The Economy is Already a Five-Alarm Fire

So many alarms in the news today, I can't even cover them all.

Alarms are ringing everywhere for the economy. Not all of them are due to Donald Trump, though many are. For example, one big alarm that is ringing is a towering stack of evidence that emerged today, showing the economy was already entering a stealth recession before Trump even took office. Back in January, auto loans hit a peak delinquency rate that is worse than they were just before the 2020 mini recession its stock-market crash and worse than they were at any point during the Great Recession and its stock market crash. Far worse than they ever reached during the dot-com bust and its recession and worse than they were when stocks crashed around the world in 1997 due to the global Asian financial crisis.

Auto loans NEVER look this bad unless the economy is in deep trouble:

It’s a strong sign that the US economy was already sliding well into recession at the start of the year. At least, part of this brewing economic trouble is due to the inflation that I’ve said all along will take us down:

Owners are also getting hit by higher incidental costs of ownership.

Car insurance rates are up 19 percent year over year, while repair and maintenance costs have risen 33 percent since 2020.

Jessica Caldwell, an expert at the auto data firm Edmunds, says buyers show mounting signs of stress in a turbulent economy.

'People that are in the middle of their loan, they may be hitting the point where the cost of living has gotten to them, and they can no longer make these payments,' she says.

More economic turbulence is clearly going to make the auto-loan situation, already by far the worst on record, worse still.

Are we looking at another sub-prime loan crisis about to blow?

