Economic Predictions for 2022

I spent all of 2021 warning people to keep an eye on inflation because it would would kill the stock market by forcing the Fed to taper and then to taper faster, even as the economy sinks. We have now reached that time that I warned you to watch for.

Speaking of the big themes from 2021 that are likely to rock the new year, Bill Blain writes,

The big theme remains how the price of all financial assets remains grossly inflated both on a relative and outright basis. Monetary distortion warps the basis of everything we think about capitalist free markets, and not in a good way. On a relative basis, stocks look cheap to bonds, but bonds remain outright massively expensive.. meaning… so are stocks! Basically… artificially low bond yields screw up everything. Unravelling the distortion is something Central Bank are ultra cautious about – for good reason.

This unraveling of bond price distortion and the markets it will impact is , of course, the theme I wrote about in my last two Patron Posts, one of which I will soon be making generally available to other readers because I want everyone to be able to understand what is about to happen all around them in the early months of 2022. You, however, got to hear it well ahead of the pack.

Bond repricing, as the Fed lets its grip slip as it shifts to no longer being the buyer of first resort, will massively impact all financial markets. Patrons were able to realize that first in a series of articles that revealed how inflation would push the Fed out of its QE bond buying at a rapid pace and pressure it to stay out and why that would result in bonds repricing, so you have had more time to consider your preparations. Now, inflation has risen to the point I was forecasting where its forces have clearly captured the Fed's full attention to such a point that the Fed admitted to the entire world it was wrong about inflation and to where inflation is now high enough to rip into the economy, too. The Fed has already been forced to taper faster at a time when the economy is already deteriorating in stagflation. The Fed couldn't ask for a worse scenario.

I don't give advice on where to invest, other than in the most general sense (and even then rarely) because I'm not licensed to give any specific investment counsel to anyone ... and because knowing where the big problems will emerge doesn't mean I know for sure what else remains safe. So, I stay with predicting what I am certain of, which has been for this past year that 1) inflation would NOT be transitory, 2) that it would build through the course of 2021 to become red hot, 3) forcing the Fed to start its taper, but 4) that the Fed would be late to taper its monetary expansion in terms of how soon it really needed to act because it believed its "transitory" claim (because it needed that claim to be true in order to keep from crashing markets, and it hoped it would get lucky), which would mean 5) the Fed would very quickly have to ramp up its tapering, as it just did this past week only a month after starting to taper on an already rapid schedule, so that 6) inflation and Fed would ultimately kill the stock market.

All but point #6 have become hard reality. And #6 is the trembling we are starting to feel, which will prove out as the Fed's taper progresses.

That brings us to the starting point for 2022, or, as Bill Blain asked, "If you think 2022 is going to be any saner… Why?" Indeed, why on earth would you? More wishful thinking like the Federal Reserve's "inflation will be transitory?" Of course, if you were that kind of person who lives in economic denial, you wouldn't likely be reading my blog. So, you're more likely to be a realist who takes his or her truth straight up ... at least, when it comes to financial matters -- someone who wants to hear and evaluate the possible bad news, whether you accept it in the end or not.

Because, says Blain,

For what it’s worth; I reckon markets and the world are likely to become even more unpredictable and unstable in ‘22 – but that doesn’t mean there won’t be opportunities galore!

Knowing what's going down might help you figure out what will hold solid or even go up. To that end, I've put my predictions in red below.

The inflation vortex

Inflation is a fire tornado that creates its own winds for its own spread.

Inflation is not going to die down in 2022 just because the Fed has slowed its rate of monetary expansion. It will continue to run hot through, at least, the first half of 2022. (It may run hotter for longer, but just the fact that it will continue hot is as far as I need to go right now to give people a warning of what to expect.)

Because tapering will not slow inflation, the Fed will have to hike interest in the first half of the year IF it's going to slow inflation ... also with little immediate effect on inflation, but I have a caveat below as to whether it will actually do that.

