What a Day! The "Non-Systemic" Collapse Deepened Systemically as the Fed's Balance Sheet Suddenly Skyrocketed with "Not-QE"

Wow! What a day. What an upside-down world!

Eleven megabanks joined hands to rescue their flailing competitor, of all things. Either they are especially nice banks -- all of them -- or that is how systemic they see the failure of these recent mid-sized and smaller regional banks. Each megabank made deposits in the billions into First Republic Bank. These deposits were pledged to remain there for 120 days to reassure the public and businesses there is sufficient cash in the bank to meet any deposit demands. Those were NOT purchases of shares or ownership conglomerations, but just unsecured deposits (we were told) by the nation's largest banks to save one of the "little guys" that is apparently not so little or non-threatening as we were told.

Perhaps the systemic fear conveyed by such a joint and ostensibly altruistic rescue from normally non-altruistic sources is exactly why this rare kind of bailout (I think not seen since the Great Depression) of First Republic by its friendly competitors did nothing to reassure the stock market about either the bank or the economy in general. As the deal became known, Republic's stock plunged (20%) and took the Dow with it on a 450-point dive in morning trade, finishing down 384 at day's end. Sometimes the more you do to rescue something, the more you exacerbate fears. In this case, it appeared the rescue screamed the serpentine hissing "S" word, "systemic," for why else were major banks willing to deposit billions in a failing institution with, we were told, no guarantees they would get their money back if Republic failed.

The market is on the verge of a Lehman-style event as the financial world thrashes in the wake of global banking turmoil, veteran trader Art Cashin says....

"We are on the edge of what we were doing back when Lehman got in trouble," Cashin told CNBC on Friday. "They were buying credit default swaps and they were buying out-of-the-money options [and] then compounding it by spreading the word...."

Cashin said the "game is afoot" as certain market participants may try to "agitate things as much as possible" for their own financial gain....

"[This] is systemic. The Fed has forced many of these banks to reconfigure their portfolios."

How aptly named Art Cash-in is. He's a wise old veteran of Wall Street who has built-in body memories of what these events feel like just before they go for broke. His arthritic bones could tell him more about what's coming on Wall Street than most guys' charts. Some things you develop a feel for after many, many years.

