What Went Up Came Down and Up and Will Come Down Again

It can't come as any surprise that the stock market's lofty balloon ride during the past couple of months fell because of a few words this week. It only rode up on sweet tweets by Trump about trade, which created a thermocline for it to ride. So, of course, the market plummeted this week in the unexpected downdraft of Trump's out-of-the-blue statement that his trade deal may be a year away ... even for phase one.

I don't know if ignorant traders drive these vain accessions and declensions or just ignorant machines that have no ability to discern truth, so blindly they take all presidential headlines at face value.

Who could be surprised that stocks got off to their worst December start since the beginning of the Great Recession when Trump said a trade deal might best be shelved until after the 2020 elections? It was, however, apparently a fleeting horror to those who had actually believed Trump about a phase-one deal being imminent this month. One could only watch the surprised reactions with amusement, given there was no reason there should have been any surprise at all.

Even if the market's downfall was all algo action, those algorithms would all be rewritten if actual people actually cared about truth or reality. The people who own the bot traders would rewrite their algorithms based on what anyone can easily learn from the present negotiations -- rewrite them to ignore all that is said about those talks as fluff and price in the current actual economic damage of the trade wars and the lingering damage from the Fed's recent experiment with tightening its balance sheet.

We all know there is not much more on the table in phase one with China than a cessation of additional tariffs in exchange for some more agricultural purchases by China and maybe another sweetener or two, maybe a relaxed tariff here or there. That means we also all know the damage from the current tariffs is going to continue for a long time because right now we are struggling just to get the easy stuff out of the way.

If people were interested in truth and reality they'd recognize that. They've had well over a year to watch the damage from tariffs relentlessly build; and negotiations and talk of tariffs began two years ago. So, if it takes about two years to negotiate the easiest parts of a deal with China, everyone has to know that it is going to take a whole lot longer for all the president's men to hammer out a deal over the hard stuff that Trump has stated many times is necessary in order for him to remove all present tariffs. That clearly makes it past time to just factor tariffs in as long-term trade troubles.

Said Trump on Tuesday about tariff timing:

“In some ways, I think it’s better to wait until after the election if you want to know the truth. But I’m not going to say that, I just think that,†Trump said.

Yet, hope springs eternal:

“We have seen this movie many times before, however, where the president throws out remarks during trade talks that in retrospect have just been a negotiating tactic, especially when he starts off by saying China wants a deal more than he does,†said Chris Rupkey, chief economist with MUFG. “We still think a phase-one deal is coming, although it is likely to go down to the final deadline of Dec. 15. Markets are trapped by the changing news, but this is exactly like a reality TV show where the outcome continues to be drawn-out to the bitter end,†he said. “The president can’t afford for stocks to crater, that much is clear, with an election hanging in the balance less than a year away. “

There's a guy who can see the obvious and still not see it! If it's just negotiating bluster, as he says, why have tariffs gone up and up for the past year, and we're still negotiating. How is that merely a tactic?

With that said, we all know that, as soon as Trump trumpets that a trade deal could happen soon or sends his minion Larry Kudlow out to blow smoke, stocks will fly back up in a dead-brain bounce, even if the December 15th deadline is missed ... so long as Trump doesn't implement the new tariffs. So long as he tweets an excuse for holding off a little longer on the additional tariffs, there will be sighs of relief and upward bids.

The market bounced back, but should it have?

O.K. I wrote all the above on the day the market plunged -- that we all knew it would bounce back as soon as it got the right tweet. And, a day later, as I was writing the rest of this, that's what happened. I cannot write about these things as quickly as they bounce.

What was really telling was how the market came back right after Trump told us he was adding nations to the tariff war that had not yet been tariffed. Trump tweeted that tariffs will be added to Brazil and Argentina because their currencies are crashing, and the market bounced back. It didn't care that the trade war was broadening.