Of course, neither the government nor the debt-laden economy can handle seeing the ten-year bond and all interest that is pegged directly or indirectly to it rise above a nominal rate of about 2.5%. So, the Fed's maneuvers as the walls close in on them are going to become very interesting.

I'm not going to pretend I can decipher where bond rates are going to go under real market forces due to inflation once the Fed fully releases its grip (per my earlier Patron Post); but, if the two-year bond goes fully to market-set rates when the Fed stops buying, the two-year would have to rise to around 7% nominal interest just to keep up with nominal inflation where it is today. How much of a loss bond holders are willing to take by accepting yields lower than that in a climate of falling bond prices, will depend on how desperate they are for security as there is not going to be any money made by speculating bond yields will fall (causing prices to rise), which is the bet the big bond money has long been playing. Belief that rates will fall even more is why investors buy bonds that offer low or negative interest, hoping they will be able to sell them at a profit when real bond interest plunges even further.

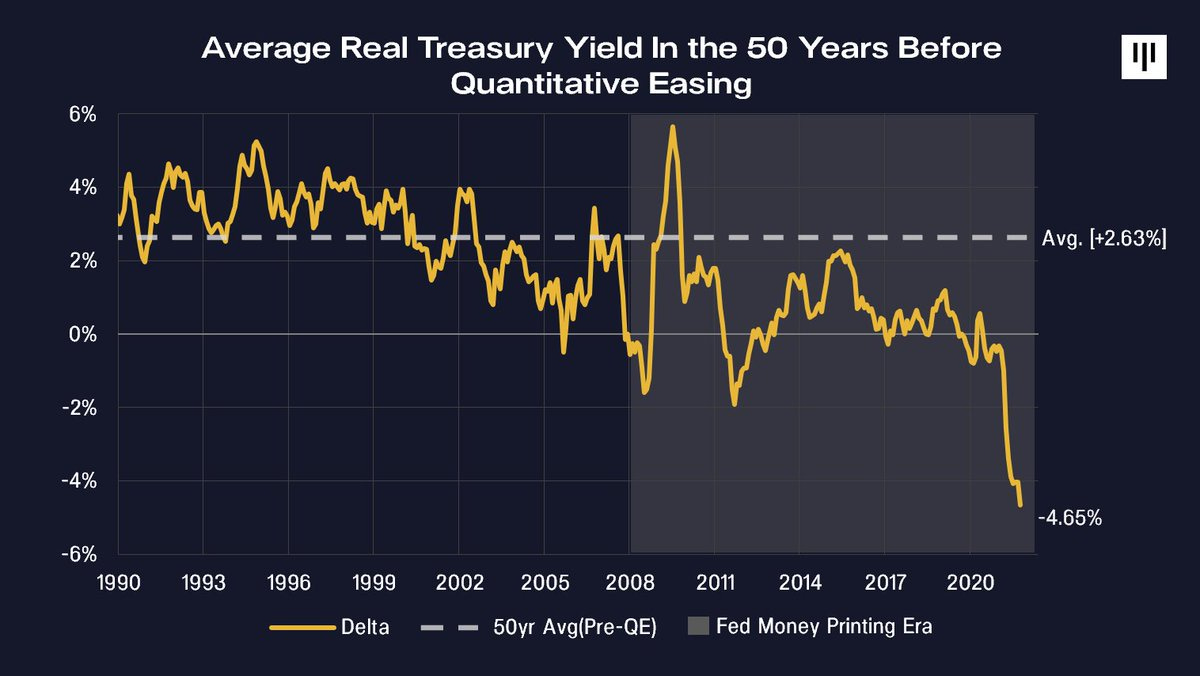

Here's how far real yields (i.e., adjusted for inflation) have fallen below their fifty-year average:

Do you think there won't be a real mean reversion back to the mean when market pricing takes back over as the Fed steps out of the treasury-hoarding game?

