Trade Deficit Falls by Most on Record, but Look out Below!

Plus we get to see a billionaire brawl as the Musk-Trump bromance goes bust.

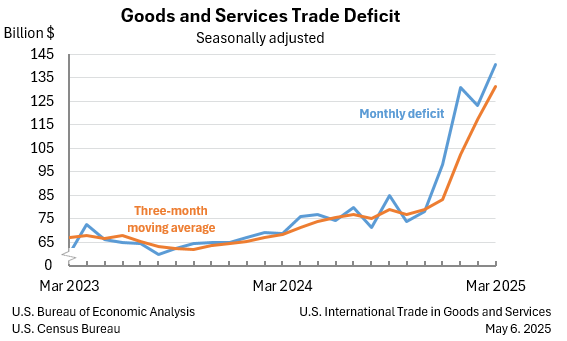

The big news today is that the US trade deficit fell by the most on record. That part is no surprise with such high tariffs. I would expect the trade deficit may fall further once the final tariffs are in place, but that will depend on how much of the present drop came during the ultra-high tariffs that Trump has already pulled back down and on how much the final tariffs wind up being.

This big drop in the trade deficit is what I’ve been warning about because the downside to what appears to be good news in terms of Trump achieving his objective is that achieving that objective means all of us will now live with a lot less stuff and a lot less variety and a lot higher inflation because that is what seriously crimped foreign trade means for a nation that loves its imported goods and loves the low prices they deliver. None of that means, however, that most of these companies will be setting up shop in the US, which was the ultimate objective. They MAY, but to what extent they do certainly remains to be seen. Many have already said they will relocate from China but not to the US.

Following a record-breaking surge in the trade imbalance, the deficit slid to $61.6 billion, a decrease of $76.7 billion from the prior month….

There is, however, one major caveat that your spotlight on truth needs to point out with regard to the universal reporting on this:

The move reverses a massive surge in imports that came ahead of Trump’s April 2 “liberation day” announcement.

Well, in that case, it means the hyuge plunge reported by the Trump Administration in this report is coming off a massive trade-deficit month the month before! So, how much of the $76.7-billion plunge from the prior month was due to the prior month’s deficit being far higher than normal?

Total imports to the US in March came to $419-billion, which, of course, includes March’s pre-April surge from front-running the tariffs.

Total imports to the US in April came to $351-billion

The difference in import trade between the two months was $68-billion.

That means the difference in the trade deficit was likely around $68-billion since that is the total amount import trade fell while export trade only rose a small amount. Still, that’s a big chunk.

If you look at the front-running surge from all months in anticipate of the tariffs, you’ll see it was enormous, starting clear back in January when Trump took office so everyone knew tariffs of some kind were coming:

However big the goods chunk of the deficit reduction was (as opposed to imported services, which are a much smaller component in foreign trade), it means stuff that won’t be available on shelves not far down the road as businesses work through existing stock.

“‘Deficit’ implies something bad, but in this case the story is more nuanced. International trade has been good for the U.S. economy — importing more than we export has benefited Americans, by and large,” said Elizabeth Renter, senior economist at consumer site NerdWallet. “So when the trade deficit shrinks we should be cautious of interpreting this as fully positive news.”

We import a lot because we like a lot of imports and love the prices. That’s what you're losing. So, before you you do the happy dance over the intended victory in lowering the trade deficit—almost a certainty with tariffs because that is clearly what they are used for—you might want to wait until you see the results in availability of the imported products you’ve come to like and in their prices, which constitute 60-70% of what you see on the shelves of most stores and Amazon. That 60-70% won’t all go away, of course, but most of what stays is going to face a lot of price pressure due to the tariffs that are applied to what stays and due to demand being spread across a smaller selection of goods.

Collateral damage

Also, major in the headlines today, as posted below, is the Billionaire Brawl, as I’m calling it, that has broken out between Elon Musk and Donald Trump in the last two days. It is possibly costing Musk billions in lost government contracts because he got Trump so angry, and it brought down his stock by 14% as investors either punish him for becoming critical of Trump’s Big Bill or weigh the risks to his companies of lost government contracts. Each of the angry MAGA champions ripped each other to shreds over the past 24 hours. The bromance has clearly ended.

“Elon was ‘wearing thin,’ I asked him to leave, I took away his EV Mandate that forced everyone to buy Electric Cars that nobody else wanted (that he knew for months I was going to do!), and he just went CRAZY!” Trump wrote on Truth Social.