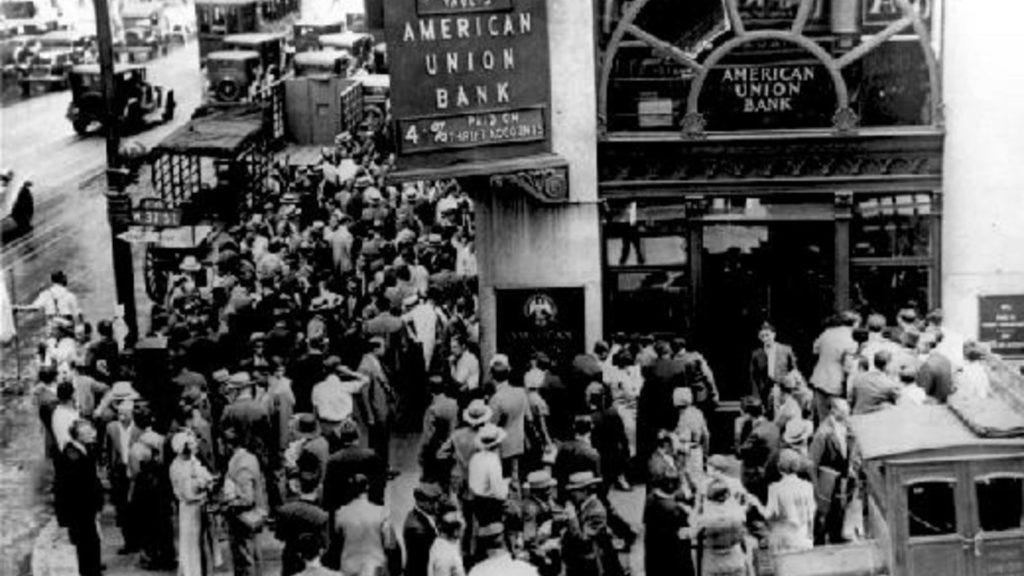

A real old-fashion Great-Depression era bailout

Jamie Dimon, Jerome Powell and Janet Yellen assembled the First-Republic deal. That cooperation between Fed, Treasury and the CEO of JPMorgan to bring together major competitors to rescue one of their own reminds me of how the original John Pierpont Morgan brought together a group of bankers who pooled their money prior to the Great Depression to do this very same kind of thing. In that instance, their concerted action was definitely to fend off a systemic crash that could have hurt their own banks. An historically grand and unusual act like that now makes me think the present was a systemic failure, though the former FDIC chair initially assured us this was not. Her empty assurances remind me of the lies I used to cover all the time in my articles back in those Great Recession days that this blog was named after. One has to think Dimon was inspired to act like a son in the footsteps of his bank's namesake.

In an unusual rescue that several sources said was orchestrated by JPMorgan Chase & Co Chief Executive Jamie Dimon earlier this week along with Treasury Secretary Janet Yellen and Federal Reserve Chair Jerome Powell, 11 Wall Street firms said they were depositing $30 billion into First Republic.

Investors' relief, however, was short-lived. The bank's shares, which had closed 10% higher after a volatile day that saw trading halted 17 times, slumped in after-market trading. Volume hit 15.6 million shares in the post-market session....

The reversal in First Republic's shares after the rescue deal from the biggest U.S. banks underscores the extent of jitters in global markets, set in motion when two regional banks failed. Separate attempts earlier this week by U.S. and European regulators to calm investors through emergency measures to shore up confidence in the banking sector have not stuck.

Jason Ware, chief investment officer for Albion Financial Group, said the Dimon-led banking sector intervention on Thursday was a "shot in the arm for the system" but likely more was needed. "It's not big enough," Ware said....

The rescue saw large lenders such as JPMorgan, Bank of America Corp Citigroup and Wells Fargo & Co make uninsured deposits of $5 billion each into First Republic.

Goldman Sachs Group Inc, Morgan Stanley also agreed to pump in $2.5 billion each. Other lenders including BNY Mellon, PNC Financial Services Group, State Street Corp, Truist Financial Corp and U.S. Bancorp channeled $1 billion of deposits into the San Francisco-based lender.

Not enough, they said, even though all the new deposits made by Dimon & Co. came on top of the $34 billion in cash Republic already had and the $109 billion it borrowed from the Fed between March 10 and March 15 and an additional $10 billion from the Federal Home Loan Banks on March 9.

Not enough. Down its shares went again. When that much money isn't enough, that sounds systemic to me.

More holes in the Suisse Cheese Bank

But Wow! What a day ... because Credit Suisse also got a huge rescue in the last twenty-four hours, promised by the Swiss government to the tune of 50-billion Swiss francs ($54-billion). That was an enormous sum for the tiny Swiss government's central bank. When you consider that Credit Suisse, even in its fallen state is 5/8 the size of the entire Swiss economy, you realize how short of being up to the job of rescuing their major global bank the entire Swiss economy is.

The Swiss National Bank made the rescue because it deemed Credit Suisse a “systemically important bank." There is that hiss of the "S"-word again. Of course, CS's troubles go all the way back to stories I covered in my book Downtime back in the Great Recession era, which still haunts us because of its bailout rescue plans. While headquartered "across the pond," it appears the US banks tied to tech and crypto exacerbated CS's troubles. Anyway, the bold Swiss rescue resulted in Credit Suisse's stock going up 18% yesterday, but it didn't hold as the stock slipped alongside Republic's 8% by the end of today.

"Not enough," investors said. "Not enough."

The problem is that stoking the bank with cash doesn't convince investors that the notoriously difficult CS has stopped being a bankster bank. You have to restore more than cash. You have to restore confidence. All fiat money, after all, is a confidence game. Without the full confidence of all players in the system, the money loses its value. Likewise with the banks that move the money, store the money, and even create the money in our fractional-reserve monetary system where banks create the money by making loans with money they don't have, based on an allowed ratio to their banked reserves.

It seems investors are having a hard time believing these central-bank rescues will do the job.