To avoid seeing major yield curve inversion (not just flattening), the ten-year would have to rise above the 7% the 2-year needs to hit just to be at 0% in terms of "real" (inflation-adjusted) yields. However, bond investors will believe inflation is not going to last all of those ten years, so the yield curve will see some fairly quick and severe inversion. At present, I don't believe inflation will last that long either unless the Fed loses all control (which is not outside the realm of possibility here, but I stay with what I think is likely not what is simply merely possible). The reason I don't think high inflation will endure that long is that the whole economy will lie in tatters under a severe recession long before ten years are up.

So far, the Fed has done nothing to stop inflation as Sven Henrich explains:

Under which economic theory or construct do you fight inflation with real negative rates? I know of none and I suspect neither does the Fed. So the Fed is overtly risking that inflation is becoming entrenched with a weak response and that can be a big problem.

"Real" interest likely has to rise higher than inflation to beat inflation down, so we have a lot of interest rate increases to see from both market forces coming back into play and Fed changes to their targets if the Fed is going to truly fight inflation, and if it doesn't....

The one caveat to this big change in bonds is if the US stock market so badly self-destructs and the rest of the world does so much worse than the US that US bonds remain the last living horse in the glue factory, then maybe the US bond market will be spared by outside investment pouring in; but I don't see that as a likely source of salvation.

A greatly reduced labor force assures labor rates will remain pressured to rise. Even with the rises they have made, wages have fallen behind inflation. The vortex is this: the updraft in labor rates pressures the next upward cycle of inflation. Shortages of goods and services will certainly continue under a labor shortage as supply-chain problems are far from being figured out, much less resolved, and short supply will mean prices for what is available get bid up. It will mean producers keep bidding up prices for their needed resources, too, and those costs will be passed along as much as possible.

Nations will continue to shut down parts of their economies for pandemic reasons, and that, too, will cause global shortages to persist and possibly grow. Those who have money will be the ones who get the goods because we all know that is how the world works, but that means the cost of those goods and services will rise.

At some point, the inflation vortex will likely deplete its available fuel (money) and will begin to starve itself out; but, by then, the damage is done. At that point, we could see rapid disinflation due to a collapsed economy, but my economic predictions for 2022 are not running that far ahead for now, as I remain with what I see as nearly certain, not mere possibility. High inflation can be like a supernova that explodes into hyperinflation (Zimbabwe style), or it can swell quite large like a nova that, subsequently, burns itself out and deflates into a small, dark star.

The oppression of the Unvaxxed

Even if the courts axe the vax mandates of the Biden administration, state and local mandates that force unemployment upon those who are not willing to be forced by their governments to inject themselves with experimental medicine are going to hurt everyone. Hopefully, some of those lower government mandates will be removed if Biden's mandates are struck down by the Supreme Court, but it is not clear even in the words of lower courts that a Supreme Court rule against Biden's mandates will govern congress or state legislatures, as a good part of the court challenges is based on the separation of powers that do not allow the executive branch to pass laws.

The vaccine mandates assure that the labor market that was decimated by COVID lockdowns will remain in bad shape for as many months as such mandates continue. That, in turn, assures that product shortages and shipping blockages will become more dangerous and will continue for months to come.

And all of that assures an increasingly hostile social and political environment.

The Unvaxxed in the US are bound to protest intensely once they start to feel the pain of starvation being forced upon them. In recent days, thousands of protestors filled streets, often violently, in the UK, the Netherlands, Belgium, and Germany. In Germany, more than 10,000 gathered in protest, many of of them using slogans that accuse their government's oppressive vaccine mandates of being "Nazi." I see it the same way. Those kinds of hostile protests will show up in the US soon, too, and will grow as the damage of the mandates becomes more personally devastating.

The truth of the Biden mandates IS eventually forced starvation if you run things to their logical conclusion. Biden is laying siege to each household, hoping economic deprivation will starve them into compliance. I'm not saying we'll get as far as people actually starving, but I am saying those who are unvaccinated and intend to remain that way will do the math for themselves and quickly realize where they will wind up. Their forced desperation will add even more heat to politics than we have now well before they get to the point of actually starving.

