Goldman Sachs Failed Major Test

Other banks are falling in behind.

Today brought some interesting news in the banking sector. To start off with, Goldman Sachs failed its stress test last week. In addition to GS, the Fed’s Dodd-Frank stress test revealed problems in other banks as well. The Fed noted that its staff do try to work with the banks to make adjustments to the test. So, I would add, if a bank can’t even pass the adjusted test, it must be in poor shape, should times become stressful.

Says one risk analyst who wrote about the failure in the links below:

Given the clear conflict by the Fed staff in Washington, the stress test results for GS are rather alarming. This is the test result for Goldman that the Fed assigned after the private consultations and hand-holding with Board staff?

Well, maybe Goldman can be our next ivy-league Bear-Stearns or Lehman surprise. Wouldn’t that be fun?

You can read all the detail in the highlighted article below, but here’s a summary of the author’s concerns:

Just by coincidence, Stephen Gandel and Joshua Franklin of the FT wrote an important piece last week reporting on the results for Goldman Sachs. They suggest that the bank is attempting to change the Fed stress test results. "Goldman Sachs faces long odds in getting the Federal Reserve to reconsider its disappointing grade in this year’s bank stress tests, according to regulatory experts," they relate.

We reminded readers in our last missive … that GS continues to have the worst credit performance of the group. We regret to say that the Fed test results confirm our view and more. If you page through the individual bank stress test results, you will see that GS is clearly the outlier in the group in terms of assumed credit and counterparty risk losses through to Q1 2026.

The article provides much more granular detail. Don’t worry about poor Goldman, though, they have plenty of well-appointed friends in congress to ream Powell out this week at his congressional meeting and press him to back off so that Goldman can pass with a D-. Today’s world of politicians always pray that God forbid the truth be known about the incompetency of presidents … or major banks. It’s better, they think, that we all live believing everything is fine.

The next article up says,

Regional bank failures have started again.

And … there goes “everything fine.” First Foundation is crumbling due to its poor footing in commercial real estate. In fact, its shares plunged a whopping 24% last Wednesday because it reported an unexpected need to raise almost a quarter of a billion in capital. Smaller regional banks heavily exposed to CRE are, of course, the ones I’ve been saying are most likely to fail, just as we saw a year ago last spring.

It’s the same ol’ news I’ve been sharing all along:

The announcement illustrated the struggles of banks with large exposure to commercial real estate as the Federal Reserve’s aggressive interest rate hikes and lower occupancies due to a shift in office work patterns trigger default fears.

