Trump Douses his Own Fiery Tariff Threats ... or Not

Trump's tariffs have already been cycled on and off again twice this year, and now Trump says he will dial their heat way down before he attempts to turn them on for a third time.

Today, Trump began to rapidly cool his tariff threats, a move he indicated was coming on Friday. The sudden reversal is not surprising, given how his beloved stock market has crashed at one of the steepest rates in history:

Wall Street’s “American exceptionalism” trade has been shattered in recent weeks as mounting political uncertainty over Donald Trump’s tariffs, the economic outlook and geopolitics have fueled an unusually prolonged and deep twin sell-off in the US dollar and equities.

The greenback has lost 4 per cent against a basket of six peers so far this year, while the blue-chip S&P 500 has tumbled almost 4 per cent.

Such large and persistent falls in Wall Street stocks and the currency are unusual, with these types of episodes occurring only a handful of times over the past 25 years, according to research by investment bank Goldman Sachs….

“Growing doubts in recent weeks on the sustainability of US exceptionalism sparked one of the fastest US equity market corrections since the early 1970s,” Goldman Sachs told clients this week, adding that “while equity market corrections are historically not that uncommon, a coincident dollar sell-off is — especially when equities rapidly reprice”.

The recent ructions for both US stocks and the dollar come as Trump’s escalating trade war has shaken global financial markets and sparked concerns about the trajectory of the world’s biggest economy. The Federal Reserve on Wednesday slashed its growth forecast and lifted its inflation outlook, citing tariffs for a significant portion of the downgrade.

Seeing the stock market go up in smoke apparently has taken some of the tariff fight out of Trump, something I’ve stated as a caveat in each of my predictions about how damaging his tariffs will be. I added the caveat because he has twice boldly imposed them only to instantly snatch them back like Lucy and her football. The primary game plan of the presidency seems to be controlled chaos.

The extent to which the Don’s threats of tariffs have been the cause of destruction in the stock market could be seen quite notably today:

Stocks jumped Monday on optimism that President Donald Trump may hold back from implementing some of his wide-ranging tariff plans and so the U.S. could skirt an economic slowdown from a protracted trade war….

Investors remain jittery over a potential rise in inflation and recession ahead of Trump’s April 2 start date for reciprocal tariffs. But sentiment appears uplifted on reports the duties could be more narrow in scope and that sector-specific tariffs are expected to be delayed, according to Bloomberg News and The Wall Street Journal.

Trump said late Monday afternoon that he may give “a lot of countries” breaks on reciprocal tariffs. He also told the press following a cabinet meeting that levies on sectors such as pharma and autos would still be coming in the “near future,” essentially confirming they would not be part of the early April rollout.

“Market conditions are improving dramatically as the angst around reciprocal tariffs is somewhat diminishing. From a risk standpoint, escalation or retaliation has always been a concern, but should the administration come through with a more targeted and tactical strategy around tariff implementation, risks of a full-blown trade war are reduced,” said Charlie Ripley, senior investment strategist at Allianz Investment Management. “We see this as a potential lift to growth in the U.S., should reciprocal tariffs come in a more watered-down form.”

Trump on Friday told reporters that there could potentially be “flexibility” for his reciprocal tariff plan, which had helped push major averages into the green for the session and resulted in the S&P 500 avoiding a fifth straight losing week.

“Targeted and tactical” has not been Trump’s approach with anything this term. He came all-on with tariffs just like he did with government cuts where he slashed entire agencies with very little deliberation about what needs to go (then immediately rehiring hundreds of people wrongly let go).

Trump is making these new concessions, having gotten nothing that he’s asked for from the threatened countries. The only thing he’s gotten from them is their retaliatory tariffs against the US and they, unlike Trump, have kept theirs in place. It looks like Trump is starting to wince first, and we should be glad if that proves to be the case.

Originally, Trump had stated that all the pain from his tariffs would be worth it because the tariffs would help make America great and because foreigners would then be paying our taxes for us, so that Trump could seriously cut income taxes for Americans. If he backs away from tariffs as his replacement source of revenue, he’ll have to come up with a new way to pay for his big tax cuts.

But who knows which way this equivocating leader will go?

Stocks are wobbling. Inflation is expected to tick higher again, if maybe only in the short-term, if President Trump follows through on expansive tariffs threats against trading partners around the world. The messaging from Trump and his top economic advisors is that he plans to do just that on April 2, and any short-term market correction or economic “detox” is a price worth paying to reset the U.S. economy.