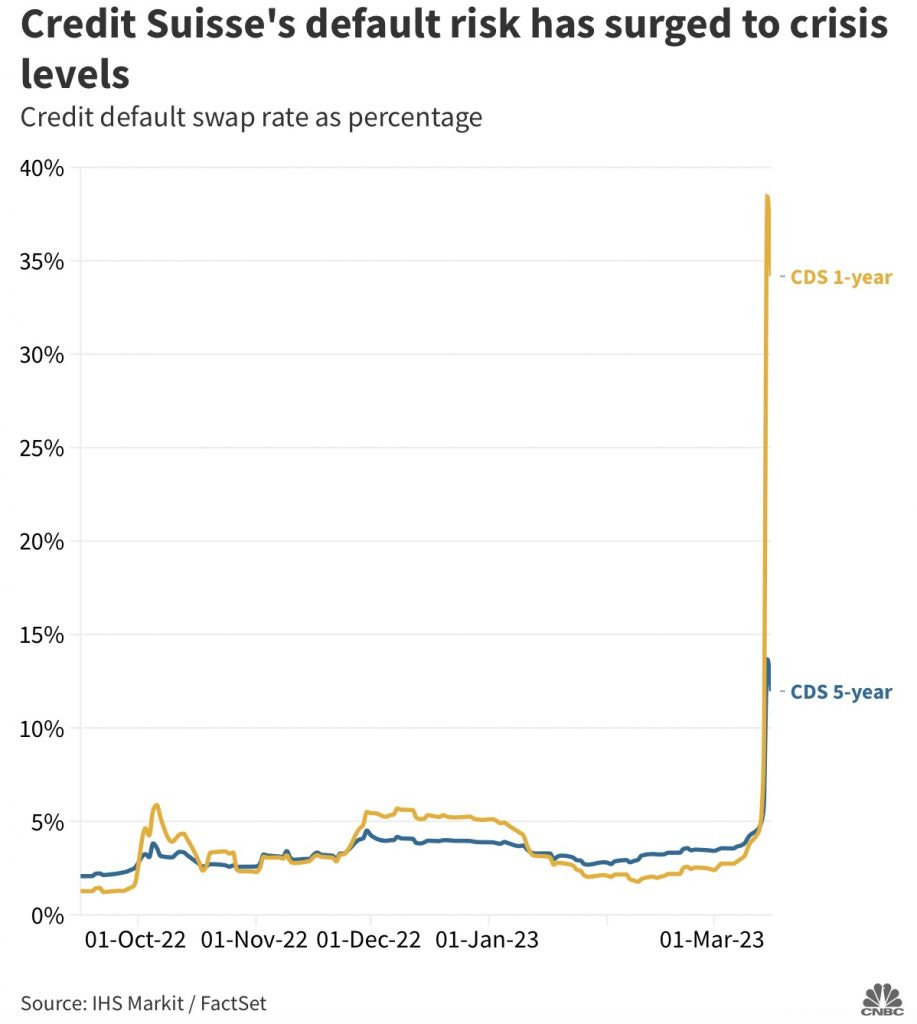

One measure of the instability of CS has its risk of default since the recent US banking crisis skyrocketing like this:

Yeah, that looks a little steep, especially when you consider what a truly terrible bankster bank CS already was prior to the present US banking crisis, crippled and patched along for years after its punishing fall during the Great Recession. Look at how exponentially worse it got the second the United States' supposedly non-systemic crisis hit. That looks like a banking crisis for Switzerland made worse by the US of A to me.

Investors have also been ditching Credit Suisse’s funds this week. European and US funds managed by the bank reported more than $450 million in net outflows between Monday and Wednesday, according to Morningstar Direct data on open-end and exchange-traded funds.

I'd call that globally "systemic."

The "hardly big enough" bank that put the US military on alert

But Wow! What a day ... because all of the above was only part of it. The Pentagon also screamed "systemic." One of the other headlines in The Daily Doom this morning said the Pentagon mobilized its financial side during Silicon Valley Bank's contribution to this crisis to protect tech startups precisely because all the trouble focused on Silicon Valley's high-tech industrial theater:

Pentagon Mobilized to Support Tech Startups After Bank Failure

The failure of Silicon Valley Bank presents the Defense Department with warnings.

