Evidence of Inflation's Inferno is Everywhere, but President Can't Feel the Heat

As I promised in my last article, I'll now lay out where inflation has gone since my June update. Because so much inflation has emerged in the last few weeks, I can hardly keep up with the number of ways in which it is soaring and the reasons it will be more persistent than the Fed claims, even after Chairman Powell was pressed to up his own prediction last month from “transitory†to “possibly persistent.â€

It amuses me to hear anecdotes like President Joe Biden's claim that putting on a summer barbecue now costs sixteen cents less than it did last year. I know for a fact that my last barbecue doubled in price; so, for the first time in my life, I backed down from providing my usual T-bones for all (my favorite barbecue steak) to sirloin. Fresh-caught wild salmon at $28 a pound locally (ten bucks above last year's price) also fell off the menu as it made the smile fall off my face. Even though my wife says I'm the best salmon barbecuer she knows, sorry, not with today's inflation running hotter than my wood-fired grill. (And, with the price of gas on the rise, it may be a good thing I prefer wood fired so I can scavenge what I need.)

Biden's out-of-touch claim reminds me of President George Herbert Walker Bush's pretense that he was out buying socks at Christmastime like ordinary folk do (on camera, of course, like ordinary folk, to talk up the economy) when he exclaimed, "Well, would you look at that! Isn't that amazing!" He was gesturing to the store scanner, having never seen one in action, thereby proving how truly out of touch he was with the slavering masses who had been familiar with store scanners for years. So, Sure! ol' in-touch George was just out buying socks for Christmas like all of us do!

I have no doubt Barbecue Biden paid less this year, as he claimed, given that the White House is now paying for it. For the rest of us, though, inflation is real. I know I'm paying about 30% more for fuel than last year, and I'm told the old gas-guzzling SUV I drive will sell for 30% more, too; so, I'm offloading it while inflation is on my side in order to save on gas. Some of us live in the real world and not by theory, nor by the testimony of the splendidly ignorant. So, let's look now to some real examples of persistent inflation.

Belaboring the labor issue

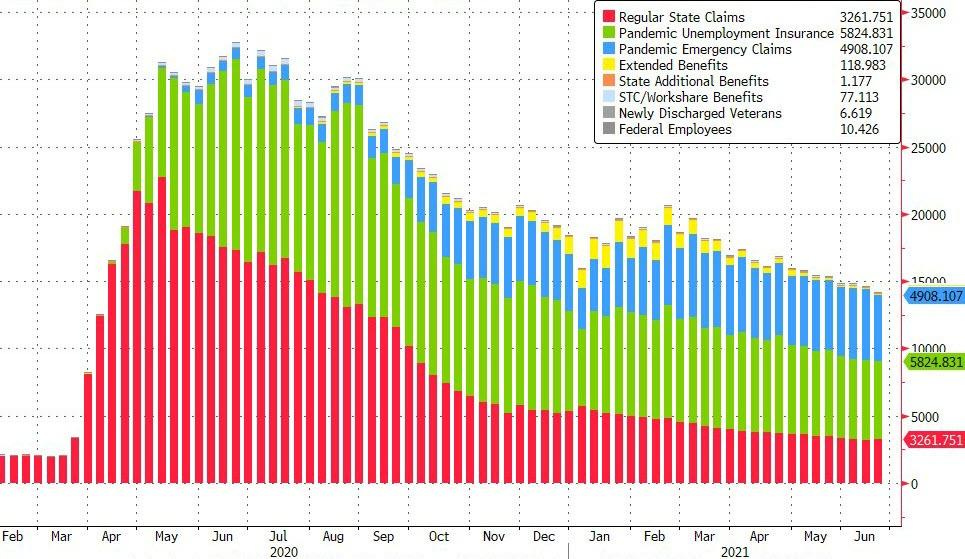

First, I stated in my last article that unemployment is every bit as serious now as it was during the Great Inflation of the seventies, if not more so. The Wall Street Journal provides the following update:

More than nine million Americans said in May that they wanted jobs and couldn’t find them. Companies said they had more than nine million jobs open that weren’t filled, a record high.... Wages are rising briskly even when the unemployment rate, at 5.9% in June, is well above the pre-pandemic rate of 3.5%.... Sand in the wheels of the labor market could cause inflation pressures that spur Federal Reserve policy makers to pull back on low interest rate policies....

