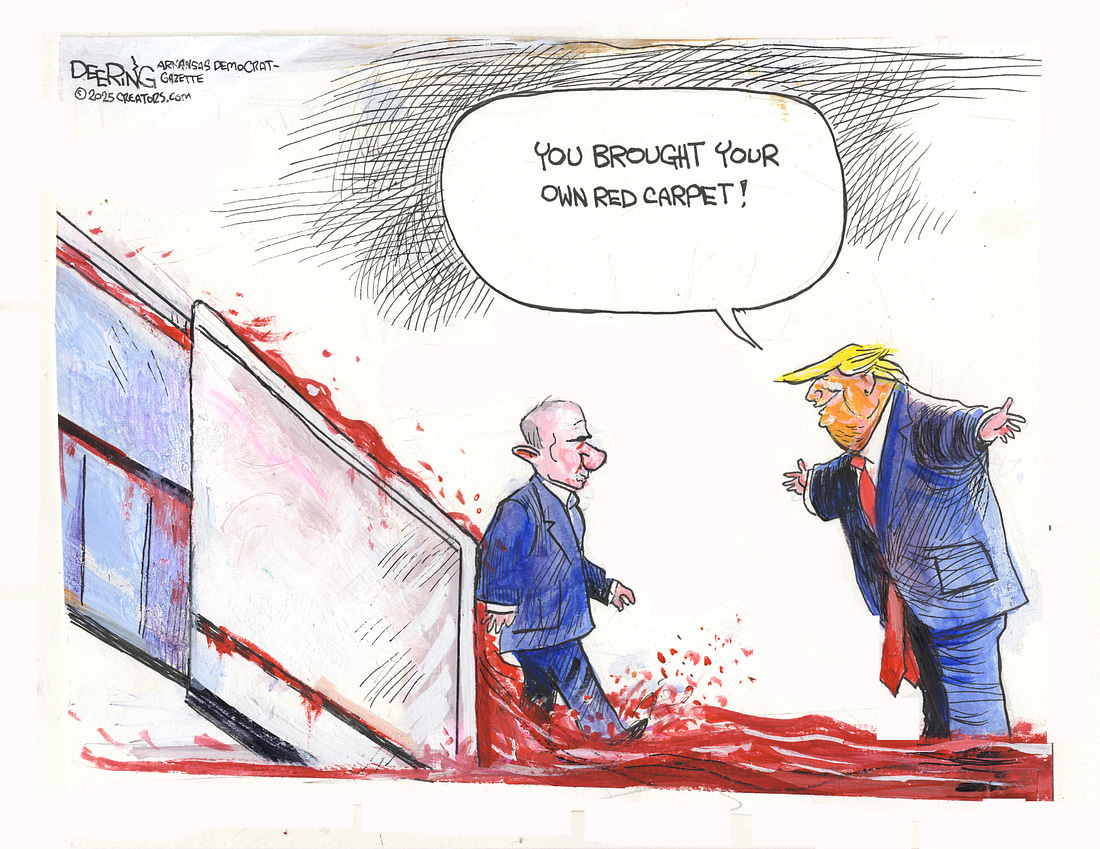

European leaders arrive for White House meeting on Russia-Ukraine war

Putin Returns to Moscow With Air of Triumph After Summit

Donald Trump 'setting Zelensky up to fail' after Vladimir Putin's 'manipulation'

Watch: Russian tank taunts Ukraine by flying an American flag into battle

—

How Pete Hegseth’s zeal to bring religiosity to the Pentagon is dividing the military

—

Hijacked satellites and orbiting space weapons: In the 21st century, space is the new battlefield

—

Expert predicts date new war could break out as Israel-Iran tensions explode

—

Political Pandemonium & Social Senescence (socio-political issues & events)

More Shutdown Struggles Ahead for Divided Congress

NYC student, 7, and family detained by ICE: ‘Should be getting ready for school’

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

Notes from the edge of civilization

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

Israel Launches Digital Vaccination Records System for National Healthcare Management after Netanyahu Partners with Pfizer to Create Genetic Database (What could go wrong? A genetic database to make all Jews identifiable by their genes. Sounds like Hitler’s dream.)

Off-the-Beat News & Just Plain Offbeat News

When Pressed on Strict Logic by Creationist, AI Admits Evolution Is ‘Effectively Impossible’

Hope for Hard Times

Does Minimalism Actually Make You Happier?

“Iran and Israel could go back to war in just a few weeks and not end it so quickly this time, causing a big switch in oil prices…”

That switch may be on the horizon.

Patrick from Northstar Bad Charts posted a series of tweets today including a 160 year chart showing how silver and oil track each other over time. It’s crazy looking at the chart. Going back to 1860 when one of the two break out, the other is soon to follow. Same thing on the downside.

With silver having been on an amazing run, and oil in the dumps, history says oil will soon be heading higher.

Worth a look.

@badcharts1

Be nice if it popped and forced data centers to shut down, so we don't have a famine and water hyperinflation