In the hours after Silicon Valley Bank collapsed on March 10, Pentagon officials who work directly with startups that develop national-security technologies grew increasingly concerned.

Would startups that had money in the bank need to stop work? If that happened, would there be supply-chain disruptions? Would a company under financial stress put its intellectual property at risk?

Officials prepared different courses of action to get cash to companies, if needed....

No immediate action was needed. The Treasury Department stepped in on Sunday and said depositors with funds at Silicon Valley Bank would have access to their money....

Had the Biden administration not acted quickly to back up account holder funds at SVB, the United States—and the national-security community in particular—would have faced a major challenge in supporting and growing innovative new technologies....

Had SVB collapsed, Brown said, it would have hit some of the companies that he works with very hard. “You're, you're a small company, you raise money from your venture backers; you don't maybe have revenue coming in yet and you can't make payroll if you can't access your cash balance? Yeah, it really would have been a horrific situation...."

"I think we all woke up Monday morning with a big sigh of relief. But it was a very close call...."

Brown, who previously ran the Defense Department’s outreach to Silicon Valley, said the national-security implications of SVB depositors’ funds vanishing would have gone well beyond the lost money. Many of the young startups that had funds in SVB were working on projects with clear defense and national-security applications....

“You certainly would have seen the national-security implications for autonomy for AI, for cyber space, a lot of the sectors which are so vibrant right now and could be used to better effect by the Defense Department,†he said. “It would be like cutting the [research and development] for all of those different companies. And you can imagine what happens, right? That means you're just living on your current product. And as soon as they run out, nothing's coming.â€

That sounds pretty systemic to me. Ah well. Risk averted. All's well that ends well ... until it doesn't.

"Not systemic!"

“You could hardly call it systemic,†said the former FDIC chair, who ruled during the Great Recession.

“Not systemic,†Treasurer Janet Yellen seemed to many to be saying, if not in so many words:

Yes, I think the President and Secretary Yellen and the Federal Reserve did a nice job of immediately communicating to the American people that the banking system is not at risk, there is not systemic risk in the system, that their deposits are safe on the whole

I heard Yellen say that Silicon Valley Bank was an isolated incident with bad management, “not systemicâ€, yet, here we are with a second bank with the same issue.

https://twitter.com/BusinessCrypt0/status/1635686433171161088?s=20

I was sure I heard her say it, too; but now I can't find it. Maybe it's been scrubbed, or maybe I heard someone saying it about her comments. Certainly many in the financial media were making that claim.

But then ...

Treasury Secretary Janet Yellen told senators that government refunds of uninsured deposits will not be extended to every bank that fails, only those that pose systemic risk to the financial system.

Hmm. If only banks "that pose systemic risk to the financial system" will receive the government refunds on unsecured deposits, doesn't that make the banks that just crashed and got the full refunds on all deposits "systemic?" One would think the former FDIC head would have recognized that.

To make matters worse (something government can be good at), when government makes these sweeping emergency decisions almost overnight, it often doesn't foresee disastrous side effects. In today's testimony to the Senate Finance committee, Senator Lankford from Oklahoma pointed out a serious defect in the program that he said is suddenly sweeping across the nation.