This is a persistent problem, not something that will go away as soon as the government removes its life-support:

Several factors are behind the development: Many workers moved during the pandemic and aren’t where jobs are available; many have changed their preferences, for instance pursuing remote work, having discovered the benefits of life with no commute; the economy itself shifted, leading to jobs in industries such as warehousing that aren’t in places where workers live or suit the skills they have; extended unemployment benefits and relief checks, meantime, are giving workers time to be choosy in their search for the next job.

This is not going to all go away in September when extended and enhanced unemployment benefits end, though that is likely to help a little. The situation as it stands today, looks like this when you include everyone in the count who was employed before the pandemic and who is not employed now but who is still considered likely to be part of the labor force:

The rubber meets the road

While not as important as oil to the economy, natural rubber plays a broader role than you might think. Right now, for numerous persistent reasons, including COVID shutdowns, rubber has gone so flat some are calling it a "rubber apocalypse." Prices, however, are not flat, even though the industry is. Again, the video provides a little historic perspective on the importance of rubber to the very security of our nation.

Where are there not product shortages?

Heck, you can't even get patio furniture. How can you have a cheap barbecue without any patio furniture??? What is true in this one example is true for thousands of products across the nation:

The garden supply store in suburban Baltimore has been waiting six months for a shipping container from Vietnam full of $100,000 worth of wicker and aluminum furniture. Half of the container has already been sold by showing customers photographs. The container should have arrived in February, but it reached U.S. waters on June 3 and has just docked in Long Beach, California. “Everyone is just so far behind,†said John Hessler, 62, the patio section manager. “I’ve never seen anything like it.†[There are] persistent delays for anyone trying to buy furniture, autos and a wide mix of other goods.

While the rosy-eyed economist in this article tries to lay the blame of shortages on a good thing -- rising demand (in other words, things are so great we cannot keep up) -- the core problem is clearly a persistent supply shortage. The evidence is given in the article, but economists cannot see what they don't want to admit even when it is staring them in the face. Let's hope the demand remains, but the supply shortage is the real problem:

“This is a very good problem for the economy to have,†said Gus Faucher, chief economist for PNC Financial Services. “You’re much better off having too much demand than too little, because too little demand is the recipe for an extended recession.â€

Too little supply is also the recipe for extended recessions as we saw from the oil supply shortages of the seventies.

The real challenge goes far beyond the blunt talking points of politicians to an economy being steered by a mix of market forces, tensions with China, setbacks from natural disasters and the unique nature of restarting an economy after a pandemic.

Those are supply problems. It should have always been clear to everyone that this restart from a global economic lockdown was never going to a V-shaped recovery! That belief was delusional. The stock market, which rose based on that narrative, was and is delusional, so it will have to crash down to reality, and inflation will chew its butt to make sure it has plenty of opportunity to do that. Give it time, because inflation gnaws away at human sentiment over time, but inflation will prevail, forcing the Fed to deal with it to the demise of markets.

As America hurtles out of the July 4th weekend into the heart of summer, the outdoor furniture industry provides a snapshot of the dilemmas confronting the economy. A series of shortages has left warehouses depleted and prices rising at more than 11% annually as Americans resume BBQs and parties after more than a year of isolation. The industry cannot find workers, truckers and raw materials — a consequence of not just government spending but crowded ports, an explosion at an Ohio chemical plant and the devastating snowstorm that hit Texas in February.

Of course, the White House provides all outdoor furniture for the president, so he didn't have to worry about that at his barbecue. As for me, however, I'm just now moving; so, my wife and I need to buy new patio furniture, having given the old stuff to charity. So, I'll be feeling the pain.

Those problems for which furniture is just "a snapshot" are not going to vanish when the government ends extended unemployment benefits. They are part of the wreckage created by a global economic lockdown! I warned last summer we would see a quick restart, but would only come to know the extent of the damage months later when we see what did not restart:

You only know how much of the economy is going to stop short of bouncing back when the initial bounce slows down, and you see what didn’t return — what businesses remain closed.

There will be a great deal more [failed recovery news] to come as we see what doesn’t recover and what gets hit with knock on effects.

"Papa Powell Sees “Tremendous Human and Economic Hardship†(No V-Shaped Recovery)"

Even the Fed, which tries to be as optimistic in every statement it makes as it can be, says it will take years to recover the lost jobs, even IF a vaccine is approved by January. The damage is in; and, if you cannot see that, you are intentionally blind to the obvious.

And, since the Fed knew it would take years for jobs to recover, you'd think J. Powell & Co. would be able to figure out that "supply chain problems" are not going away anytime soon because people who are not working are also not producing! To me, that's a no-brainer, but obviously economic experts don't get it.