Taking stock

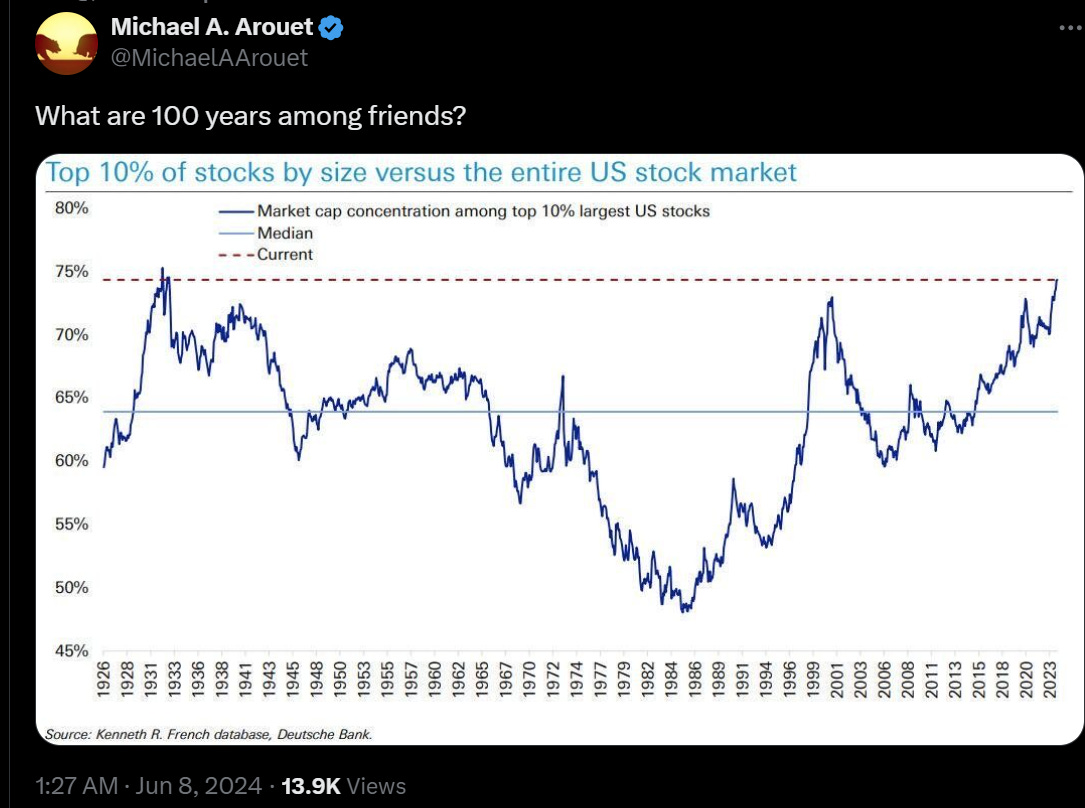

There is also an interesting interview in Quoth the Raven today about how imminently and hard the stock market is about to crash, according to an investor who is taking his fund deep in shorting. He gives his reason why he thinks his loooong short is still the right move to make money, even though he’s been feeding it for some time. He notes, among many points, that the market has only twice before looked this extremely out of balance:

The market is on a reach, and he doesn’t think it can reach much further before the wind runs out of its sales. It’s already priced at approximately 25x run-rate operating earnings while the US consumer is just now cracking in this consumer-driven economy. As the consumer slips into the doldrums, already overstretched stocks should start to drift without any tail wind.

He states many other factors in the market that look like imminent trouble that can’t likely run much further in terms of their extreme measures—not historically, anyway.

Today, being Monday, the headlines are free for all:

Given the lack of any paid subscriber growth for almost two months (in fact, a slight shrinkage), which I recently mentioned, I need to streamline what I’m doing a little because it’s a lot of time for where things have settled financially; but I think the changes, based on a couple of readers’ recommendations, will not be felt that much. Before I make them, I want to get your input by collecting as many opinions as are willing to anonymously share in the poll or are willing to speak out in the comment section, which is open to paying and non-paying subscribers today.

What I am thinking about is doing my Deeper Dive on Friday in lieu of the usual Friday headlines and editorial. Everything else would stay the same, but that would mean I don’t have to work every single weekend. So, there would continue to be four days a week of free editorials, and Mondays would also include free headlines for everyone, while headlines would continue to only be available for paying subscribers on Tuesday-Thursday. I may include any earth-shattering headlines in the Friday Deeper Dive. (It may also be that I’m giving away too much for free in order to have the broadest reach.)

Please let me know what you think in the comments below, including any ideas for change that you think might be improvements or might work better for getting more paying subscribers:

GoldSeek Radio Nugget - David Haggith: Gold Poised for Growth

Economania (national & global economic collapse plus market news)

Goldman Sachs Fails Fed Stress Test Plus other Banks of Concern

Regional bank failures have started again: Will CRE defaults push the economy over the edge?

Crash Or Bear Market, Either Way Stocks Are Going "Down, A Lot!”