Apparently, feeling the pain as nations flee US commerce, Trump doesn’t have as much fire in his belly for following through with tariffs. That, or he just felt some serious jawboning for the market was in order today after testing tariff relief with a hint on Friday to see how responsive the market was. It responded nicely, so today we got the full on talk of relief before the imposition.

Who can know which of Trump’s statements about tariffs he will actually follow through on—the ones that talk about how extreme and broad they will be or the new statements that already seek to cool them down considerably? It is not clear the president knows which way he will go. He appears to be learning as he goes about how these things work and how nations actually do fight back and seek to damage you as much as you are trying to damage them.

Hard to say, but the news of tariff relief before the tariffs have even been put in place brought a huge sigh of relief to the stock market today. Of course, you can only fake-slam the whole economy from floor to ceiling to floor again so many times before something breaks and just stays broken … like this:

“It appears that market participants are starting to look elsewhere outside of the dollar or starting to diversify their dollar holdings into other markets and currencies,” said Bob Michele, head of global fixed income at JPMorgan Asset Management. “The broader markets are telling us that it looks like dollar exceptionalism has peaked.”

Who knows which way the dollar will fall as Trump tries to learn how to be president of a big country without breaking it … worse than it was already going to break anyway.

I just published my full article that I said was coming about the five-alarm fire that is already burning through the US and global economy, and I can tell you the burnout of the Everything Bubble is going to be quite the enormous conflagration with all of the gasoline that is being poured on right now that will make it even worse than it was going to be. That is, if Trump actually does all he has said he will do.

The effects of tariff wars and governmental firings haven’t even begun to be significantly felt. Regardless of what Trump actually does with tariffs, the effects from government firings will start to heat up in a hurry from this week forward, and five major economic alarms are already howling. Depending on what happens in April with tariffs, such as whether they remain on for longer than a day this time, we could soon be staring into the self-immolation of an empire:

Economania (national & global economic collapse plus market news)

Services PMI Soars In March, Manufacturing Tumbles Into Contraction As Inflation Fears Rise

Dow rallies 600 points to start week on hopes Trump is softening tariff stance

Why Trump’s economic policies may have canceled the DOGE dividend check, at least for now

Roundup Weedkiller Verdict: Georgia Jury Orders Bayer To Pay $2 Billion

Trump awards Boeing much-needed win with fighter jet contract

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Where Condos Came Unglued: 10 Big Cities with Price Drops from 10%-22%

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

The Strategic Bitcoin Reserve: Trump’s Crypto Gambit, or the Greatest Pump and Dump in History?

Mid-tier and junior gold miners are finishing reporting an epic record quarter

Inflation Factors (from too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

US turns to Brazil for eggs and considers other sources during bird flu outbreak

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

Jeffrey Goldberg: The Trump Administration Accidentally Texted Me Its War Plans

—

France Tells Citizens "Leave Iran Immediately"

Leaked TOP SECRET Documents Show Israel to Attack Iran Nuclear Sites "Early March"

Hegseth Orders Additional Carrier To Middle East Amid Yemen Escalation

—

Pentagon Set Up Briefing for Musk on Potential War With China

FLASHBACK: Bannon Says Elon Is Owned by Chinese Communist Party

—

Concerns about espionage rise as Trump and Musk fire thousands of federal workers

—

Germany is unlocking billions to supercharge its military at a seismic moment for Europe

Trump Trade Wars & Turf Wars

Donald Trump’s policies shatter Wall Street’s ‘US exceptionalism’ trade

China says it is ready for ‘shocks’ as fresh Trump tariffs loom

SUMMER BUMMER: Europeans reconsider trips to USA in protest against Trump

Trump says countries that purchase oil from Venezuela will pay 25% tariff on any trade with U.S.