The stockpiling has already begun

One of the things that causes a vicious vortex in inflation is when it becomes self-fulfilling as consumers and businesses anticipate higher prices so they stock up now, causing immediate shortages which, then, cause those higher prices people feared, which causes more people and businesses to do the same resulting in another cycle.

I've repeatedly stated that what makes the present time different from the past ten years when the Fed created lots of money but little consumer price inflation is that there were no shortages. Today's widespread shortages increase the likelihood of stockpiling because businesses and consumers not only stockpile to avoid paying a higher price down the road but simply to get their hands on limited goods whenever they can.

Supermarkets Are Stockpiling Inventory as Food Costs Rise

Supermarkets are stocking up on everything from sugar to frozen meat before they get more pricey, girding for what some executives anticipate will be some of the highest price increases in recent memory. Some supermarkets said they are buying and storing supplies to keep their shelves full amid stronger demand. Grocery sales in the U.S. for the week ended June 19 rose about 15% from two years earlier....

There you see both dynamics in action. Part of that stronger demand is likely due to customers, now that businesses are open, wanting to make sure they don't get caught shorthanded if things close back down. Others are laying away goods before prices go up. The article states that grocers are stocking up now for the same two reasons.

As I warned in my Patron Posts, this is creating its own feedback loop, which is spinning up into an inflation vortex:

Stockpiling by food retailers is driving shortages of some staples, grocery industry executives said, and is challenging a U.S. food supply chain already squeezed by transportation costs, labor pressure and ingredient constraints.... Now, retailers themselves are stockpiling to keep costs down and protect margins.

That is certainly the kind of activity that persistent inflation causes and that causes persistent inflation. It's a death spiral.

The inflation vortex is real

Says one writer,

Persistent Inflation Threatens the Recovery

“Our company has had to deal with import delays due to backlogged West Coast ports, higher domestic freight costs, and a labor shortage at distribution centers that has prompted wage increases. Earlier this year, we thought, or maybe we hoped, that some of the industrywide supply-chain issues would have started to settle down by now. But that clearly hasn’t happened. In fact, the whole global supply situation seems to have gotten maybe even a little bit worse.†-- John Crimmins, chief financial officer of Burlington Stores Inc., 5/27/21

Crimmins’s observation summarizes how business costs are driving persistent inflation due to multiple factors....

Supply bottlenecks and commodity shortages are causing long-term inflation. Sales are increasing dramatically in pandemic impacted sectors like hotels and restaurants as consumers resume traveling and eating out.

And consumers have the money to do it ... thanks to the Fed and the Feds.

As the economic growth and inflation risks have shifted from too little to too much, any reasonable person would conclude that the current scale of monetary accommodation is too much. Sound policymaking is as much about managing risks as it is hitting arbitrary targets. Staying the course increases the odds of a bad outcome.

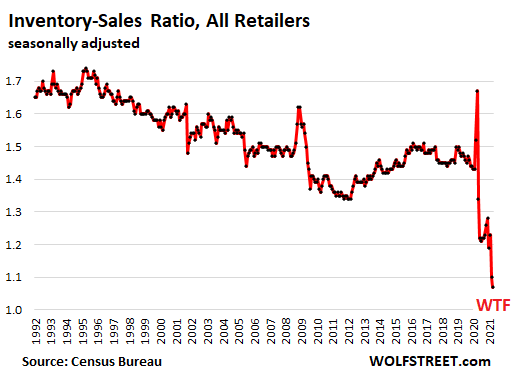

As a result of all the stockpiling, retail inventory is running bare, meaning prices are likely to rise in another round as retailers become more desperate to fill their shelves:

The WTF Plunge in Retail Inventories

How messed up the economy has become, fueled by government moolah and Fed manna, when nothing and no one was ready for it.

When the government spends trillions of borrowed dollars to boost demand from all sides, and when the Fed prints trillions of dollars to monetize the borrowing binge by the government and also to inflate asset prices so that asset holders feel richer and start spending these gains (the Fed’s doctrine of the Wealth Effect), well, then you’re going to get some demand, a lot of demand, suddenly, particularly for goods. And this sudden demand has been ricocheting through the economy for over a year.

And supply? Duh. Maybe they thought supply would suddenly materialize. But supply chains are long and complex, and then there were all kinds of additional issues, ranging from container shortages, spiking ocean-freight container rates, the blockage of the Suez Canal, a capacity shortage among container carriers and freight companies, a ferocious winter storm that hit the Texas petrochemical industry and semiconductor plants....