While Trump thinks those nations are manipulating their currencies into hell just to get an edge in trade over the US, it should be obvious to anyone who hasn't dipped his head in agent orange that Argentina's currency is in a long-term free-fall because its economy sucks. It's been mismanaged for decades, and its leaders are corrupt! Have been for a long time. Both of these nations are doing everything they can to arrest their currency's fall. Argentina is the new Zimbabwe, and Brazil is starting to look a little like the new Greece. And Tromp l'orange is the new black and white. We are supposed to believe these nations are currency manipulators and that this can be resolved with more tariffs because Trump has tweeted so.

Their currencies are falling because no one wants them. So, slapping tariffs on those nations is not going to solve their hyperinflation problem. This is just a whole new set of tariffs to add to the trade wars to accomplish nothing ... other than to hurt American manufacturers more by raising the price of aluminum and steel. We might as well consider those permanent tariffs because Argentina's problems aren't about to go away just because Trump punishes them for their currency crash.

Trump also said new tariffs will be added to France because France plans to tax internet commerce in France. France's plan will hit American companies doing internet commerce in France harder than French companies because there are a lot more American companies (like Amazon) doing major commerce on the internet; but France is not singling out American companies. Tariffs, it appears, are becoming Trump's answer to everything. But that didn't matter either on the day the market rebounded because the one-track market heard what it wanted on China tariffs, regardless of whether it is true.

So, stocks took off for over a month and broke records because the bottom was in for the economy, according to the gurus and a partial trade deal was in the works, and then stocks plummeted because an "Oops, I guess not" number came back in for manufacturing, putting US manufacturing deeper into recession than ever, and a "guess not" tweet came in about the trade deal.

We already knew what would come next. The market would be saved the day after I wrote the above opening because of a tweet ... like this:

I predict there is a high probability that President Trump or a senior US official will openly say in a few hours that China-US trade talks have made a big progress in order to pump up the US stock markets. They've been doing this a lot.😀

— Hu Xijin 胡锡进 (@HuXijin_GT) December 4, 2019

Only Trump didn't need to make the tweet that blew the market back into the sky. This time Bloomberg provided a puff piece on the trade deal. Nothing changed for the better on trade or in the economy, but Bloomberg breathed some helium hope back into it by just saying trade talks were continuing. Well, of course they were!

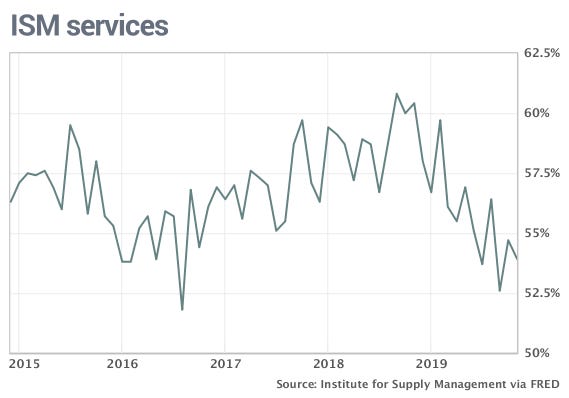

In terms of actual trade, though, things got worse, as noted above. In terms of the economy, they got worse, too. The services sector, which everyone long said was far more important than the declining manufacturing sector (so we could just ignore the latter), fell again from 54.7% to 53.9%. That's still above the 50% recession starting point, but look at where we've gone in 2019:

Continually lower highs and lower lows -- all year long. The index for business production in the service sector dropped to it's lowest level since 2010. That's the kind of closest-match-would-be-the-Great-Recession statistical decline we've seen in numerous metrics for a long time now.

Last summer, everyone was saying a manufacturing recession didn't matter because manufacturing is less than 20% of the economy. Services were doing fine, and they are the other 80%. Since that was the excuse for buying stocks back then, you'd think that a day with bad news on the services sector would not be a bonus day for the market after three days of decline.

