Turn, Turn, Turn: To Everything, even Epstein, there Is a Season

This has been a time of turning--a hard 180 over the past week by stocks, and an equally hard 180 by the president this weekend over the Epstein Files.

Only a week ago, maybe less, President Trump demanded voters fire Marjorie Taylor Greene, one of his most ardent supporters for years, because of her nonsense push (in his opinion) to release the Epstein Files. Trump said “She’s lost her way,” and said that all Republicans should have nothing to do with taking the bait to release files of such a “Democrat hoax,” and he noted disparagingly that “a couple of few Republicans have gone along with it because they are weak and ineffective.”

“Marjorie Traitor Greene,” he wrote, “is a disgrace to our great Republican Party.” On Truth Social, Trump continued the thought: “All I see ‘Wacky’ Marjorie do is COMPLAIN, COMPLAIN, COMPLAIN!” He, then, referred to her as “a ranting lunatic … who attacked me and lied about me.”

Green responded, “It’s astonishing, really, how hard he’s fighting to stop the Epstein Files from coming out that he actually goes to this level.” She even claimed she’s been getting death threats due to how harshly Trump has turned against her. “I am now being contacted by private security firms with warnings for my safety as a hot bed of threats against me are being fueled and egged on by the most powerful man in the world,” Greene posted to X on Saturday.

In the meantime, House Speaker Mike Johnson has finally stopped stalling and scheduled a vote to release the files, leaving no need for the petition that was intended to force a vote on releasing the files past Johnson. Likely, he did the twist because he saw the petition would easily win, as momentum was quickly building, so he wanted to finally get on the right side of the issue. Once they knew they were going to be put on the record as to whether they wanted the files released, the “couple of few Republicans” Trump mentioned instantly turned into a large number, and it became clear that, with the support of many Democrats, the House easily had the votes to get the files released at last. (Whether the Senate will vote the same way is still another story for another day.)

And soooo … this weekend, the president swung around and demanded, “Release the files!” … while still demanding MTG be sent packing. What gives?

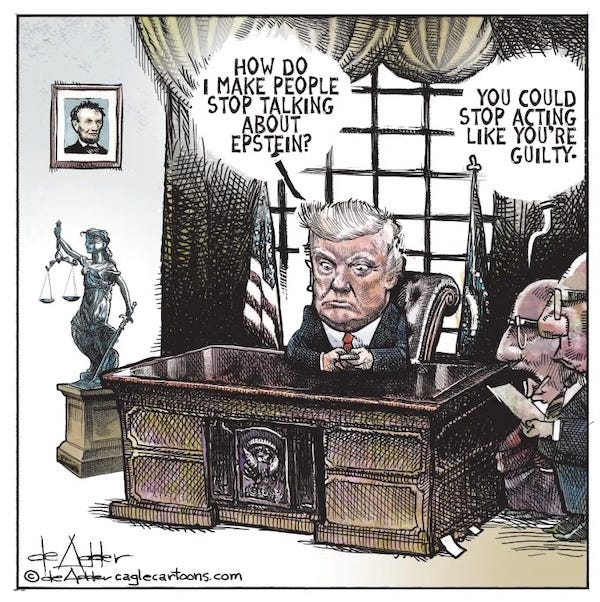

Counterpoint, my usual cartoon source (including today’s cartoons on this issue), offers the following common-sense (I think) insight to explain the president’s sudden flip:

In a plot twist so blatant it should arrive wearing a MAGA hat and carrying a blinking neon sign reading “PANIC REVERSAL IN PROGRESS,” Donald Trump has now demanded that House Republicans vote to release the Epstein files, just days after he warned them not to “fall for the trap.”

Why the sudden change of heart?

Simple: Trump saw half the GOP sprinting toward the vote without him and apparently decided the best move was to leap in front of the parade, wave his arms, and yell, “I was leading the whole time!”

In a classic Truth Social post written in emotional crayon, Trump declared:

“House Republicans should vote to release the Epstein files, because we have nothing to hide, and it’s time to move on from this Democrat Hoax perpetrated by Radical Left Lunatics in order to deflect from the Great Success of the Republican Party, including our recent Victory on the Democrat ‘Shutdown.’”