“Elon and I had a great relationship. I don’t know if we will anymore,” Trump said in the Oval Office on Thursday. “I was surprised.”

“Whatever,” Musk fired back as the president spoke.

“Without me, Trump would have lost the election, Dems would control the House and the Republicans would be 51-49 in the Senate,” he posted on X.

The same can be said of the Biden camp on a less billionairish scale as former staffers go scorched-earth on "incompetent" Karine Jean-Pierre now that she has defected from the Democrats.

Speaking of Trump’s Big Beautiful Bill, Bill is dragging his fat butt through the Senate, losing more support as he slides along like a dog with worms, thanks in part to Elon shredding Bill for not carrying through any of his DOGE cuts … and certainly also because he lost his EV credits that powered Tesla sales more than gas or electricity. (Of course Trump was all for helping Elon sell Teslas back when the E-Don bromance was hot with a little White House shuck and jive.)

Horrendous housing

Finally, two more articles confirm the seriousness of the crash in housing and commercial real estate I laid out in last weekend’s Deeper Dive. One says that prices are falling so quickly that something truly big appears to be happening that could be on the order of the events of 2008. More than 60% of the US is now engulfed in significant price decreases. The analyst says that the pattern of declines indicates more are coming.

We haven’t seen declines of this size and spread since 77% of the market fell after the initial Covid real-estate mania, which took a big dive when the Fed started raising rates to kill inflation. This time, however, the dive is coming right after the Fed went through a period of lowering rates. Perhaps that happened because the bond market largely ignored the Fed, believing more in the inflation the Fed caused than in the sensibility of its interest rates in light of that inflation. Thus, they didn’t lower bond rates as the Fed intended but raised them as the Fed lost control, which may mean there is nothing the Fed can do about this if its mojo is gone because it’s lost control of rates when inflation became more important to bond investors than the Fed that caused the inflation.

The increase in the breadth of decline shows contagion. The analyst in the article says we haven’t seen anything like the present decline since the housing bust closed up in 2010. When the brief period of broad decline happened after Covid, inventory was at or near record lows. Now, with more inventory, prices have more room to fall for the simple reason that rising supply tends to reduce prices, unless demand rises to match, which definitely is not happening.

And over in commercial real estate (CRE), one of the most expensive properties ever purchased in San Francisco just prior to Covid just got offloaded by Dutch megabank ING at a 75% discount from its original pre-Covid price on the sale. The bank took a loss on all that remained owing, but the investors who financed the downpayment and any other payment made subsequently to the bank took the biggest loss. (ING lost about $235-million on an original loan of $402-million plus unpaid interest added to the balance on a property that originally cost $722 million.)

Banks have held out on realizing these losses as long as they can, which they have managed via what Wolf Richter calls “extend and pretend.”

To avoid ending up with the property, banks have extended mortgages when landlords could not pay off the mortgage at due date because they could not get a new mortgage, and banks have been modifying existing mortgages such as to lower payments to avoid a default.

This “extend and pretend” has been the standard method, where possible, to provide for more time and runway to deal with this stuff. For all lenders, not just banks, 40% ($384 billion) of the loans that mature in 2025 already matured in prior years and were extended, and another $205 billion were extended to 2026, according to a report by Colliers in March. These loan maturities in 2025 and 2026 are in addition to the scheduled loan maturities. And they all have to be refinanced.

Looks like a tsunami on the horizon now that extend-and-pretend is running out of runway to make a soft Powell landing. The Fed will have to abort its landing and start money printing again quickly, as Trump has ordered, dumping its 747’s jet fuel all over the glowing embers of inflation -or- it will just have to let things crash. Rock meets hard place (or plane does).

However, this is how fool-hardy mania gets real again, and neither the housing market nor CRE will start to percolate again until prices do get real … unless, of course, the Fed decides to go the hyperinflation route and seriously drops interest rates by dumping jet fuel (money), which probably won’t work even if they do because the bond vigilantes have seized the reins of power, knowing any targeted Fed rate-changes will drive inflation hotter, which simply means investors will likely keep demanding bond yields stay at present levels or send them higher still to compensate, knowing that lowering them will deliver inflation that requires raising them anyway because most interest is pegged off bond rates. Catch-22 for the Fed.