And so it goes. Trouble doesn't wait for a pile-up to get out of the way before it piles on.

“Turns out it’s a heck of a lot easier to create demand than it is to bring supply up to snuff,†Jerome Powell mused at the press conference.

Guess he's still learning. Let's hope the bemused Powell figures out how these things work before he destroys the world by turning high inflation into hyperinflation.

This mess has shown up in inventories, which also indicates that this will take a while to get straightened out.

And here is what that future-pointing situation looks like:

And that's not all from cars like my old SUV:

Thus, in a more recent article, Wolf Richter concludes,

This “Temporary†Inflation Is Turning into an Inflation Spiral

Get Used to Higher Inflation. My Thoughts on the Biggest Mess I’ve Seen in Decades.

(I recommend listening to his video, which accompanies that referenced quote.)

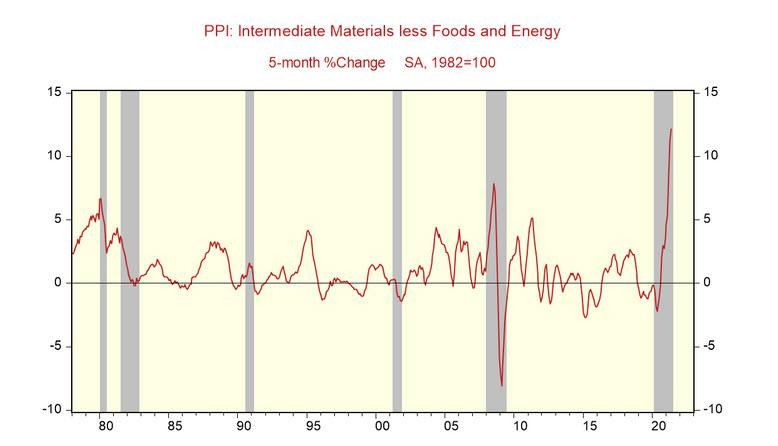

It's already in the pipeline

So here we are:

However, if you think consumer price inflation looks bad now, take a look at what is pushing its way down the pipe as producer inflation runs far ahead of consumer inflation:

It'll get here.

Inflation on the menu

Some business are well beyond their ability to absorb more losses already, so they must now pass along all higher costs, reluctant as they are to do so because they have been hurting for customers already. Nowhere is that more evident than the badly wounded restaurant trade, hit most directly by COVID lockdowns.

Restaurants Have No Choice But To Raise Menu Prices Amid Inflationary Pressures....

Many Americans are ditching their on-demand food delivery apps this summer and are supporting local restaurants with an in-dining experience but have been sticker shocked by the rise of menu prices....

Restaurants, big and small, are passing along the increasing costs of basic commodities and labor. For instance, the cost of vegetable oils, cereals, dairy, meat, and sugar has been erupting since the beginning of the pandemic. Compound this with labor costs, along with the cost of everything soaring, and restaurants already suffering from a lost year in 2020, are raising menu prices at a much faster pace than historical rates, according to Bloomberg....

Bloomberg spoke with Tampa, Florida, restaurateur Andrew Koumi, who increased menu items by 2% to 4%. He operates a six-location chain called Green Market Cafe and attempts to keep food and paper costs below 35% of his menu prices. His computer keeps warning him that certain items, like chicken, have doubled in the last six months.

Koumi isn't worried about passing along costs to consumers because "everyone" in the industry is "doing it." He said some restaurants are "drastically" raising menu prices."

I guess COVID Joe hasn't been eating out much since emerging from his basement bunker.

“[Prices] haven’t gone up. They’ve almost doubled,†said Nick Rando, who owns Ziti Trattoria in Natick. He compared what he paid back in January to today’s prices. “Red meat for steak tips and steak was $7.35 a pound. Last week, it was $13.20 a pound...."

“We have seen prices that we’ve never seen before,†said Jim Tselikis, who runs Cousins Maine Lobster, a national chain of lobster roll trucks, along with his sister.

I'd say that confirms my barbecue experience, and I'll trust the ground-level, get-your-hands-dirty expertise of numerous restauranteurs working in the real world when it comes to meat costs over White-House Joe.

And yet demand keeps growing:

“We’re just seeing this continuing ramp-up of demand on the lobster system,†said Annie Tselikis.