This is a bold argument, especially coming from the same man who just last week attacked Republicans for pushing this vote and demanded that DOJ investigate Epstein’s Democratic contacts instead of releasing all the files.

Also awkward: one of Epstein’s emails claims Trump “knew about the girls,” which might explain why he briefly went into full “BLOCK IT NOW” mode before pivoting to “release it, I don’t care, it’s all a hoax, anyway look at the shutdown!”

The truth is, Trump didn’t suddenly become a transparency hero. He simply counted the votes, realized he was losing, and decided that being publicly defeated is far worse than pretending this was always his idea.

So, we have a president claiming he’s totally fine releasing every Epstein document while loudly insisting there’s nothing suspicious about how hard he tried to stop that from happening for several months.

But don’t worry—he says it’s all a hoax. Which, historically speaking, has always meant something big, strange, and deeply incriminating is about to drop.

The near proof that Trump is just turning a PR trick, as his former White House Communications Director called it purely a PR move, is that he doesn’t need this vote to release the files. If he really wants them released, he has the power to order their release today without any congressional vote. It is, after all, only HIS DoJ that is holding them back!

Since the vote is to force his administration to release them, you know he’s grandstanding by pretending he wants them released. He’s doing this because he knows his base clearly wants them released. They have spoken, and he knows he’s lost the vote on this in congress already; so, it’s better to try to suddenly look like he stands on the right side of something that has become inevitable (in terms of the House vote) than be seen defeated by his own party.

If what I just wrote isn’t true, Mr. President, just release them today. They’ve already been fully redacted—your name in particular—so no reason to hesitate.

However, going through the voting process with the house, then with the senate, then taking his time on signing it into law, gives him some time for something to possibly come along that might work. While that’s a desperate hope, he can also always veto it if they don’t get enough votes to override a veto … and then make up yet another reason why he had to do that.

Stocks have put in a sudden turn, too

Today, JPMorgan stated, “It’s unlikely that we’re in an AI bubble as the market is still behaving rationally.”

Sure!