Whether or not the Vaxxed will have a heart and relent or will continue to say, "You brought this upon yourselves," though no one has a right to force such deprivation on anyone for not taking forced medication, remains to be seen. From what I've seen of the increasing hardening of human hearts in the US, especially among the Woke who think they are righteous, I think fear and self-righteousness may hold the line.

That means, I think the Great Unwashed will become deadly violent in their protests if actual starvation and social deprivation and loss of housing and ability to care for their children and availability of medical care that was once assured as a benefit of employment start to seriously impact people's lives.

There are caveats to this one; so, I'm not going as far as making deadly violence a prediction because I lack certainty. I don't know, for example, the resolve of the Unvaxxed. Most who didn't want to be vaccinated caved in already when it came close to the date of losing their jobs. Maybe those who remain will also mostly capitulate and take the vaccine so they can take care of their families, rather than stand on principle. It seems to me, fewer and fewer people believe in dying for liberty if that is what it takes, which is what built this nation; and it is much harder to take such a stand if you see your children suffering because of your choice. I hope they surprise me by not letting the government force them to get a vaccine they don't want, but I understand if they do not. The will to eat and to make sure your children eat is strong. Another caveat is that Omicron may save us and keep the pandemic from lasting that long. Maybe the Supreme Court will strike down all mandates that deprive people of their livelihoods. So, let's just say I see the deadly violence I put in bold as a likelihood for 2022 -- and certainly not something I encourage -- but there are a number of caveats as stated. The part in red, I am certain of.

If one gets vaccinated because they believe it is the best thing for their health, I support their right to make that decision without anyone plaguing them about it, even though I am concerned they might be wrong about that. However, I don't know I am right about not getting vaccinated either. Just because something is completely new to the human body and has never had longterm testing does not mean that most humans will be hurt by it, but they could be. I hope they aren't because the minority who remains unvaccinated would never be able to carry the dead weight of the Vaxxed if a great many became disabled. (I don't really think that is a likelihood, but it is a possibility.)

I laud those who hold the line and say, "I might choose to do this for my own health reasons, but I will never do it on the basis that any government thinks it has a right to force experimental medicine into me. My body, my choice." Certainly, if you have had COVID, society has more to fear from you than it does from those who are merely vaccinated, so the vaccinated have no basis for acting more righteous than you.

Omicron and other new variants will, of course, be used, as I have already warned to increase the uptake of the vaccines that are financially rewarding to Fauci and to many of his egg-nog sipping colleagues -- even though Omicron could save us if it spreads. I am not saying it would save us, but only that they will even consider giving it that chance. While it is Fauci & Friend's job to make sure plagues don't take their course, it is also their financial best interest to make sure a variant that so far appears relatively harmless never has the chance to replace vaccines. Thus, Fauci is, as I noted in a recent comment to my article that I just linked to, already turning Omicron into a scare tactic to boost his boosters. Never miss an opportunity for good press for your proprietary products.

Go green or die

It may be die.

Europe is already struggling under extreme energy prices and shortages that could kill people if this turns into a normal winter or a harsh one. These are partially due to all the lockdowns and resulting labor crises, but also partly self-inflicted by Europe's choice to eliminate sources of energy that are seen as less environmentally friendly.

I like environmentally friendly transformations because I love the beauty and health of this earth far more than money, so I lean toward moving in that direction; but we cannot just leap there without hurting ourselves and killing people. In the US, for example, there is a big push to have all new cars electric by 2025. No one is talking about where all this electricity is going to come from. California already experiences huge brown-outs due to electricity being shut down during fire season. Texas and some other areas saw electricity bills rise exponentially last year due to shutdown of a single run of pipes.

Yet, the Biden administration has clamped down additional pipelines, and fish lovers have blown up dams and hope to blow up more. Maybe those are good moves for the environment, but NO ONE appears to be dealing rationally with figuring out how we are going to generate so much more electricity in just three more years to run all these electric cars that gobble huge amounts of electricity when all we are doing is shutting down electricity generation, and certainly few people are talking honestly about the environmental costs of the alternatives.