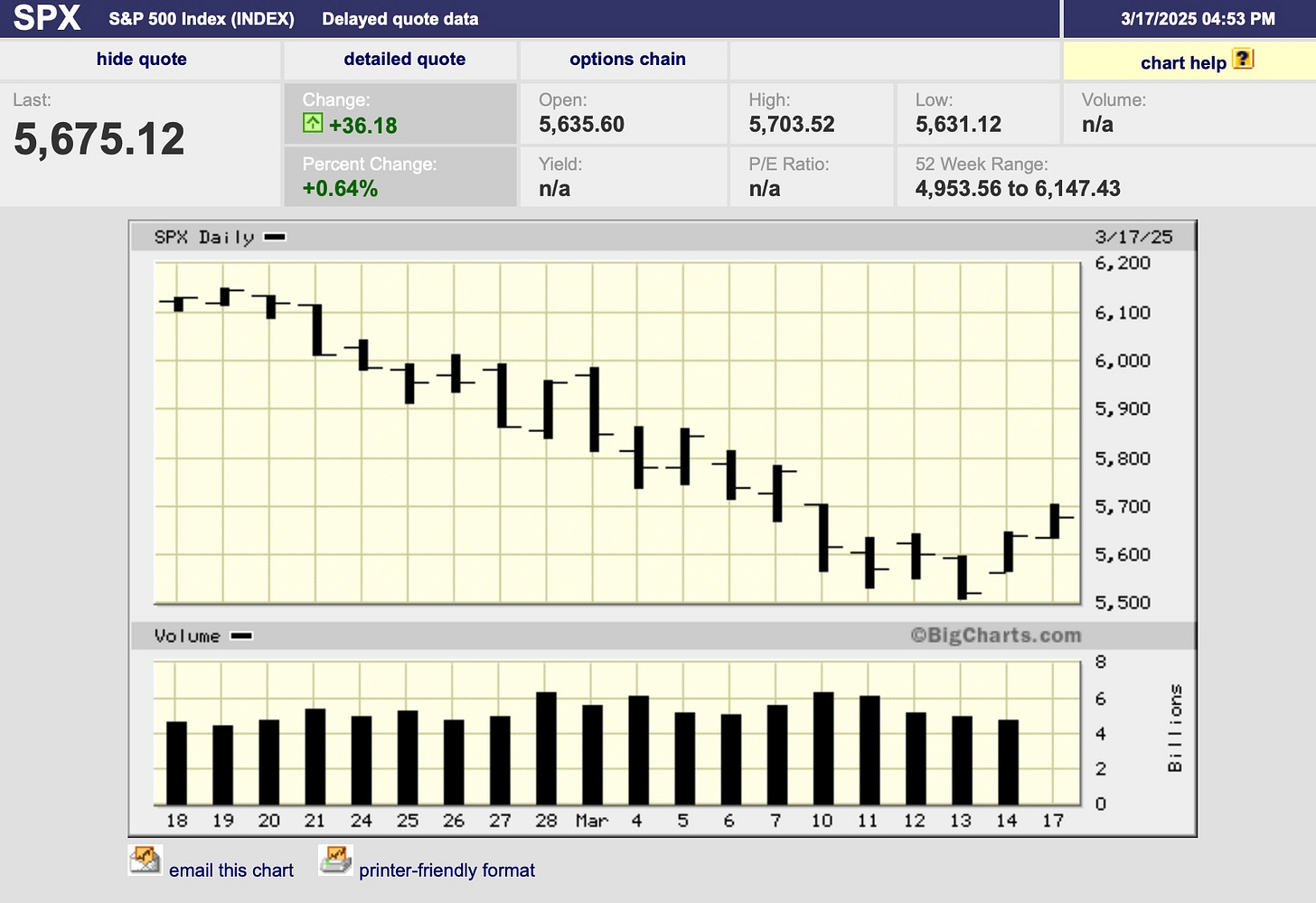

Into the economic turmoil behind the rising collapse in auto loans, we already have a stock-market collapse well underway. Sure, the market did well on Friday and today, too, but Deutsche Bank predicts we have, at least, another 6% drop to go, and Treasury Secretary Scott Bessent said we might be heading into a recession, though he doesn’t anticipate another financial crisis. Oddly, Trump’s National Economic Council director Kevin Hassett said about the same thing.

It’s unusual to ever hear a US Treasurer or an NEC director say a recession may be forming. That’s usually the last thing any government admits. Is it because we just have, for once, an open and honest government, or is it because the stealth recession is now gaping so wide so quickly that they know they’re going to have to face it, and they’ll look foolish if they say it wasn’t likely coming, then tomorrow it is obvious to everyone.

I’m going with the latter, since it was obvious to me back in January when I put a recession and stock-market crash in my “TEN 2025 ECONOMIC PREDICTIONS”—at the top of the list, no less, because I figured those two things would be first to emerge. They are admitting what they know will soon be obvious to everyone.

So, it is no surprise here that businesses are sounding their own alarms in the news today. In fact the reasons I gave for a rapid descent into the recession that was already forming (invisibly to most people but not those who read here) were the same reasons given in the article today about alarms business are ringing:

The uncertainty brought by Trump's threats of tariffs and his shape-shifting trade policies is starting to have a chilling effect across many industries, businesses warn, as consumers pull back on everything from basic goods to travel.

The president's back-and-forth tariff moves against major trading partners have kept markets on edge, and prompted companies to warn they may have to raise prices, which could boost inflation and dent economic growth.

No surprise here at all, as this scenario was laid out at the top of the year for paying subscribers.

Already we’ve seen a massive wipeout of $5-trillion in market value from the S&P 500.

One of the dispensable things Americans dial back on when they go into conservation mode over a dawning recession is travel:

Speaking after the market close on Monday, Delta Air Lines (DAL.N), opens new tab CEO Ed Bastian warned that economic worries among consumers and businesses were hurting domestic travel, without referencing tariffs directly. He noted several sectors were showing softness, including autos, technology, media, and aerospace and defense.

Several other airlines warned of softness in U.S. spending on Tuesday, sending shares of those companies, along with cruise operators and entertainment giant Walt Disney Co (DIS.N), opens new tab, lower. Shares of Apple (AAPL.O), opens new tab, the world's most valuable company, touched a five-month low.

"Economic uncertainty is a big deal," American Airlines CEO Robert Isom said at a JPMorgan industry conference.