Think again. Instead of falling on a day of nothing but bad news, the market lifted off because the only news that mattered that day was Bloomberg's timely claim that a trade deal with China was still on track, which wasn't based on anything stronger than the usual vague comments from nameless sources that have become journalism's new standard. It's unclear why unnamed sources should be considered more weighty on the subject than the president's own statement a few hours before that a late 2020 timeline might make more sense, especially when he was joined later by his chief negotiator, Wilbur Ross, who also said moving the timeline to late 2020 would make more sense.

Even if those statements are just negotiating tactics, that doesn't 't change the essential fact that parleying negotiating tactics is all we've seen happen for two years; so no more reason to think actual trade results will be different before December 15th than before all the other meetings where we heard that kind of posturing followed by promises that a deal was near. So, the market not only ignores all bad economic news if there is good news about China trade, but it readily replaces bad news on China trade with any unsourced good news on China trade. That is a lot of bias toward hearing what you want to hear.

Just how thoroughly does the president own the market and manipulate it with empty tweets?

"Trump perfectly orchestrates the stock market’s rise whenever momentum wanes"

Price action, internal momentum and volume aren’t great, but that doesn’t matter when the president wields his baton. President Trump has successfully turned a segment of stock market investors into puppy dogs. Just witness trading this week.

This stock market is controlled by the momo crowd. Clearly Trump understands that the momo crowd is fickle and can be moved in either direction based on momentum in the stock market. This is the reason that Trump is able to manipulate the momo crowd into behaving like puppy dogs.

Nothing matters to the market's mad hatters

In an investment world that no longer cares about truth or reason, all that matters is that algos get the message they are programmed to rise on; so, rise they did, taking the market up a lofty 147 points (200 midday) on the Dow (0.5%) and 20 points on the S&P (0.63%). Apparently we haven't hit peak Trump in market gullibility yet.

It also didn't matter that, for the fourth straight month, the manufacturing sector came in below the 50-point line. The day before the market floated back up, ISM's manufacturing report fell from 48.3% to 48.1% even though economists were expecting it to improve. It looks like it's digging a tunnel now:

The "new orders" section fell off the hardest, going from 49.1 to 47.2, which means there is not much hope for the immediate future either; but that didn't matter.

Another survey reported just before the market rose that fewer than half of mid-size American businesses expect sales and profits to rise anytime next year. That also doesn't leave much hope for the immediate future from those who ought to know their own business, but that didn't matter. Stock investors no longer care at all about quaint ideas like how business is doing. All that matters is that they get their Trump treat by tweet.

“It still baffles me that investors hang on every Trump statement and tweet,†said Craig Erlam, an analyst with OANDA Europe. “His trade deal optimism changes on a near-daily basis and yet investors are very sensitive to it. It is probably a reflection of the relative lack of other talking points.â€

With no other truly solid good news left to stand on, which is where I said we'd end up this year, the helium-hyped market's only hope is that a turn in the trade war will start bringing all other conditions around; but it doesn't set its course based on all those other conditions that actually exist but, instead, just based on that one ephemeral hope of a Chinese trade deal. If you are an actual investor and not just a trader, your hopes are hostage to the daily tweet.

Thus,

Stocks shrugged off a report on U.S. private-sector hiring Wednesday morning. Employers added just 67,000 workers in November,

That didn't matter at all. However, when the market got news today jobless claims were down, that mattered, so the market went up. The first number was a truly terrible number in a year where hiring has been slacking all year (when you factor in the 500,000 error in new jobs that the BLS said it made in the past year's reporting -- over-reporting of new jobs that you can be certain is still happening because that is what usually happens in years when the US slides into a recession. In fact, those are the ONLY years when the BLS new-jobs numbers for each month wind up that far off from the change in the actual census of all jobs that the BLS takes once a year.)

The new-jobs number fell drastically below expectations of 135,000 new jobs, which continued to drive the long-declining average in new jobs further down ... to the lowest point it has hit since the end of the Great Recession:

But that horrible number didn't matter either. All that mattered was the good number later on jobless claims. The market ignored most bad news.