‘Nuclear’ Jury Verdicts Rise against Corporations Alongside American Anger

Crushing Debts Await Europe’s New Leaders

BOEING to plead guilty to criminal fraud charge stemming from MAX crashes

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Money Matters (monetary policy, metals, cryptos, currency wars & CBDCs)

Rubino: Where You Store It: Choosing a Country for Offshore Gold

Next Leg Higher in Gold is Major Inflection Point

It’s All MMT: The Fraud of “Monetary Policy”

Inflation Factors (due to too much money chasing too few goods)

Air travel demand is breaking records. Airline profits are not

Oil slips as Gaza talks ease supply worries, Hurricane Beryl in focus

Record US summer heat, huwrricanes could roil fuel prices as oil refiners sweat

Wars & Rumors of War, Revolts, Hacks & Cyberattacks (+ AI threats)

‘A kind of civil war’: Divided France on alert for unrest amid political earthquake

—

Russian missiles hit children's hospital in Kyiv

Putin Warns Of Nuclear War If NATO Troops Are Deployed In Ukraine

—

Hamas Drops Key Demand, Making Gaza Ceasefire Deal Closer Than Ever

Senior Israeli Lawmaker Suggests Nuclear Attack on Iran

—

The intense battle to stop AI bots from taking over internet

Tech prophet who predicted the iPhone years in advance makes alarming forecasts for coming years

Job scams surged 118% in 2023, aided by AI. Here’s how to stop them

Political Pandemonium & Social Senescence (socio-political issues & events)

Our first significant truth bomb just exploded

The Lies Continue, As a Matter of Principle

‘We’re doomed’: Democratic lawmakers worry Biden’s interview won’t save his campaign

U.S. Mainstream Media Await New Orders Now Their Big Lie About Biden is Rumbled

Media concealed Biden’s cognitive decline because they hate Trump

HuffPost Encourages Biden Campaign to Push Disinfo Using Fake AI

Biden and congressional Democrats are headed toward an all-out war

Dr. Pippa: The Geopolitical Avalanche

‘Blitz primary’ could open up Democratic race if Biden drops out

Biden campaign provided a list of approved questions for 2 radio interviews

Former Trump Staffer Reveals New Texts Alleging More Secret Payoffs and Settlements

"Traitors" - Musk Blasts Democrats Voting Against Republicans' Election Integrity Bill

Election Shock: French Prime Minister Attal plans to resign as projections show leftists lead

France Election Live: Left celebrates surprise lead as far right stunned by projected loss

France avoided a far-right election win — now the radical far left is demanding power

Putin's multipolar world takes shape with Orban in Beijing, Modi in Moscow

Russia-based websites masquerading as local American newspapers

Globalism & Deep Domination (undemocratic government & censorship)

Watch: Klaus Schwab Says Humanity Must Be "Forced Into Collaboration" With Globalist Elites

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

400 Doctors, Scientists & Academics Call for Suspension and Investigation on mRNA Genetic Serums

Calamity, Catastrophe & Climate Craziness

Global Warming Is Causing Summer Again

This Italian vacation hotspot is turning tourists away as it runs out of water

Off-the-Beat News & Just Plain Offbeat News

10 Scientific Mysteries We Don’t Fully Understand

Karl Rove is rumored have said "we are an empire now, and when we act we create our own reality."

Whether or not he said it, that's the weakness of your newsletter. This is not simply AN empire; it's the most powerful empire ever, by several long miles, simply by virtue of its technological and energy era. So long as they will it, reality is in a semi-permanent state of suspension.

Not a good sign, David. I'm sure you saw Pam Martens' and Russ Martens ' article - "Goldman Sachs’ Bank Derivatives Have Grown from $40 Trillion to $54 Trillion in Five Years; So How Did Its Credit Exposure Improve by 200 Percent?"

I linked it on 6/25/24 @https://nothingnewunderthesun2016.com/

If not, here's the link: https://wallstreetonparade.com/2024/06/goldman-sachs-bank-derivatives-have-grown-from-40-trillion-to-54-trillion-in-five-years-so-how-did-its-credit-exposure-improve-by-200-percent/

Linking yours tomorrow as usual.!!