Political Pandemonium & Social Senescence (socio-political issues & events)

Trump reveals powerful figure trying to 'usurp' his presidency and demands Supreme Court take action

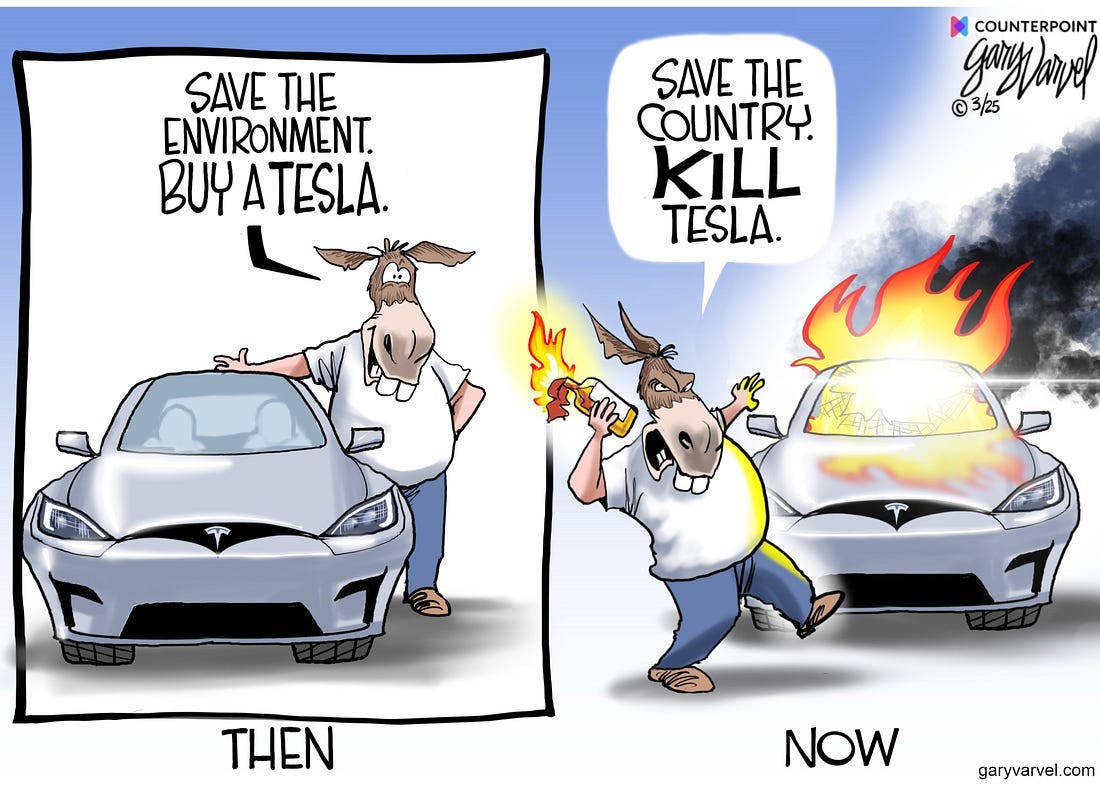

Tesla owners are trading in their EVs at record levels, Edmunds says

Tesla’s Europe sales collapse as anti-Musk backlash grows

Commerce Secretary Lutnick urges Fox News viewers to buy Tesla stock, raising ethics questions

Trump Cabinet vouches for Musk, Tesla, as vehicle company stock value sinks

SpaceX Positioned to Secure Billions in New Federal Contracts Under Trump

Retail Army Piles Into Tesla At Record-Breaking Pace

Stocks have never been so political as Howard Lutnick says buy Tesla and Tim Walz says sell

Republican politicians face mounting anger over Doge cuts

Tax revenue could drop by 10 percent amid turmoil at IRS

IRS braces for $500bn drop in revenue as taxpayers skip filings in wake of DOGE cuts at agency

She hoped Trump would revive her farm. Now she worries his policies could bankrupt it.

America Is Watching the Rise of a Dual State

Why Trump Is Wrong About Tariffs

Mises: Trump’s False Tariff “Fairness” Argument

Cancer research, long protected, feels ‘devastating’ effects under Trump

Trump didn't 'cancel cancer research,' but new NIH guidance cut funding for some medical studies

GOP senators warn Trump agenda will be slowed by internal divisions

Emboldened President signals long court fight to expand power

Postal workers rally against privatization amid Trump's call for USPS overhaul

After losing millions in federal cuts, North Texas food banks must now rely on donors

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

Musk’s X suspends opposition accounts in Turkey amid civil unrest

Off-the-Beat News & Just Plain Offbeat News

Why so many people are getting scam texts saying they have unpaid tolls

Counter-terrorism police lead fire inquiry as Heathrow closed all day