On one hand, one can understand the emphasis on the China's trade (if it were not a one-track, tunnel-vision focus that is oblivious to everything else), given the problems it is contributing to:

After nearly 17 months of trade disputes between the US and China, with no immediate resolution, farmers across Central and Midwest states have seen their personal incomes collapse, soaring farm bankruptcies, depressed commodity prices, and little relief from the government bailouts (mostly because the farm bailouts went to big corporate farms). As a result, the farming industry has plunged into a nasty recession, with tractor sales coming to a screeching halt. Deere shares are down 3.5% to 4% on Wednesday morning following the better than expected Q4 earnings report. Investors were alarmed when guidance for agriculture-and-turf 2020 sales was lowered by 5% to 10% for the full year. The construction and forestry segment was also guided lower, down 10% to 15% next year.

On the other hand, China is just one part of the trade war, which is now spreading with escalation now happening with France, Brazil and Argentina and more likely in store with Europe as a whole. Moreover, phase one isn't going to do much to drop existing tariffs ... even if it does happen this month. That makes this phase-one deal hope a thin string from which to hang all market hope when phase one is just the easy stuff. Hoping that it will reverse all the metrics that are declining throughout the US economy -- especially things like earnings, revenue and profits -- even in the services sector, is nonsense, especially when services don't rely directly on Chinese trade.

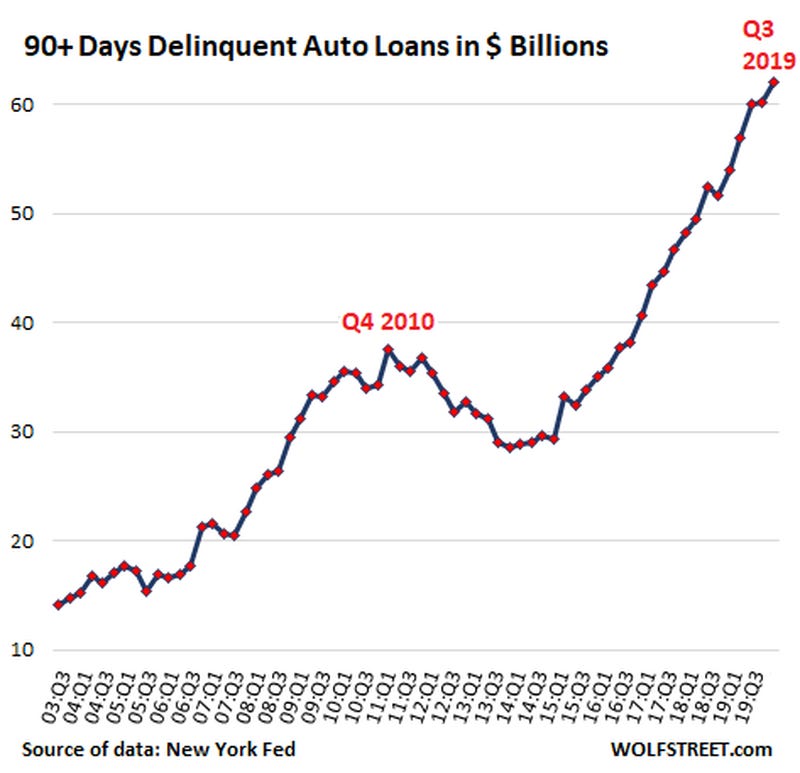

Sure, John Deere's tractor sales are hit hard by Chinese tariffs on agricultural products, but not its domestic construction and logging-equipment sales, which are also falling. US auto manufacturers are doing even worse than John Deere, and their failing domestic sales are not particularly impacted by the tariffs. Yet, they are now offering the largest incentive packages to car buyers ever ... just to keep sales from falling any further ($4,538 aver per car, an 12% increase over last year). The rising troubles from auto market look like this:

Far worse than the Great Recession's auto crash.

But that doesn't matter either. Investors couldn't care less.

Do you think a US trade deal with China is going to solve a global recession problem?