No coal. No gas. No new hydro. No nuclear. Part of the "ESG" movement involves using central banks to coax investment banks to stop funding those kinds of projects in favor of ones that are seen as being green. Hydro, which was once thought of as being the greenest source of energy available, has been besmirched by the early Woke, who do not have the nuance to recognize that ALL forms of energy generation are environmentally damaging because they don't WANT to think it through.

So, what do they leave us as alternatives to power all the electric cars they want? Thousands of miles of ridge tops covered with migratory bird choppers? Tens of thousands of additional acres of green forest hacked down or food-producing fields lost in order to cover the land with brightly shining sheets of plastic and toxic chemicals that ultimately get cycled into land fills every twenty years because they lose efficiency, get damaged by the environment (such as being crushed by snow and ice or ripped lose by high winds) or short out? Will the earth truly be happier with all that soil blocked from the sun and all that life rendered impossible because things don't grow well under solar panels? Does natural beauty not matter when we turn our beautiful mountaintops into machines to power our computers and cars by covering them with windmills? Will the recovered eagle population die back off as a result?

No one thinks through the ultimate real costs, economically or environmentally, of going green. When we recycle cans, for example, has anyone really evaluated the cost of pumping water to each home to rinse each and every can as requested, the loss of heat opening a door to go outside to put the cans in a special bin, the inefficiency of human beings all doing this one can at a time, the costs and energy and resource use involved transporting all the cans back to manufacturers and to build the trucks that do that, then the cost of reprocessing them? Does anyone really know whether or not all of that is even net positive for the environment? I certainly don't and haven't seen any study that dispassionately analyzes all of that.

Regardless, one thing is certain for 2022 all over the world, we're going green, and it is going to increase costs reduce available energy in the short term and, therefore, either add to government debts that subsidize these incalculable and hidden costs or add to the prices you pay for electricity, fuel and everything that uses energy in the production and transport/transmission of this new energy. So, inflation is continuing upward even for reasons having nothing to do with the Fed as cheap fuels are pulled out of the market and replaced with more expensive sources of energy with much of that expense hidden via government subsidies; but even those increase your costs by raising the cost of credit due to all the additional debt they demand.

The Biden administration hopes to do a lot more of that, financed by the Fed and by increased taxes, if it can. It's unclear how it will handle such financing when the Fed claims it is going to stop sopping up the surplus of government treasuries, which will force the government to pay higher interest on the open market to whatever extent the Fed tries to do what it says it will do in backing away.

Go green and the rest of Biden's "infrastructure" plans assure continued inflation through 2022 due to rising debt costs for everyone that result when government interest rises and due to competition for resources and services and products by the government as it carries out these stimulus projects, including the additional demand for labor that is already in short supply.

Manchin has single-handedly stopped the Democrats from their plans for the the moment, but they won't give up. The battle will take new turns, and some kind of compromise will be reached.

The zombies will start to die

The certainty of rising credit costs during 2022 means that zombie corporation that should have died off a few years ago and especially during the pandemic lockdowns will face sudden death. These are companies that have only been kept alive by cheap credit made abundant by all the Fed's money printing. As credit reprices to market, it will no longer be cheap enough for these companies to roll over their corporate bonds or maintain their lines of credit.

This leads to another problem, we are likely to see become worse in 2022:

Credit defaults will rise. This is potentially such a massive global problem that I don't know how it will sort out. It's the biggest potential mess in global history as both the Bank of England and the Fed are now pressed to fight inflation by tightening credit in a faltering economy. Undoubtedly, they will not be able to restrain themselves from further bailouts when banks start to fail, but they cannot bail out anything without going back to loosening credit and making inflation even worse on their watch. I expect the outfall of their attempts to taper and tighten to become messier than the Great Recession of 2008-2010 in the years ahead, and 2022 will only be the beginning of those default troubles.