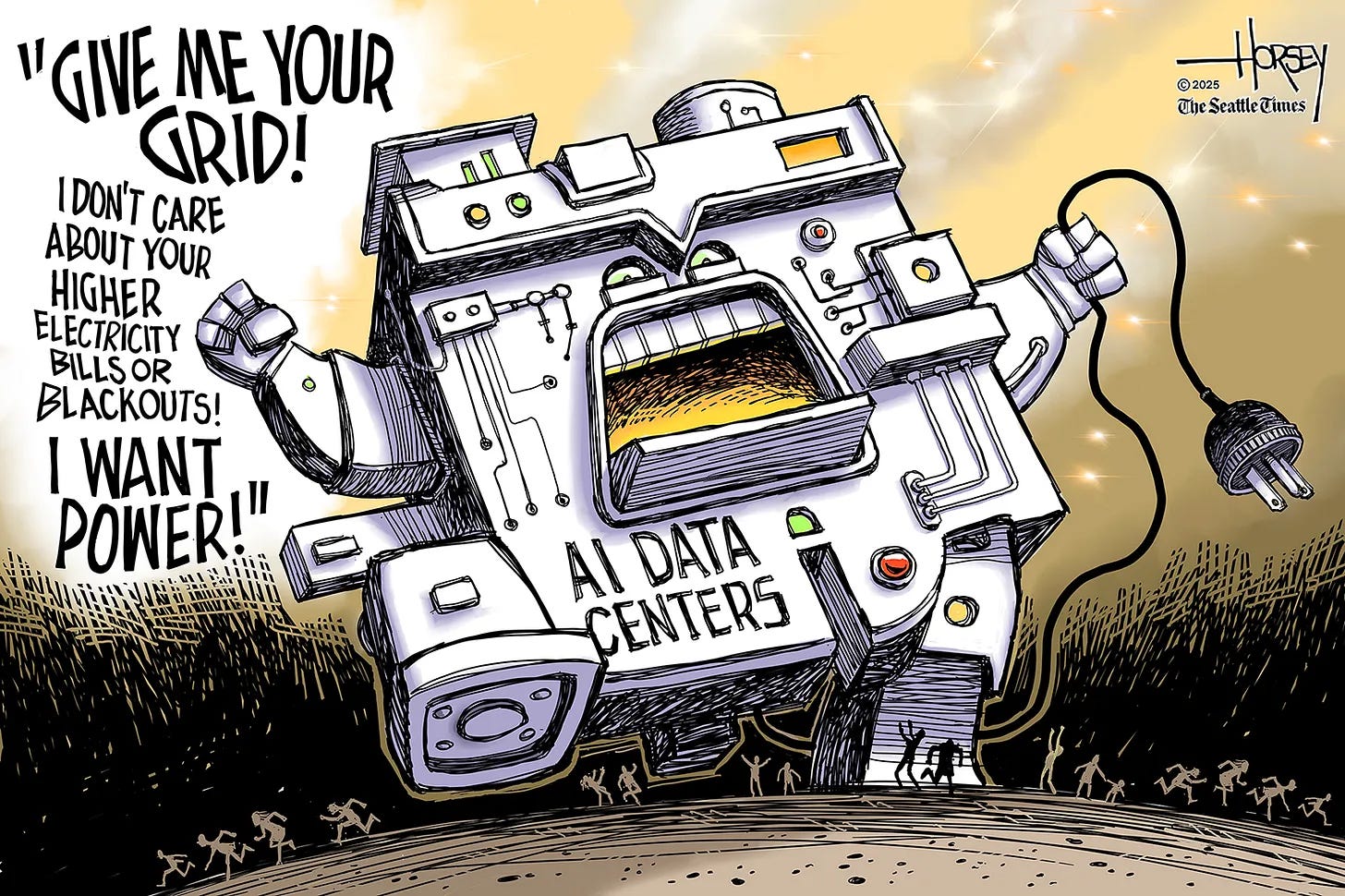

That statement, itself, is evidence of how irrational the market is. While it might be true that some rationality is being seen among AI stocks in recent days, that is certainly not proof that AI investing was not insane in previous months. Every crash begins when the irrational ones finally start getting their sense back. That’s when irrationality begins to implode, sucking the life out of the bubble, as investors FINALLY start asking a few reasonable questions, which, then, leads to more questions. And down it all goes.

Comments like that one by Tai Hui from JP Morgan’s Asset Management department only go to prove how long irrational people will cling to any desperate hope to keep fueling their irrationality: “Look some people did something smart last week: proof they were never irrational.” Nay. It’s proof that irrationality may be caving in at last. It is exactly the kind of diehard hope we heard just before the dot-com bust took everything down, clinging to every unreasonable reason for thinking it wasn’t all about to flush. Even more irrational is how they fail to realize they are doing the same thing their predecessors did in all of the last crashes.

Speaking of which, one interesting article today shows some interesting chart comparisons between now and all other recent bubble mania meltdowns. These were provided by the Big Short’s Michael Burry, whose latest turn to shorting AI was reported by mainstream media as been a $920-million short or something like that (nearly a billion) when, Burry later clarified it was a $9.2-million short. So, Burry wasn’t the betting the farm (at his scale of operating), but it was still a sizable bet since one can lose a lot more than they bet on a short.

The charts at that link provided above are not immediately easy to understand in terms of how they point to this being the flux point where the market is now turning south for the big bust, but Burry seemed to be countering an argument that AI stocks cannot crash now because their companies still have plans for billions in capital expenditures and chip orders, etc., which supposedly means there is a lot of growth to come. His charts showing that such expenditures have ALWAYS continued well beyond the point where the stock market turned and ultimately crashed.

Business Insider explained the significance this way:

Burry’s chart shows that stocks have peaked in the middle of past investment booms, while capital spending has kept climbing or remained elevated for another year or two before collapsing. The broader implication is that periods of overinvestment are inevitably followed by corrections.

It seems to me they worded that last point wrong and meant overinvestment in Capex projects by corporations has inevitably followed major market corrections (stock bear markets) because that is what the charts show.

The chart highlights the Nasdaq index’s peak just before the dot-com bubble burst, the S&P 500’s peak just before the housing bubble popped and sparked a global financial crisis, and the S&P Energy index’s peak just before oil prices crashed and the energy sector entered a prolonged downturn.