That's the picture of global trade in year-on-year numbers, showing a year of deceleration. It is the worst global trade has looked since 2009. You might blame some of that on Trump's tariffs, since the US trade decline with China is part of the global total, but clearly there have to be significantly deeper problems throughout the world for all world trade to have so totally disintegrated all year long! And the US is not immune to that.

Do you really think a phase-one deal between the US and China will right all those numbers? It may keep the statistics from plunging further by preventing more tariffs between the US and China from going into effect; but it's not going to right the damage from all the tariffs that are going to remain until a full deal is completed.

The market, of course, is also maintaining float via support from central-bank money printing. Global-bank printing presses can print the stock market up almost as fast as a Trump tweet, but it takes many months for their actions to start to trickle through the general economy, lifting auto sales and tractor sales and use of services. The CBs can pump stocks up all they want, but there will be no quick change to the economy even if Trump does get a deal he can blow his horn about; and I'm sure that deal, if it happens this year, will be a lot of horn blowing powered by low-oxygen, hot hair.

Expecting this thin deal to turn around a dismal global trade picture like that above is nonsense. The Trump Trade War, after all, began well before the global manufacturing decline, and the decline did not steepen any after the trade war began:

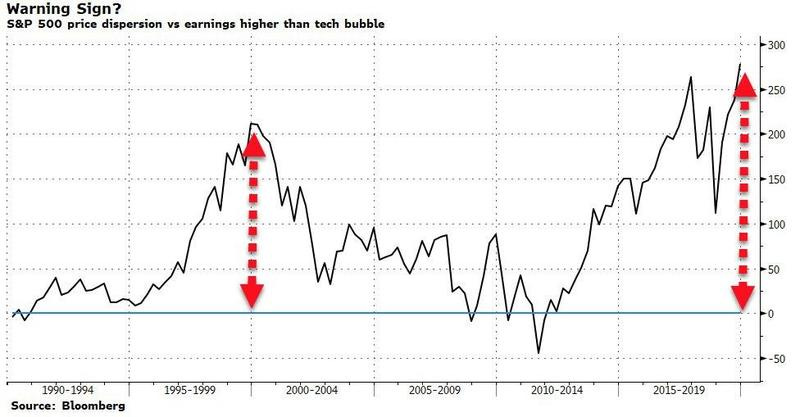

Of course, it also doesn't matter that the the disparity between stock values and corporate earnings, which used to be seen as necessary for underpinning stock values, is further out of skew than it has ever been in history:

What befalls the market next?

The fact that nothing matters in this market any longer outside of the Trump Twitterverse is why I've said it will take a recession to bring this market down. I believe a recession will become severe enough to finally break through the denial, bust past the tweets of fleeting trade hopes and bring the market back to reality. Whether that will happen during these dawning months of recession, I don't know; but it will eventually come down due to the developing recession.

Until then, the market is hostage to one thing, which means that one thing has all the power needed to bring the market down. If the market ever loses confidence in Trump trade tweets, that alone will bring a bad fall since that is all it is hanging from now. However, I don't know that anything can convince it that China is in this for the long haul, willing to wait out the 2020 election.

After seeing the market's bouncy ways these past few days on the hopes that December tariffs would be postponed, one can read in that wave action how the market hangs on that hope. If the tariffs do go into force on December 15th, the market will throw a tantrum, and Trump may very well feel empowered to move forward with those tariffs, just as he felt empowered in starting new tariffs with parts of South America and threatening new tariffs on France because the Fed now has QE4ever undergirding him as he wanted and the stock market still residing near record highs.

Whether that will be enough of a jolt to break through the false hope that a trade deal will turn the world right again, I don't know. I doubt it. It will be a big December jolt if that happens, but I think it will take months of attrition from recession to keep wearing down these false hopes to bring the market down as far as it needs to go to align with the economy ... because....