We've seen it in China with Not-so-Evergrande, and we'll see it emerge in many points of smoldering smoke and ash around the world -- probably not in the first half of 2022, but later in the year as interest rises due to the tapering and tightening that the Fed and the Bank of England do in the first half of the year. It will take time for the impact on interest to play through, but not as much time as it usually does due to how unstable all top-heavy, poorly supported markets are right now. (If you've believed the "economy is strong" nonsense, you haven't been paying attention below the surface. Just like if you believe the stock market is not in a bear market already, you haven't looked at most of it. It is not as if only the high-flying stocks that are the index makers matter. Somebody holds ever one of those stocks in the more than 50% of companies that are in bear markets. (See below.) The bear market matters to them.)

As goes the Fed balance sheet, so go stocks

Even in the stock market far more stocks fell in 2021 than rose, so most US stocks are already deep in a bear market. In that broad sense, I am already right in my claim that inflation will kill the stock market. It just doesn't show up on the index level because of how a handful of big stocks outweigh all the others.

Be absolutely clear: While main indices are making new all time highs & give the appearance of a raging bull market underneath there already is a raging bear market in individual stocks.... Given the absolute disastrous performance in the majority of individual stocks, bears were absolutely correct to warn of chasing into unrealistic valuations.

Two thirds of the stocks in the NASDAQ are trading below below their 200-day moving averages! More than 50% of the Russel 3000 stocks are already 20% below their last high (meaning priced down to bear-market levels), and nearly 20% of the Russel stocks are 50% lower than their last high! There is already a serious crash going on behind the market leaders who are simply blocking the view of this train wreck. Once the Fab Five fall, and they will fall when the Fed taper is seriously underway, the market will be screaming for a Powell Put! Or just screaming.