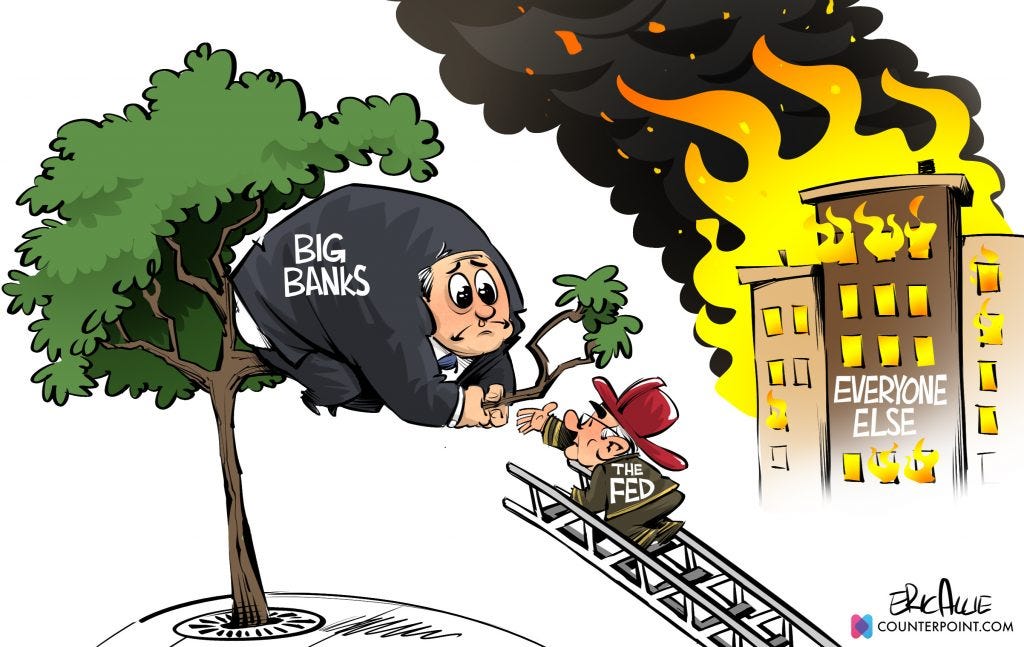

Because only those banks that are considered "a systemic risk" will have all depositors, regardless of how huge their deposits are, fully insured under the new program, businesses have started rapidly pulling their big accounts out of small regional and community banks and putting them in the nation's top-ten banks because everyone knows those "too-big-to-fail" banks will certainly be considered systemic risks; therefore, they now have default deposit insurance that will cover accounts over $250,000 to the sky is the limit, but only in banks like JPMorgan, Bank of America, etc.:

https://www.youtube.com/embed/CX6O--sk48A?start=5432

Yellen waffles around his point that large depositors are now fleeing from small banks to major banks, but Lankford states,

It's happening right now.... It's happening because you are fully insured if you are in a big bank; you're not fully insured if you're in a community bank.

Guess who wins the megabucks in that scenario?

Cornered, Yellen ultimately admits that is happening, but tries to make it sound like a fleeting problem due solely to immediate concerns about the bank failures that just happened. That, of course, is nonsense. It's not a fleeting problem; it's a fleeing problem in the sense of driving flight of capital from small banks across the nation into the accounts of the nation's largest banks to make them even more too-big-to-fail.

Why wouldn't all businesses and organizations with an account of, say, a mere $750,000 (not large on a business scale) move their money from the local community bank to the local BofA branch to make sure all of their money has the new de facto insurance? It's almost a no-brainer, but Yellen thinks this exodus from small banks is an inconsequential one-off. By the time she pretends to have just figured it out as something no one could have seen coming, the nation's biggest banks will have bloated from feeding on all the sizable accounts that are fleeing their way from the smaller banks for safe cover.

After the crash of the first three banks, the Treasury and FDIC worked together through the long hours of the night last weekend in what Yellen, at one point, privately described as a “hair raising†situation to create a program for SVB they called a “systemic exception†because existing law only allowed them to bailout the big boys with over a quarter-million in deposits if it was an emergency systemic exception. And then they applied again in the story in today's Daily Doom about First Republic.

At least, now that the "hair-raising" "systemic" crash of the non-systemic banks has been resolved, our Chair person at the Fed went back to the lovely assurances she was giving just before that crash:

“Our banking system remains sound and Americans can feel confident that their deposits will be there when they need them,†Yellen said.

That's a yada, yada Yellen. I know I feel reassured. Wash that down with enough brandy, and I'll sleep peacefully tonight.

"Not a bailout!"

“Not a bailout!†Yellen yelled in her soft-spoken, diminutive way.

“No, not a bailout,†the president parroted, even though JPMorgan says the end result is likely to amount to $2-TRILLION in new money created by the Fed and pumped enema-style into the goose-end of the financial system — a number so big you have to spell it out or you get lost in the train of zeros.Â

True, they didn’t bail out the principle investors or the common stock owners in the bank this time as they did in the torrid bailouts of 2008-2010, and PERHAPS their new plan will, as they claim, not lay the financial risk on taxpayers (PERHAPS); but insuring all the mega wealthy depositors for free in all the recently failed banks does reek of a bailout, especially with a price tag in the trillions where it is hard to imagine that will not cost every American, no matter how poor, a lot in universal “inflation tax.â€

If they’d just let it all crash, on the other hand, there is no doubt we would get that deflation they keep saying they’re aiming for.