Even if the new tariffs go into effect, and the market falls spectacularly for a couple of days, Trump will again tweet of trade talks in January looking strong, and the slavering market will grasp what it can, relieved to hope all is well again.

Just remember when that happens, the economy isn't going to buy any of that. World trade won't improve. Auto sales won't take off. Tractor sales may bloom a little if spring weather is kind and Chinese tariffs on ag are lifted; but services won't feel much impact, and numerous tariffs will remain clamped down on manufacturing with more forming as fast as Trump can dream up reasons to apply them. He now has a government to fund with tariffs, since he removed a lot of other tax funding. (Tariffs are his replacement tax on US businesses and citizens, but he thinks the Chinese are paying for them.)

All those graphs above and many others shared recently on The Great Recession Blog will continue to go deeper into recession. You can't tweet those up. They are not fickle like market investors running on hype. And, as those statistics about reality grow worse and continue to be ignored, the market will simply become further out of touch with reality, which only means it will fall all the harder when recession is clearly fully in at such a level that it becomes impossible to disbelieve in it. Yes, it is forming beneath us already, and the market is merely a smoke screen keeping many from seeing how the real economy is doing:

In the past 5 years, the S&P 500 stock index has risen over 50% and during that period operating profits for non-financial companies have declined over 15%, a drop that has always been associated with economic recessions.... The decline in profits in the past year continues a long stretch of weak corporate earnings. In fact, operating profits peaked in Q3 2014.... In the past year, profits for non-financial corporate businesses declined nearly 5%.... Profit declines of this scale, and even less, have always been associated with an economic recession. In fact, since 1975, there have been 6 recessions and of those only two--- the dot.com bust and the Great Financial Recession - recorded larger declines in operating profits than the current slump.

We were already deeply into those recessions before profit declines became as great as they are right now; so, where does that put us right now? No wonder the Fed has made "insurance cuts" in its target interests rates three times in the last few months and leaped back into QE with both feet.

Which brings us back to the following as being an even greater crisis than the Trump Trade Wars; the credit crisis, which first showed up as a Repo crisis, will break out in a bigger way (possibly at the end of year when all accounts are reconciled). Somewhere big banks will start breaking or non-bank financial institutions. The first to fall may be Deutsche where we all expect a break, or it may come from China or Italy. What we know from the ongoing and still-growing Repo crisis is that some seriously deep trouble in the banking realm keeps pushing through the surface and hasn't been resolved by months of renewed Fed largesse:

There, at last, is a simple picture that aggregates all the new money the Fed has created in the financial system since late September when the Repo crisis broke through the ground. When I said this was a big problem in its first week in September, not everyone believed me. Now it is an obviously swelling volcano. At $130 billion per month, that is far more per month than the Fed added under QE3 (which created $80 billion a month).

“The big picture answer is that the repo market is broken,†said James Bianco, founder of Bianco Research in Chicago, in an interview with MarketWatch.... “This is now far bigger than anyone thought this was going to be,†Bianco said. “I think they’re hoping the market will magically fix itself. I don’t see why it would.â€

It's not even slightly bigger than I have consistently said it would be since late September. Not even slightly. I've said it will reach half a trillion by April and probably won't stop there because the Fed balance sheet is one thing that is going up that isn't ever coming down again. So, who you gonna trust? The person who told you immediately how enormous the Repo problem was going to be? I don't see why it would fix itself either. Nor do I think the Fed has fixed it with this volcanic mountain of new money.

Yet, when the Repo crisis recently forced the Fed to add longer-term Repos than it has ever had to employ, that, too, didn't matter to the market. It soared even higher ... because nothing matters.

Until it does.

And it will.

![By Neuroxic (Own work) [CC BY 4.0 (http://creativecommons.org/licenses/by/4.0)], via Wikimedia Commons By Neuroxic (Own work) [CC BY 4.0 (http://creativecommons.org/licenses/by/4.0)], via Wikimedia Commons](http://thegreatrecession.info/blog/wp-content/uploads/DescendingBalloonSmall.jpg)