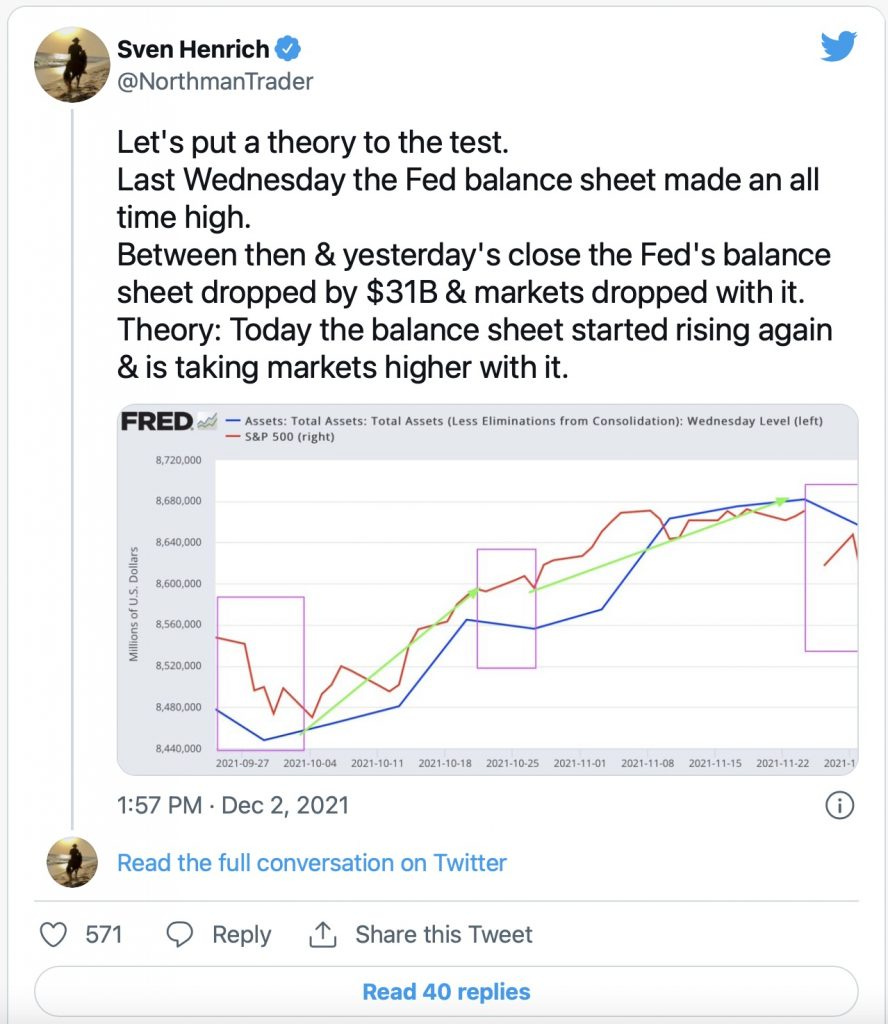

On the small chance that any of my readers still question whether stocks are married to Fed support, I present the following evidence:

Balance sheet drops, stocks drop. Balance sheet slightly rises, stocks slightly rise. Balance rise steepens, stock rise steepens. Balance sheet flattens, stock rise weakens. Balance sheet rise steepens again, stock rise steepens again. Balance sheet rise tapers off, stocks taper off. They are confined dot-to-dot.

Michael Wilson, Morgan Stanley chief market economist, now warns of what I've been predicting all along for the Fed taper:

The Fed's pivot to a more aggressive tapering schedule poses a larger risk for asset prices than most investors believe.

As I called that the market's "blindspot" in my Nov. 8 Patron Post.

Says Wilson,

Tapering is tightening for markets, if not the economy.

It certainly is in this case precisely because, as the Nov. 8 post laid out, tapering this time means loss of Fed control over treasury interest at a time when inflation wants to push bond interest much higher. That, I repeat, is the key difference. During the last taper and even the last tightening, there was almost no inflation to push bond interest up. Now we have scorching inflation, and bonds have a very strong tendency to price in inflation ... when the Fed is not artificially setting interest rates by buying up more than half of all treasury issuances. So, the Fed's taper will raise interest rates, and that is tightening, and that will crash stock indices as it is already doing to a majority of stocks in those indices.

As Wilson also points out,

the Fed is exiting QE twice as fast this time,

asset prices are much richer today and

growth is decelerating rather than accelerating.

In 2014, the Fed tapered over the course of 10 months, and that was from a much lower level of QE support. This time it will be done and out in about four months from far more dependent markets! And Wilson didn't even mention the inflation factor burning a hole in the Fed's hopes because of inflation's natural effects on bond interest that wasn't there last time! Moreover, stock prices have never been more important to consumers because many put their stimulus checks into stocks and then leveraged that up, which is where a lot of their spending power is now coming from. That is where the crashing market will severely impact an economy that has already dropped a lot this year in its GDP rate of growth, which plunged to a mere 2.1% last quarter, and which I've already predicted will go negative for the present quarter.

During the Fed's taper from now through March, beware particularly of what Blain describes as "unprofitable companies relying on faddish customer acquisition strategies to create 'value'," which will begin to "struggle." As stocks lose their fuel because the Fed balance sheet rises at a slower rate until it rises no more, and as bonds reprice higher as the Fed releases its iron grip on the treasury market, the zombies will fall.

The next obvious stage of the present ongoing crash likely will happen in fundamentally unsupported meme stocks and NFTs, which I think are the stuff of peak investment euphoria and stupidity, so I haven't even written about them, and in the market's highest (therefore most top-heavy and fundamentally unsupported) stocks. It will likely also pull down a great number of crypto currencies with only a few survivors (as we saw in dot-com companies around the year 2000 that had huge valuations but no real profitable use).

Take your profits now because things that are "faddish customer acquisition strategies" that attempt "to create value" out of almost nothing are the weak hands that are likely to fold first. Don't be the final tier on the Ponzi. 2022 will not be flooded with the financial largesse it takes to tolerate this kind of nonsense, which is simply the froth that develops whenever central banks pump in way too much liquidity. Central banks are about to get constipated. (I'd put that as a prediction, but it is something they have already told us, though many are apparently not realizing what it means.)