The White House is desperate to avoid any perception that average Americans are “bailing out†the two banks in a way similar to the highly unpopular bailouts of the biggest financial firms during the 2008 financial crisis.

“No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer,†read the joint statement from the Treasury, Fed and FDIC.

Treasury Secretary Janet Yellen defended that view Thursday under tough questioning from GOP lawmakers.

The Fed’s lending program to help banks pay depositors is backed by $25 billion of taxpayer funds that would cover any losses on the loans. But the Fed says it’s unlikely that the money will be needed because the loans will be backed by Treasury bonds and other safe securities as collateral.... [Isn't that called QE? You give us billions in tired and tattered bonds; we give you clean, new cash.]

“Saying that the taxpayer won’t pay anything ignores the fact that providing insurance to somebody who didn’t pay for insurance is a gift,†said Anil Kashyap, an economics professor at the University of Chicago. “And that’s kind of what happened.â€

Biden and other Democrats in Washington deny that their actions amount to a bailout of any kind.

“It’s not a bailout as happened in 2008,†Sen. Richard Blumenthal, a Democrat from Connecticut, said this week while proposing legislation to toughen bank regulation. “It is, in effect, protection of depositors and a preventive measure to stop a run on other banks all around the country.â€

Biden has stressed that the banks’ managers will be fired and their investors will not be protected. Both banks will cease to exist. In the 2008 crisis, some financial institutions that received government financial aid, like the insurer AIG, were rescued from near-certain bankruptcy.

Yet many economists say the depositors at Silicon Valley Bank, which included wealthy venture capitalists and tech startups, are still receiving government help.

“Why is it sensible capitalism for somebody to take a risk, and then be protected from that risk when that risk actually happens?†asked Raghuram Rajan, a finance professor at the University of Chicago and former head of India’s central bank. “It’s probably good for the short term in the sense that you don’t have a widespread panic. … But it is problematic for the system long term.â€

He alludes to that key notion from the Great Recession of "moral hazard." All of this sounds and feels so much like the days of the Great Recession as everyone scrambles to make it look like it isn't. Sure, it's less of a bailout than the days when the banks, themselves, were saved and the CEOs and other top execs remained in charge of them and got their bonuses paid out of the government's bailout money, while Obama charged none of them with crimes.

Letting the institutions and the executives and other stockholders fall is certainly some improvement if it actually works out that way, but that has only happened because citizens got indignant about the last bailouts.

In the very least, you can be sure the extra costs banks pay for FDIC insurance after this will be handed down to customers; and, should the megabanks that just bailed Republic lose their deposits, that cost will get handed down, too ... somehow.

However, this is also just the beginning, and none of the banks that crashed and burned this month were vertebrae on the US financial spine, though SVB was a large bank. Will banks be allowed to die and disintegrate if they are, like last time, among the big ones, such as JPM or Goldman Sachs or Bank of America? Or will the plan suddenly shift if another too-big-to-fail bank joins the party?

My guess is that it takes a lot less resolve to let these smaller banks go down than to let the behemoth's fall. Remember the Fed and Treasury and FDIC didn't bail out every bank back in the Great Recession either. The plan will change as suddenly as this new plan was hatched behind closed doors (again) ... unless citizens sound off now to their politicians to make it clear they better not go down Bailout Boulevard ever again and then just try to dress the bailout up as something different (like "not systemic").

“No sign this plan will cause inflation,†Gramma Yellen also assured, her hair still standing on end from the long nights of last week. Not too reassuring from the gray lady who assured us inflation was "transitory" at the start of the Biden term. It seems a lot of things are not what they are this week. One almost wonders if Yellen is competing for the opportunity to win the bankster meme modeling contest.

When it does cause inflation, I suppose they'll be telling us that is "not inflation." It just looks like inflation, but it's actually a thing called "transitory." Which is not a thing to worry about ... just like the flight this week of numerous major accounts at smaller banks to the top-ten big banks is just transitory, according to Yellen. How great will the wreckage be to smaller banks before they figure this out? How many runs might they have just created with this new plan?