I think Bessent is speaking with no clear understanding of the future when he says there is no financial crisis coming. He’s saying what any treasurer would say, and he is only copping to recession because it is already gaping so large and so obvious that even the Fed is showing one in its GDPNow gauge, which is bouncing along deep in the pit of recession:

As a financial guy who probably respects the Fed too much on most days, it’s hard for Bessent to dissent with the Fed regarding the obvious elephant in the room already being pointed out by his buddies at Club Fed. In fact, Bessent spent time assuring us that what Trump & Co. are doing is heading off a deep financial crisis.

Me thinks he doth protest to much. He clearly sees one coming, or he wouldn’t be talking about trying so hard to ward it off. While such a crisis was certainly going to come (he’s right on that much), he knows darn well that it is very likely to blow up on his watch, so he’ preparing the ground for what he is certain is coming by starting to tell everyone it was already forming.

Yes, it was, but it is certainly coming more quickly with all that the Trump administration is doing, though Bissent may hope otherwise. Even though major reconstruction was needed on our debt-infested economic pillars, the ham-fisted and spasmodic way it is all happening along with the needless new battles Trump is waging over the turf of other nations, is going to make it all way worse.

Treasury Secretary Bessent says White House is heading off a ‘guaranteed’ financial crisis

Guaranteed, yes. So can’t help but see it coming. Warding it off, no. They are making it deeper and more sudden by opening up battles that don’t even need to happen over tariff situations they already claimed they had won a major victory on during Trump’s first term.

Treasury Secretary Scott Bessent said Sunday that the Trump administration is focused on preventing a financial crisis that could be the result of massive government spending over the past few years….

“What I could guarantee is we would have had a financial crisis. I’ve studied it, I’ve taught it, and if we had kept up at these spending levels that -- everything was unsustainable,” Bessent said on NBC’s “Meet the Press.” “We are resetting, and we are putting things on a sustainable path.”

No doubt. I’ve been teaching the same thing here for the past years, too. But throwing gasoline on the fire along with a few open oxygen bottles isn’t going to make things better. We don’t need tariff wars with most of the major economies on earth as an answer to our debt problems. That only guarantees our income to service that debt will be lower and prices will by higher.

“I’m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great,” Bessent added. “I say that one week does not the market make.”

Notice he didn’t mention tariffs as an answer. They’re a handicap. Don’t worry. You’re going to have plenty more weeks to follow, Bessent, and I think the present market plunge has already been a little longer than your intentionally diminishing words indicate. (Therefore, not the words of a government that is simply being more honest. Rather, he is prevaricating.)

Here’s the past month in stocks:

Given Bessent’s apparent inability to discern between a week of bad market news and a month, his words claiming no coming financial crisis remind me of the haunting words of Ben Bernanke, who said he saw no signs of a coming recession when we were right in the middle of one that simply hadn’t been declared yet.

So, there you have two of the big alarms—a crashing stock market, and the worst stack of automobile loan defaults in history. I anticipate laying out the rest of big alarms found in today’s headlines and that I anticipate later in the week in my weekend Deeper Dive—that is, unless even worse things than the other big alarms in the news blow up later in the week that are begging for deeper coverage, which, at this point, I would say is reasonably likely.

(Today’s headlines are free for all. Deeper Dives are just for subscribers who value what is written here enough to support it and keep it coming.)