Cathie Woods and her ARKK demonstrate how quickly companies that shined from out of nowhere with rapid glory can just as rapidly fail. In fact, they are the ones most likely to rapidly fail because they are all shine and little substance. So shun the shine. Go for what is solid. The shrinking credit and troubled markets of 2022 are not likely to tolerate stuff that is merely shiny on the surface. It can fall as quickly as last year's New York fashion trends. The crash of Greensill is an example from this past year of how things that expand quickly, can quickly fail because they are vacuous at the center.

Even Chairman Powell has implied a warning about what is likely to happen here:

Predictably, the higher they are, the harder they will fall as their valuations greatly exceed their value. Don't stand under those that are too big to fall because hight-tech is especially coming down.

The Fed is going to fold

There is a counterpoint in all of this. We've seen it before. The Fed is going to fold in terms of its determination to end QE and its resolve to raise interest sometime before the everything bubble completely collapses. The outfall from its tapering and its relinquishing control over treasuries will be worse than it imagines and come faster than it imagines, and will require more courage than the Fed has ever exhibited if they were to maintain their path of tightening ... so they won't.

Just as the Fed did in 2018 when it tried to actually tighten, the Fed will fold before 2022 is over because it is tapering in a much, much weaker economic environment at a time when everything financial is more depended on the Fed than ever and when COVID can be blamed for why the Fed must rush back into the game.

While the Fed just raised its indicated rate hikes from one in 2022 to three, confirming my prediction that inflation would force the Fed to accelerate their tightening, I doubt the Fed will ever make it to the third hike! In fact, I doubt they will make it to any targeted interest-rate increases at all! The real question is how much self-perpetuating damage will have already been put into play just from the taper before the Fed acknowledges to itself that it cannot even taper without crashing everything. It won't acknowledge that publicly because Omicron or some other variant will provide the cover it needs.

Will the Fed even make it to the end of its taper before it rushes back in with new support? I don't know! What the Fed plans to do and what it CAN do are two different things, and then there is the question of how long it takes to break through the Fed's denial about what it cannot do. However, when the Fed does what its history says it is most likely to do and rushes back in with more support, nothing will work like the Fed thinks it is supposed to because everyone will know the Fed is throwing gasoline on an inflation inferno.

That, more than anything, is why this time is as different as it can possibly be.

The global economy, including US economy, will sink into recession.

We're doing untold damage with vaccine mandates all over the globe. In the early summer of 2020, I stated a number of times we would only know the real damage from the first economic lockdown when we saw how much did not restart. The initial restart would appear to be the hottest economy we have ever seen based on surface-level numbers (and so it was); but it would take months, I said, to fully realize how much we damaged for good.

We are still only figuring that out now as we parse beyond the headline unemployment numbers, as I've done in one of the linked references above, to understand how there can be a labor shortage when official unemployment in the US is so low. It's not that hard to figure out, but many there be who just can't seem to see the obvious. I'll refer you to that article if you haven't seen how it figures. Suffice it to say for this article, our nation still does not grasp how much damage it did with the first lockdown and then the subsequent smaller lockdowns.

As we make it worse with vaccine mandates and further lockdowns all over the world due to incredibly opaque ignorance about the damage we've already created, we'll sink all economies into the mud. That will pressure stagflation all the more -- where inflation keeps rising even as business dies because fewer companies and people are producing goods and services already in short supply, creating more scarcity.

So, a global stagflation recession is certain for 2022, and it is likely to become worse before it is over than the recession of the late seventies. I've already said the US be sinking into that recession in the final quarter of 2021, though we won't know until later in 2022 just because of the time it takes for recessions to be officially calculated and declared.

This will add to the stream of credit defaults down the road.

I hope you will consider remaining a patron for the year ahead because your patronage does not merely support these occasional thank-you posts, but all the writing that I do on economics. If there were not some reasonable measure of support, I wouldn't bother because one ought to be able to measure what economic articles are worth to people by what they're willing to give to help them continue. So, thank you, and may your new year be blessed! Survive, flourish and prosper!