"Not QE"

While some of the high heads were claiming it was "not a bailout" and some were reassuring us it was "not systemic," you haven't heard any of them talking about how this is a turn back to quantitative easing. Crickets.

If asked whether it is, I am certain you will be hearing them yell, "Not QE," if they haven't already been yelling it. Given that I am having a hard time keeping up with so much news flow on this event that widens as it spirals down the drain everyday, I thought I'd Google "not quantitative easing" just now to see what pops up. Sure enough some in the financial world are already saying it at the top of Google's results for the past week's news items:

Although the Fed increases its balance sheet, this is no quantitative easing writes Daniel Dubrovsky, senior strategist at Daily FX. He wrote:

"Make no mistake, this is not quantitative easing. On the chart below, you can see that while overall holdings rose, securities held outright (mostly Treasuries) and mortgage-backed securities (MBS) continued shrinking as one would expect under quantitative tightening."

What does it matter if the assets held are Treasuries or something else? Besides, I don't think that is even true, since their purpose is to help banks unload Treasuries that have plunged in value due to the Fed tightening, and why would the Fed take lower grade assets as collateral than Treasuries when Treasuries are exactly what the banks want to sell but can't without taking a big loss by marking to market? The point of QE was that new money was created out nothing in massive quantities and added into the reserve system. That appears to be what is happening here, regardless of what is being held as collateral. Nor does the writer state what other assets might be held.

"Not-QE" became a term used back in 2019 to name the kind of QE that we were told was not QE because, while it expanded the Fed's balance sheet as quickly as QE had, it was not intended as monetary policy but only as a rescue of banks that were short of cash in their reserves. (Never mind that pumping up reserves is what QE was about.) So, it all depends on intentions? Today's rationale seems about as cloudy.

Another argument in 2019 was that it was "not QE" because it was only a short-term measure (overnight loans), even though Treasuries were involved. I claimed it would not turn out to be a short-term measure; instead, the loans the Fed was giving would have to be rolled over every day in an unending pump of QE into the balance sheet. If you roll over the same "overnight" loans by the hundreds of billions everyday they are no longer "overnight loans" in anything but name. That happened for months until the Fed, itself, finally gave up calling it "not-QE" and just admitted, under the new cover of Covid, that it was going ahead with full QE. Only then did the Repo Crisis finally (and immediately) end.

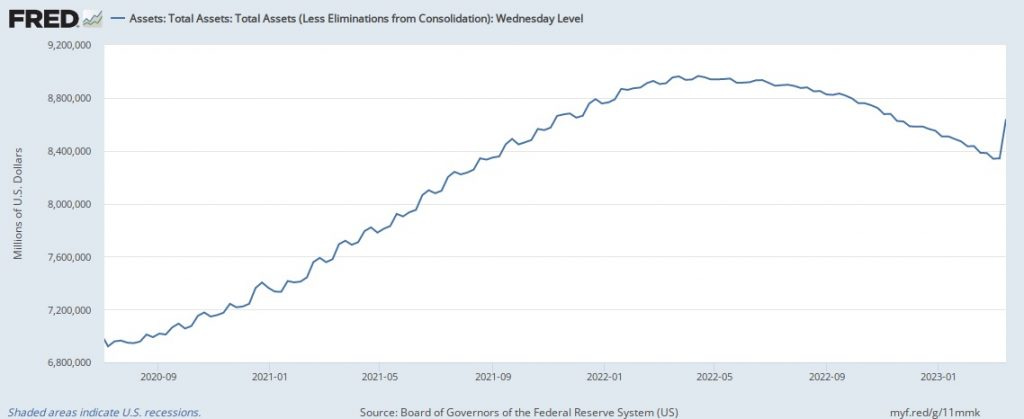

On that historic basis, I suppose this must be some other form of "not-QE" because look at what it is doing to the Fed's balance sheet already:

Ooops!