Burry also highlights the Nasdaq 100’s record high of around 26,000 points this quarter, suggesting he thinks that could be the market’s peak in the middle of this capital cycle.

In Burry’s view, the charts are just more ammo to say the turn has come, forecasted capital expenditures not withstanding because it is normal for those to happen while the market crashes around them. In other words:

His chart serves as a warning that stocks may have already topped out even as OpenAI, Meta, and other AI giants prepare to invest trillions of dollars in microchips and data centers as they jostle for position in the nascent AI market.

The market seemed anxious to prove that true today as all major indices tanked again. Of course, that could flip if Nvidea’s quarterly report after the closing bell on Wednesday shows stunning promise, alleviating the recent fears that have finally brought in rational concerns about the 1) cost of electricity (even for the average person as AI sucks it all away), 2) the time lags required to build out electrical infrastructure to handle all of this if such projects can win approval, and 3) the most recent concern about the depreciable life of the vast numbers of chips now being manufactured and installed. (How long before you have to rebuild these huge centers?)

At last, a little oxygen of rational questions has entered the walls of Wall Street; but rational questions are not a sign it won’t go down. It takes a return to some rationality to realize the market is, like Wile E. Coyote, far out over the ledge. It’s only when Wile E. finally looks down and recognizes that he left terra firma behind several steps back that he finally falls.

The news below contains lots of articles on the Epstein file release and on the falling AI stock market. So, plenty there to read for further perspective on both topics.

Economania (national & global economic collapse plus market news)

Dow closes down more than 550 points, dragged down by Nvidia, tech shares

Bubble Trouble: Thiel Dumps Nvidia Stake

AI anxiety on the rise: Startup founders react to bubble fears

The question everyone in AI is asking: How long before a GPU depreciates?

US Utility Giants Discuss Soaring Power Bills, Grid Reforms In The Data-Center Era

‘Big Short’ investor Michael Burry sends another AI bubble warning

Retail Investors Signal Red Flag As Bitcoin Falls for 12th Straight Day

“It’s unlikely that we’re in an AI bubble as the market is still behaving rationally”

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Rubino: Housing Bust Update: It’s Not Just the Cost of Buying, It’s the Cost of Owning

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

Gold Miners’ Q3’25 Fundamentals

The Crypto Industry’s $28 Billion in ‘Dirty Money’

We’re close to crypto bottom, but fundamental story remains intact

Trident Shows 304 G/M Gold. Stock Closes up 89%

Inflation Factors (too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

Scott Bessent blames immigrants for high beef prices with bizarre diseased cow claim

Wars & Rumors of War (including cyberwar, civil unrest and revolts)

—

Operation Southern Spear: Trump Commissions New Military Campaign In Preparation To Invade Venezuela

—

Poland says blast on rail line to Ukraine ‘unprecedented act of sabotage’

Digital Dominance (AI threats, transhumanism, hacks & cyberattacks, etc.)

Political Pandemonium & Social Senescence (socio-political issues & events)

Trump withdraws his support for Rep. Marjorie Taylor Greene

The Republicans who Tried to Squelch the Epstein Furor, Instead, Fed it

Searchable database with all 20,000 files from Epstein’s Estate

The FBI Redacted Trump’s Name in the Epstein Files

The Epstein Emails Show That Conspiracy Theorists Are Right: ‘Eyes Wide Shut’ Is Real

Ten Days That Shook Trump’s Second Term

Trump’s Brain Has No Idea What Part of him Was Scanned for an MRI (I’ve had MRIs 3 times in my life, and it was always obvious what part they were scanning.)

Once He Was ‘Just Asking Questions.’ Now Tucker Carlson Is the Question.

The government shutdown is over. The air traffic controller shortage is not

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

Without cows? Inside the science of lab-grown milk shaking dairy world

Doomer Humor

“Sorry, but AI cannot answer your question until after sunrise when the solar panels come back online.” ;-)

Wish I had a penny for every time Trump flip-flopped. Oh, President Trump announced on February 9, 2025, that he instructed Secretary of the Treasury Scott Bessent to halt production of the penny, and now they have.

What better way to start to bring in the use of a digital currency and more control. Linking tomorrow @https://nothingnewunderthesun2016.com/