Economania (national & global economic collapse plus market news)

Disturbing new sign that US economy is teetering on brink of recession

Businesses sound alarm as Trump tariff chaos hits the economy

Treasury Secretary Bessent says White House is heading off a ‘guaranteed’ financial crisis

U.S. stock market lost $5 trillion in value in three weeks

Deutsche Bank says the market sell-off has another 6% to go as consumer, corporate confidence dives (Headline only)

How the US economy lost its aura of invincibility

Shoppers cut spending as economic outlook concerns mount

A Market Indicator From Early 1900s Is Blaring an Alarm for Stocks

US salaries are falling. Employers say compensation is just 'resetting'

3 Reasons Elon Musk’s DOGE Could Be Good for Middle-Class Americans’ Wallets

Forever 21 expected to close all U.S. stores, blames Shein and Temu for demise

Real-Estate Rubble (housing, commercial & global real-estate bubble trouble)

Warren Buffett's latest move sends ominous warning about state of housing market

Money Matters (monetary policy, metals, cryptos, currency wars & going cashless)

GOLD CROSSES $3,000 FOR FIRST TIME

Trump’s game plan for devaluing the mighty dollar

Back to cash: life without money in your pocket is not the utopia Sweden hoped

‘Stagflation’ risk puts Federal Reserve in tricky spot as it meets this week

Inflation Factors (from too much money chasing too few goods due to weather, sanctions, tariffs, quarantines, etc.)

How Republicans Learned to Love High Prices

Eggs Are So Pricey People Are Smuggling Them Across The Border

Wars & Rumors of War, Revolts, Hacks & Cyberattacks + AI threats

—

China and Russia Unite Behind Iran in Challenge to Trump’s Plans

—

Trump weighs recognizing Crimea as Russian territory in bid to end war

Putin rolls out his classic strategy to handle tempestuous U.S. president.

Trump says Ukraine-Russia peace talks looking at ‘dividing up certain assets’

Trump Trade Wars & Turf Wars

Trump economic advisor warns of more uncertainty over tariffs

‘See you in four years’: Canada flexes economic muscle as tariff negotiations continue

Mises Wire: Trump’s False Tariff “Fairness” Argument

A trade war designed to hit MAGA communities hardest

More Canadians avoid setting foot in the U.S., 'without even a connection or layover'

Tariffs Set Off Scramble in the Supermarket Produce Aisle

Donald Trump orders military to draw up plans to seize Panama Canal

Trump Tries to Drag Nato into Backing his Annexation of Greenland

Political Pandemonium & Social Senescence (socio-political issues & events)

David Stockman on Whether Trump Will Really Make America Free and Prosperous Again

Watch: House Republican Torched by FURIOUS Constituents as Town Hall Goes Off the Rails

Watch: JD Vance Suffers Embarrassing Flood of Boos at Kennedy Center Show

Dems Divided: AOC Rips into Schumer for ‘Dangerous’ Plan to Bow to Trump

Dem Civil War Erupts With ‘Screaming’ and Primary Threats Behind Closed Doors

Democratic Party hits new polling low, while its voters want to fight Trump

1930s Redux? Trump Raises Spectre Of Return To Dark Days

Musk Retweets 'Hitler Didn't Murder Millions'

In KC, Elon Musk’s Tesla Cybertrucks now come with an added feature: Getting the middle finger

‘‘Delete’ is one of their favorite terms’: Inside DOGE’s IRS takeover ahead of tax season

DOGE Staffer Broke Treasury Rules Transmitting Personal Data

Angry Canadians get their 'elbows up' in face of Trump threats

Trump demands unprecedented control at Columbia, alarming scholars and speech groups

Is Elon Musk a national security threat?

MAGA Rabble-Rouser Nick Fuentes Says Liberals Were Right about Trump

FAA issues permanent restrictions on Washington helicopter traffic after fatal collision

Deep Domination (globalism, unelected government, unconstitutional government & censorship)

Technocracy, the Trilateral Dream from the 1930s, Is NOW

A Pox Upon Us (the plagues, pandemics & health police of the 2020s)

The 5 year anniversary of lockdowns is here and I'm angry

Calamity, Catastrophe & Climate Craziness

At least 32 dead in massive US storm after new fatalities reported in Kansas and Mississippi

Bill Gates Gives Up on Climate Change?

Off-the-Beat News & Just Plain Offbeat News

Mouse model study shows how brown fat could improve exercise performance and extend one’s lifespan

Doomer Humor