After almost a year of reducing its balance sheet, the Fed's rescue this week skyrocketed the Fed's balance sheet almost halfway back to where it was at its top in a single week! Notice how much steeper that rocket ride is than anytime along the very steep increase in the Fed's balance sheet that happened coming out of the Covidcrisis. And, to put how steep that increase was in a longterm historic perspective, look at this graph of the wreckage that has piled up in the Fed's balance sheet under QE and attempted QT since the Fed started saving us from failing banks back in the Great Recession:

Looks like a front-end collision to me with the hood buckled straight up in the air. It also looks like we're not climbing down off that mountain anytime soon! Time for another leg to a new higher summit? (These the endless cycles of monetary expansion I predicted the Fed had committed us to in my book Downtime. Looks like it's turning out that way.) We have no idea how far the steepest dog leg ever seen is going to go because it just started this week, but Dimon predicted another $2-trillion up that mountain. We can see, however, how well every attempt to come off that mountain has gone. And we can see how what looks like a 45% slope of QE in the first graph, looks almost straight up on a longer-term historic perspective. So, imagine how steep that makes this week's trip back toward the moon!

We'll get into the whole QE issue and what it means for inflation, etc. in another article, probably this weekend. But let it suffice for now to say, "What a day a week makes" as this day wraps up a particularly ugly week that followers a previous particularly ugly week. Two-year Treasury yields haven't plunged this quickly this far since the crash of '87, plummeting 70 basis points by the end of the week.

(All the news stories for this article, and many others, were featured in this morning's Daily Doom, to which all my Patrons at the $10 level are provide daily access.)

Yes, this book collects all the articles that got my writing on economics started back in the Great Recession -- the articles syndicated to The Hudson Valley Business Journal and other newspapers that chronicled and lampooned the preposterous bailouts carried out by lunatic legislators and in clandestine meetings during the Great Financial Crisis as they happened. These articles predicted we would see an even worse financial crisis down the road because the Fed's bailouts were destined to pile up in a great mountain of debt and leave a lot of dead wood in the the economy. They predicted the Fed's monetary expansion would have to be repeated in larger amounts each time the economy failed. We saw that happen in 2020, and already it is happening again with considerable acceleration all of a sudden.

But this little book also contains introductions to those articles, written in 2020, that showed how we were piling up new bailouts on an even greater scale after the Covidcrash to save the collapsing economy and how that would create an even greater crash. As you read it, today, just three years after it was published, you will perceive layers on layers in these rinse-and-repeat boom-bust cycles as your mind overlays present events on what I predicted was coming in those introductions to the events of the Great Recession. You'll see how the things described in the original articles and in the chapter intros are all repeating as was promised in the three years since the book was written and published.

You'll be amazed at how predictable the past fifteen years were based on the path the Fed chose and the predictable nature of human greed and corporate-controlled politicians. We have walked the road those articles laid out as a future path and that the introductions said we would walk again and again.

However, this little book also contains a pathway out -- the road not taken. It became a harder path to travel when things crashed in 2020 because it had overgrown from lack of any use. The easier path we chose in 2008 inflated more and larger economic bubbles, and the mountains of debt stacked higher. It has become a harder path again in 2023 than it would have been, had we taken it in 2020, as the introductions to those original articles said would be the case because of the bailout route the Fed chose. That is because the path taken since then produced scorching inflation that now limits what can be done. Because the Fed chose to paint itself into this corner where it is now boxed in by high inflation, it may be a no-way-out scenario this time; but the path should be tried as best we can anyway.

It's a short book and a humorous read along the way. Read it now, and you'll be amazed at how the cycles keep repeating, often with the same characters, even when those people hold different positions today, or by their successors in the same positions. If we would learn from this short and outrageous history, we might stop repeating it.

Buy a book for yourself, and buy one for each legislator you want to influence against new bailouts, because this little chronicle of the Great Recession is simple and kind of fun to read and small enough to be easy on the budget and easy and cheap to mail as well. All of the fiascos it described from 2009 plus its introductions written for each chapter in May of 2020 about the bailouts that were just beginning again, will feel prophetic today as you think about how those bailouts continued after the book was written to the present day and now are being repeated again, in slightly changed form, just as this little book promised they would be.

Treat it like your pocketbook to the apocalypse. Use it to help those making financial decisions wake up to see why this circular trail through the Forest of Moral Hazards and over the Mountains of Debt is an endless trap.