With so many restaurants having closed for good, as I was pointing out last summer, competition is down, making it easier to raise prices; and, with the rest of restaurants badly damaged from COVID lockdowns, they don't have the resiliency to avoid passing along costs. Consumers, who are mostly doing all right thanks to government stimulus checks, are sympathetic and willing to pay those costs because they don't want to lose more restaurants. They're also tired of sitting at home all year. They want to get out, so they will fork over the dough, knowing restaurants don't have any choice about raising prices if they want to stay in business. It's do or die.

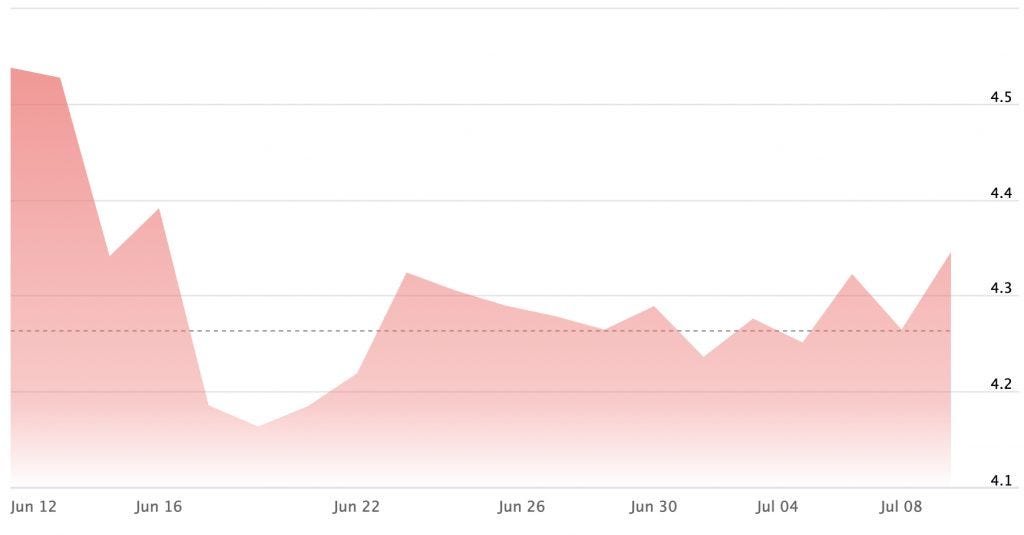

Morning Jo is rising

If you don't believe inflation is scorching hot right now, it's time to wake up and smell the boiling coffee. If you don't drink your first cup of coffee in a restaurant with the fancy people, you've probably noticed the cost of a cup o' jamoke at home (if home is not the White House) has a bitter taste. The problems aren't all COVID. You can blame some of this one on a kind of warming that isn't underneath the coffee pot:

Coffee Prices Soar After Bad Harvests and Insatiable Demand

Global coffee prices are climbing and threatening to drive up costs at the breakfast table as the world’s biggest coffee producer, Brazil, faces one of its worst droughts in almost a century.... New York-traded arabica futures have risen over 18% in the past three months.... London-traded robusta—a stronger-tasting variety favored in instant coffee—has risen over 30% in the past three months....

“I’ve been growing coffee more than 50 years, and I’ve never seen as bad a drought as the one last year and this year,†said Christina Valle, a third-generation coffee grower

That's a stiff cup of coffee!

Dr. Copper's prognosis worsening

As for those who tried to take down my inflation prediction by claiming, based on pretty theories they learned in school long ago versus all evidence of the obvious, that there can be no inflation because copper prices and other commodities were falling ... I guess they just needed a longer timeframe:

The copper bottom is in because what falls down, sometimes bounces back up.

Dollar down

And, if you misguided yourself into believing the dollar isn't losing value as inflation says it must, and you believe that based on the dollar index, note that the dollar index only measures the US dollar's value against other currencies, which are also now falling. Therefore, you have to look, instead, at what is happening to the dollar's purchasing power according to the government and the Fed:

With the dollar index, it's all relative, and the dollar happens to the best horse in the glue factory at a time when many nations have been on money-printing sprees with low interest at a time when nearly all national economies have their own internal inflation. The last days of the dollar on that last graph, look pretty lousy in terms of what a dollar now buys you. The BLS, in fact, says the last three months have been the worst three-month plunge in purchasing power of the dollar since 1982. And years when the dollar recovers any of its lost value are clearly the anomalies. I see only one.

Maybe ol' Jumpin' Joe is getting more tired than the dollar to where he just cannot see the facts straight. I thought I'd let the data speak.

And we're only three months into the beginning of consumer inflation. The party's just getting started!